Liquidity constraint put pressure on interest rates

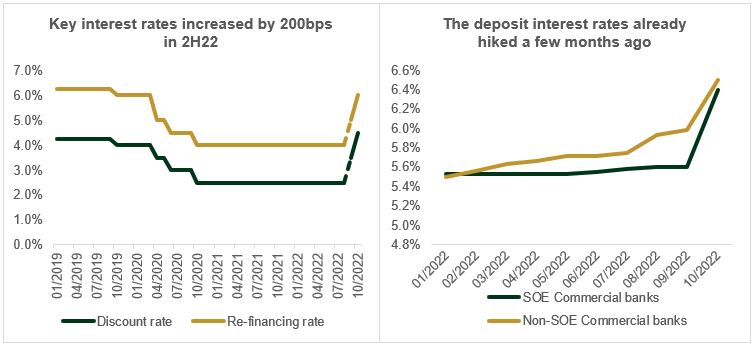

On September 22 and October 24, the SBV raised some key interest rates by 1 percentage point, respectively. After the two rate rises, the maximum interest rate applicable to demand deposits and terms of less than 1 month is 1%/year (+50bps); the interest rate for 1 month to less than 6 months is 6%/year; the maximum interest rate for deposits in VND at People’s Credit Funds, Microfinance Institutions 6.5%/year.

(Source: SBV, PHS, PHFM collected)

However, interest rates have seen a structural shift in the last few months across interbank and merchant markets. We expect the interest rates to keep rising due to the liquidity issue in the current financial market condition.

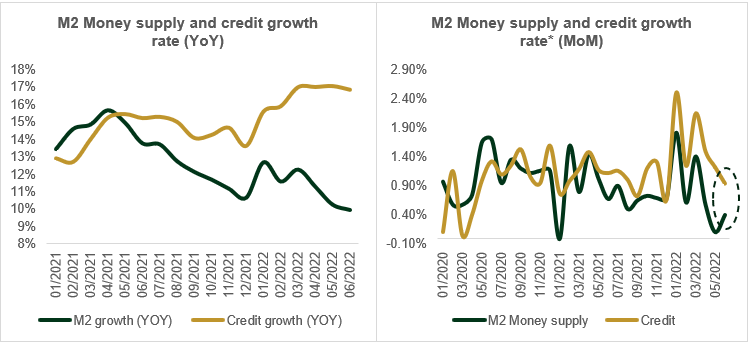

In 1H22, the credit has seen a growth of 16.8% y-y; meanwhile, the M2 money supply only expanded by nearly 9.97% y-y. PHFM estimated that the M2 has dropped by 1% YTD compared to the 11% increase in credit growth in 9M2022. As a result, Vietnam’s financial market has experienced reduced liquidity in the last few months.

(*): Data has been adjusted for seasonal factors

(Source: FiinPro, PHS, PHFM collected)

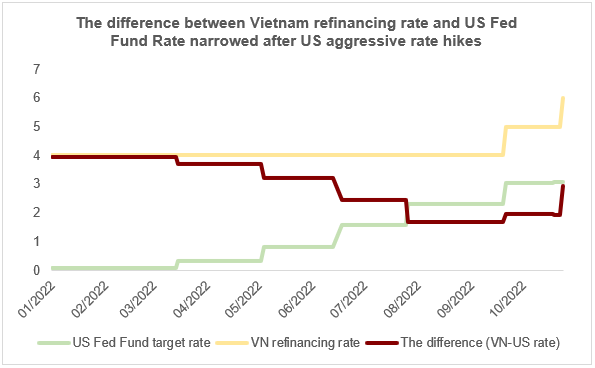

A stronger US dollar and inflation are the key risks

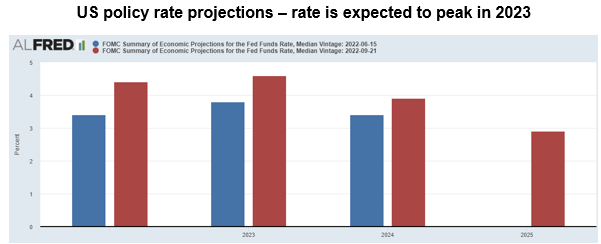

In 2022, US FED has raised Fed Fund Rate by 3% to 3.25%. FOMC cited “robust” job gains, a low unemployment rate, and “elevated” inflation as reasons for raising rates.

(Source: Bloomberg, PHS, PHFM collected)

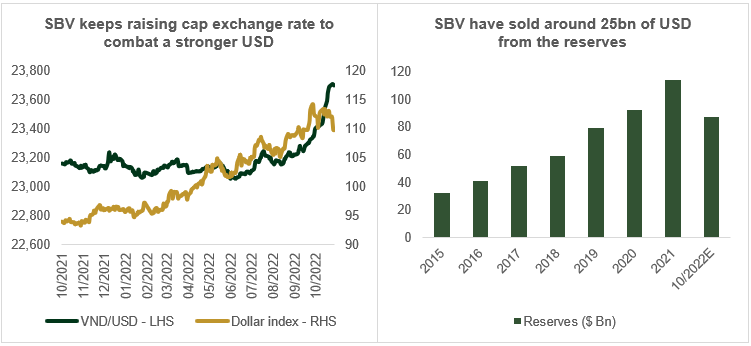

To support VND, the SBV sold massive amounts of USD, which resulted in sluggish growth of the M2 money supply. Nearly $25-$27 bn had been sold, equivalent to around VND ~600 trillion withdrawn out of the market.

(Source: SBV, PHS, PHFM collected)

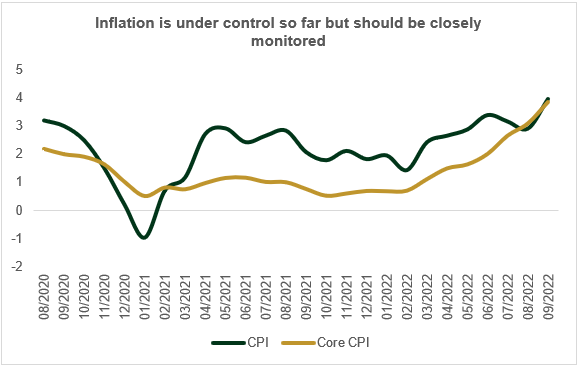

Despite the SBV’s sale of USD in recent months aimed to tame the VND depreciation pressure, the VND has already depreciated against the USD by nearly 5%. On the other hand, both limited money supply growth and the tax exemption on oil products lately are the two crucial pillars to control the mounting inflation risk.

(Source: FOMC, St. Louis Fed, PHFM collected)

The median projections for the Fed Fund rate show that the rate might peak in 2023. Providing projections are correct that the hike rate ends in 2023, the pressure on the VND should reduce. But still, inflation pressure in the upcoming months is a major concern as the uncertainty about Russia’s ongoing war on Ukraine has not yet been solved.

(Source: SBV, PHS, PHFM collected)

Further credit growth room is very limited, so that the growth driver will be fiscal policy

A reasonable credit growth rate should be implemented to both support the economic expansion and keep the inflation rate at cap. SBV’s credit growth rate target for 2022 is expected to remain around 14%YoY. The credit has grown around 11% in 9M22. In 4Q22, there are still 4 percentage points left for credit growth or about 1 percentage point of growth per month.

(Source: GSO, PHS, PHFM collected)

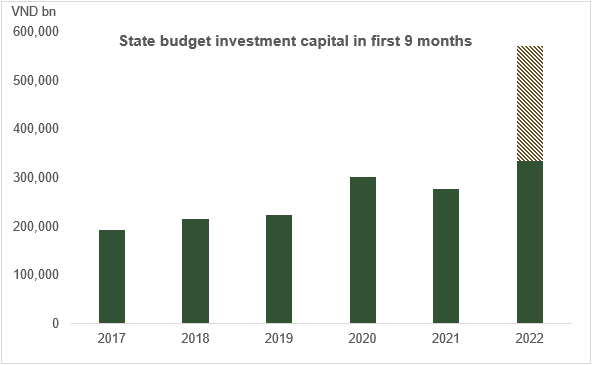

Since the monetary policy support potential is very limited, we expect it should be all about fiscal policy. The state investment in 9M2022 reached VND 334 trillion, while the target for the year is around VND 570 trillion. The achieved rate for the period of 9M22 is 59%. The massive fiscal package should benefit the following sectors:

- Materials, infrastructure development

- Industrial zones

The state investment will boost economic growth and improve market liquidity. However, the VND 235 trillion packages in the final 3 months of the year could be a huge challenge. Also, the actual disbursement number could be well below the government target.

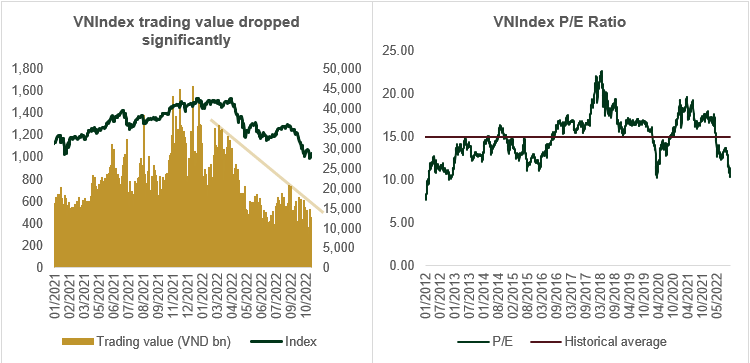

Stock market – liquidity is squeezed but valuation is good

As a result, the Vietnam stock market has seen a dramatic decline in total turnover and value in the last few months. Accordingly, the trading value has been fallen by nearly 60% in 3Q22, compared to its peak in late 2021- early 2022. As the market sentiment remains low while liquidity issue still exists, the stock market may continue to be under pressure.

(Source: FiinPro, PHS, PHFM collected)

The good thing is that with the current correction, the valuation of the market is extremely attractive for long-term investors. The market currently traded at a P/E of 10.36x, which is below the Covid-19 pandemic valuation of 10.9x.