VIETNAM PAPER AND PULP INDUSTRY – POSITIVE OUTLOOK

While encountering a great deal of difficulties and obstacles from 2021 to August 2023, the Vietnam Paper and Pulp Industry has been recovering significantly and be expected as one of the most promising industries to bring profit to investors. The signals of recovery for the Vietnam Paper and Pulp Industry are as follows:

- Packaging paper demand grew at a 10-year CAGR of 8.9% in the FY12-22 period, thanks to the strong growth of GDP, high urbanization, and exports of Vietnam. In 2022, packaging paper production is 4.6mn tons. Packaging paper is used to pack and protect a wide range of products including F&B, pharmaceuticals, home/personal care products, garments, home appliances and furniture. With the rapid growth of e-commerce, the demand for packaging paper is enhanced as this is considered as an absolute requirement in the delivery process.

- The trend is to switch from plastic to paper packaging for environmental reasons shall enhance the demand for packaging paper.

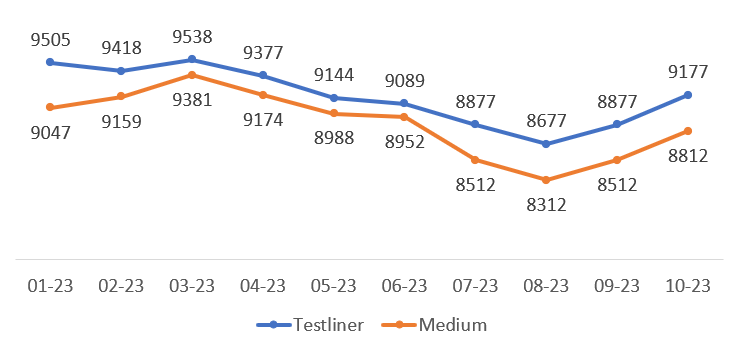

- Packaging price is recovering in the domestic market. The packaging paper selling price went up in September 2023 and October 2023, after a long decline from 2021 until August 2023. Several reasons can be included: (1) 4Q23 ahead of festival seasons as key partners such as US and EU will restock their inventories, (2) main input material price rebound and (3) China market’s trade recovery. The price is expected to be stable for the remaining months in 2023 and in 2024 by consensus.

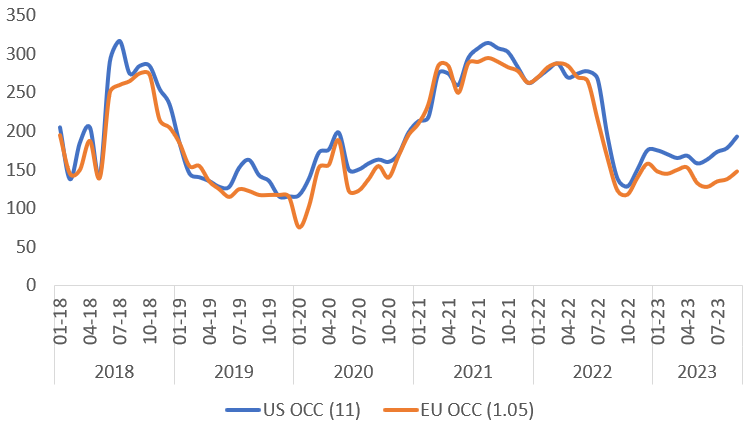

- Reduction in direct material cost for packaging paper, Old Corrugated Containers (OCC) – contributed to improve gross margin for paper production enterprises.

Source: PHFM