LIVESTREAM TOP FUNDS #07: BANKING OUTLOOK: OPPORTUNITIES AND STRATEGIES FROM FUND PERSPECTIVE

In the 7th broadcast of the in-depth livestream series “Top Funds” organized by InvestingPro – PHVSF Fund Distribution Partner – the topic “Banking Industry Outlook: Opportunities and Strategies from the Perspective of Investment Funds” has attracted special attention from investors. The guest of the program was Mr. Phung Minh Hoang – Senior Analyst from Phu Hung Fund Management Joint Stock Company (PHFM). With many years of experience monitoring the banking industry and directly supporting the Investment Department to build the portfolio strategy of PHVSF Fund, Mr. Hoang has brought an insightful, systematic and practical insight into Vietnam’s banking industry in the context of many economic fluctuations.

Banking industry: The “backbone” of the economy and stock market

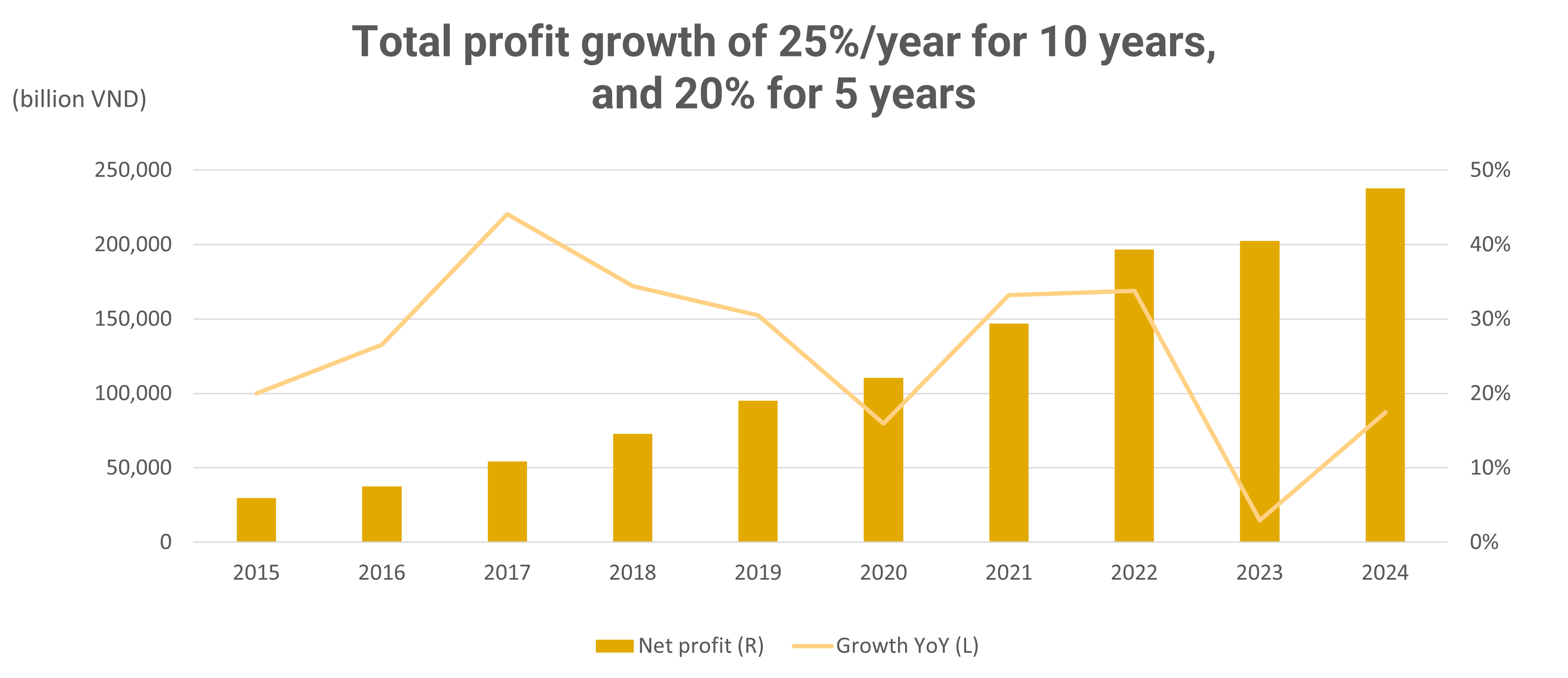

At the beginning of the program, Mr. Phung Minh Hoang emphasized the role of the banking industry as the “backbone” in the economy in general and the stock market. According to the data shared, the banking industry currently accounts for more than 30% of the total capitalization of the stock market and contributes over 50% of the total profit of the market. This is one of the few industry groups that has maintained a stable profit growth rate of 20% per year during the past 5 years – an achievement that very few industry groups in Vietnam can match.

However, he also acknowledged that the banking industry has experienced two challenging years, especially after the liquidity shock at the end of 2022 and the effects that extend into 2023. However, the recovery signal has been clear in 2024 thanks to a series of supporting factors such as the government’s monetary policy as well as fiscal expansion, cooling operating interest rates, exports as well as consumption and the real estate market have recovered clearly. The banking industry is gradually regaining its position.

PHFM and the selective investment strategy of “defensive stocks”

From an investment perspective, Mr. Hoang said that PHFM assesses banking stocks at the present time to play the role of “defensive stocks” in the context of global geopolitics with many uncertain factors, but also a group of industries with a lot of potential for long-term profit growth thanks to high credit growth. expanding the ecosystem along with digital transformation. Notably, Phu Hung Vietnam Select Investment Fund (PHVSF) is currently allocating nearly 40% of its portfolio to banking stocks – a relatively large proportion, reflecting confidence in the industry’s growth prospects in the medium and long term. Mr. Hoang shared about the differences in PHFM’s method of selecting bank stocks:

“We choose bank stocks not only based on quantitative factors but also based on qualitative factors. In addition to familiar financial indicators such as NIM (net interest margin), bad debt, ROE or cost management capability (CIR), PHFM also pays special attention to the bank’s management and ecosystem along with the level of information transparency and customer quality. In particular, the bank’s asset quality is considered the top criterion – because it is a factor that ensures the stability of profits and the bank’s long-term growth potential.”

Challenges of net selling, tariffs and portfolio risk management strategies of funds

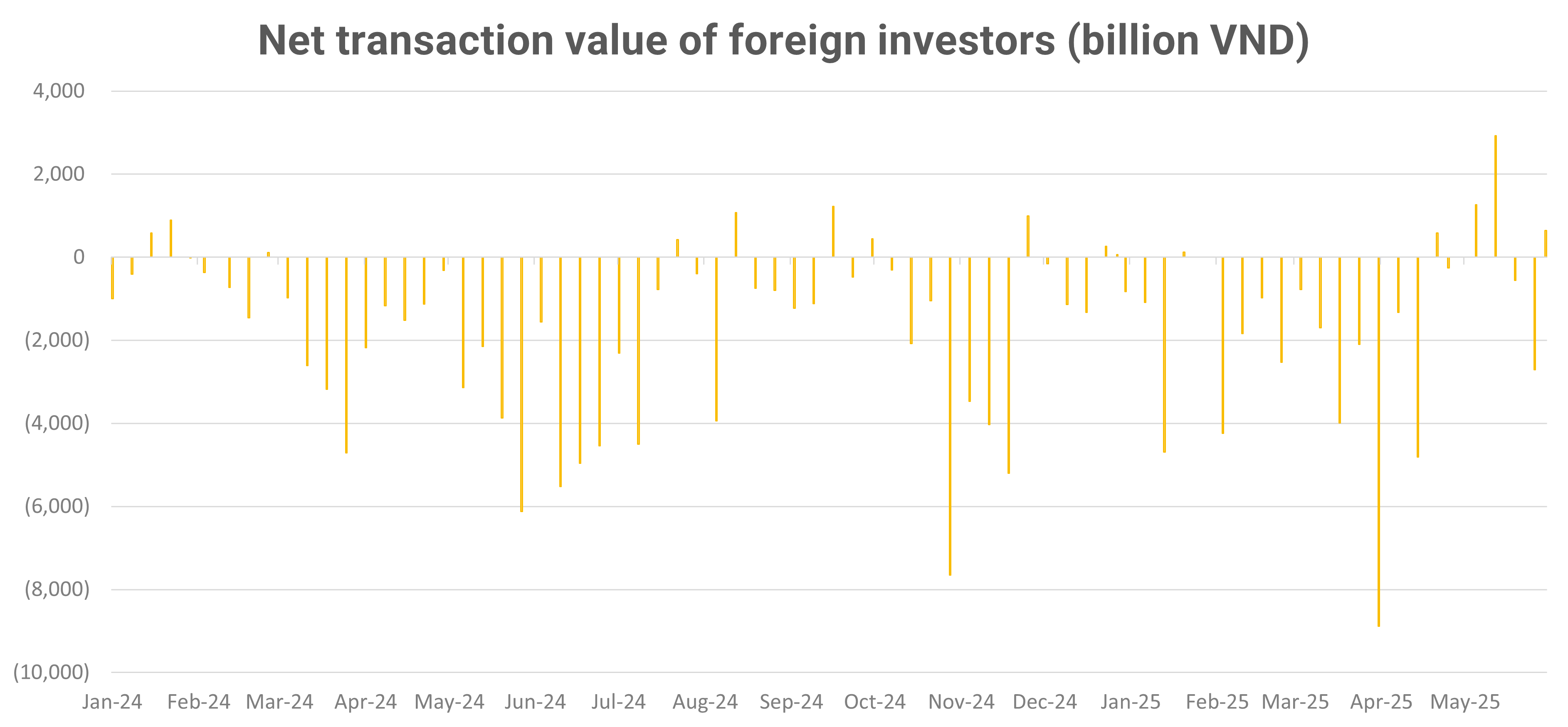

However, the conversation did not ignore the risk factors. One of the major concerns now is net selling pressure from foreign investors. According to statistics, in 2024 alone, Vietnam’s stock market has witnessed a net sale of up to 3.7 billion USD from foreign investors, of which bank stocks account for a significant proportion. This partly comes from the trend of shifting capital flows to the US, which has more attractive interest rates and is the center of the wave of artificial intelligence (AI) themed investments. However, PHFM experts are optimistic that when these trends in the US cool down, foreign capital inflows will return to emerging markets such as Vietnam – where valuations are still attractive and growth potential is high.

Another factor that Hoang paid particular attention to was President Trump’s reciprocal tariff risk. However, PHFM has developed specific scenarios to assess the impact and come up with a corresponding strategy. In all scenarios, the banking industry – albeit indirectly affected – will still maintain a positive profit growth rate in 2025.

One content that is of particular interest to the audience is how PHFM manages its portfolio in the context of increasing macro risks. According to Mr. Hoang, the fund always maintains a reasonable cash ratio to be ready to welcome opportunities when the market adjusts. At the same time, instead of focusing on a few large bank codes like many other funds, PHFM advocates diversifying stock options to both exploit the unique characteristics of each banking model and limit concentrated risks.

Although he did not make specific recommendations, Mr. Hoang said that there are currently three bank stocks closely monitored by PHFM. That is CTG – a state-owned bank with an attractive valuation and the potential to improve profits thanks to having set aside a prudent provision for bad debts; ACB – one of the private banks with top asset quality and solid business strategy; and MBB – a bank that possesses many advantages in capital costs, strong and large-scale digital transformation compared to private banks.

Expert investment advice: Patience and discipline

At the end of the sharing session, Mr. Hoang gave special advice to individual investors who are considering investing in open-ended stock funds during a volatile market period. According to him, the most important thing is to maintain patience and investment discipline, especially periodic and long-term investments, which will help investors take advantage of compound interest benefits.

“Periods of market correction are not a time to panic, but an opportunity to accumulate more at cheap or reasonable prices, thereby optimizing profits in the long term.” – Mr. Hoang recommended.

Learn more about PHVSF at: https://fund.phfm.vn/home