Anti-dumping tax on HRC steel: Perspective from the AD20 investigation

As global trade becomes more competitive, many countries are using trade remedies tools to protect their local industries. This trend has grown stronger since the Trump administration, which pushed for more protectionist policies. These measures help countries deal with unfair trade practices and sudden increases in imports.

In Vietnam, the AD20 case is a notable example of anti-dumping duties on hot-rolled coil (HRC) steel products. This case shows how Vietnam took steps to deploy trade remedies to protect its steel industry from cheap imports that could harm local businesses.

What are trade remedies

Free trade, as upheld by the WTO agreement, boosts economic growth, lowers prices, and drives innovation by allowing goods and services to flow across borders with minimal barriers, enabling countries to specialize and opening new markets. However, unfair trade practices by companies and countries can disrupt this system. To ensure a fair environment for WTO participants, trade remedies are in place to balance the benefits with the necessary protections.

How to determine trade remedies

The World Trade Organization (WTO) allows three main types of trade remedies that member countries can legally use:

- Anti-Dumping Duties: Protect domestic industries from foreign companies that sell goods at unfairly low prices (dumping), which can harm local producers by undercutting their prices.

- Subsidies: Protect domestic industries by ensuring they remain competitive in global markets, though sometimes subsidies can lead to unfair advantages over foreign competitors, which may harm those industries.

- Safeguards: Protect domestic industries from sudden surges in imports that could overwhelm local businesses, even if those imports are not sold unfairly low in price.

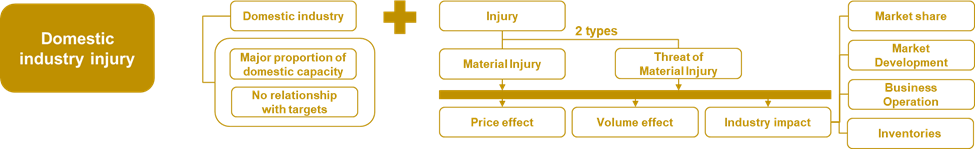

Determining unfair trade practices involves a range of legal and economic factors, which may vary by the type of trade remedy. However, these considerations can generally be grouped into three main categories, including (1) Domestic industry injury, (2) Dumping is occurring, and (3) Causal link.

- Domestic industry injury

Regardless of whether imports are dumped, subsidized, or simply increasing sharply (in the case of safeguards), no remedy can be imposed without clear evidence on domestic industries from injury.

The term “injury” refers to (i) material injury to a domestic industry, (ii) the threat of material injury to a domestic industry, or (iii) material retardation in the establishment of a domestic industry. In the determination of injury, a consideration of the volume and price effects of these imports on the domestic industry must be carefully evaluated. Moreover, a broad range of economic factors must be considered, including sales, profits, market share, productivity, employment, and the magnitude of the dumping.

The term “domestic industry” refers to the domestic producers constitutes a major proportion of the total domestic production of those products. The WTO guidance permits to exclude from the domestic industry producers related to the exporters or importers under investigation, and producers who are themselves importers of the allegedly dumped product.

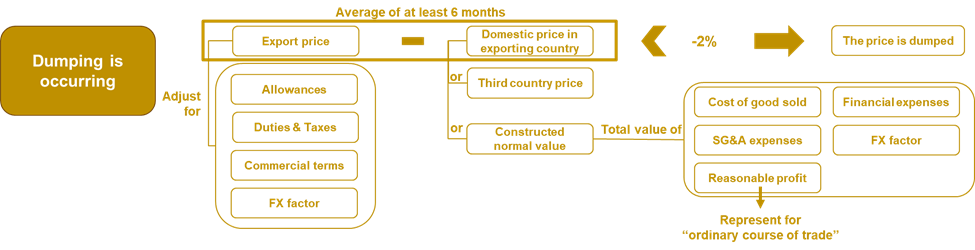

- Dumping is occurring

Except for safeguard measures, determining whether dumping has occurred is a key requirement in anti-dumping and subsidies investigations, alongside proving injury to the domestic industry. Identifying such unfair trade practices enables authorities to restore fair competition by neutralizing unjust pricing advantages.

The dumping margin is calculated by comparing the export price with one of three possible benchmarks: (i) domestic price in the exporting country, (ii) price to a third-country market, or (iii) constructed normal value.

To hold all things equal, the adjustments for allowances, duties & taxes, commercial terms, and currency conversion must be made for existing differences in the export price calculation.

Among three possible benchmarks for comparison base, the most common benchmark is the constructed normal value (CNV) because in many cases, the other two comparison bases are unavailable, unreliable or distorted. The CNV is constructed from actual data of cost of production, SG&A and reasonable profit, which represents ordinary course of trade.

The idea behind comparing the export price with the constructed normal value (CNV) in dumping margin calculation is to determine whether the exporter is selling the product abroad at a price lower than its fair market value, thereby engaging in dumping. For anti-dumping duties to be applied, the dumping margin must exceed 2%, while in subsidy cases, the support must be specific and quantifiable.

- Causal link

The demonstration of a causal link must be based on a thorough examination of all relevant evidence. Investigating authorities are required to assess other known factors—beyond the dumped imports—that may be contributing to the injury. Examples of such factors include shifts in demand patterns and technological developments. Importantly, any injury resulting from these “other factors” must not be attributed to the dumped imports.

Why the anti-dumping tax on HRC is inevitable in Vietnam

The anti-dumping tax on Hot Rolled Coil (HRC) or AD20 in Vietnam is considered inevitable due to the foreseeable fulfillment of three critical criteria for imposing the tax: injury to the domestic industry, evidence of dumping, and a causal link between the dumping and the injury.

- Domestic industry injury

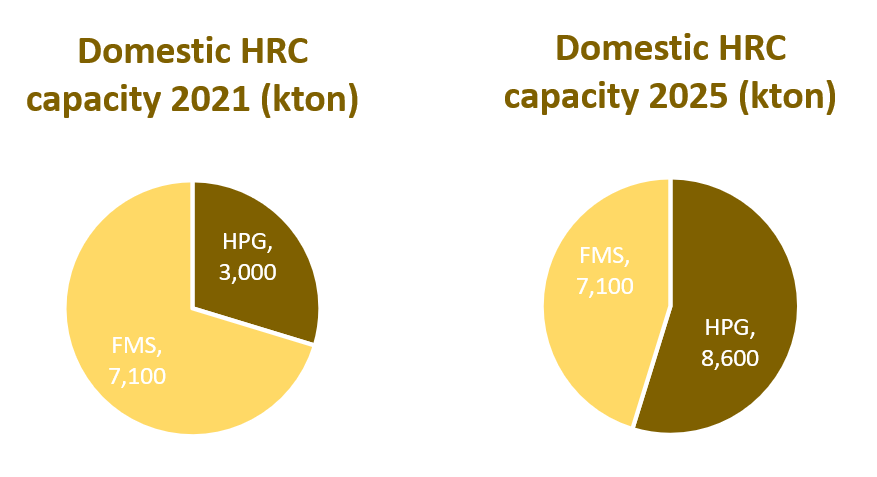

In Vietnam, there are only two HRC producers: Hoa Phat (HPG) and Formosa (FMS). In 2021, HPG was unable to act as a representative of the domestic HRC industry, as its production share was below 50% in this duopolistic market. However, by 2025, the production landscape has shifted—HPG now holds a major proportion of total domestic HRC output, enabling it to represent the industry and file for trade remedies in accordance with regulatory requirements.

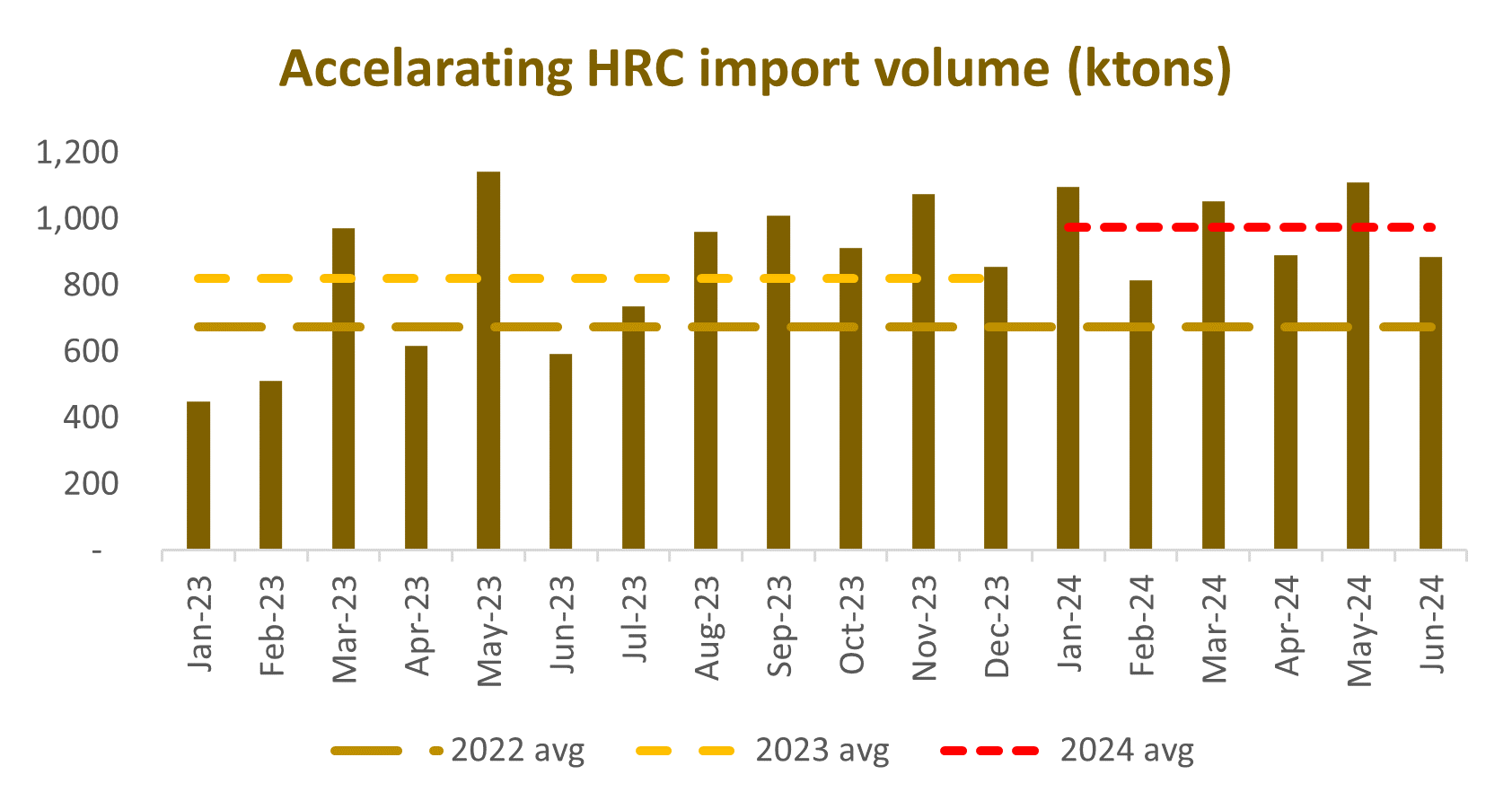

Regarding the injury, import volumes surged by approximately 25%, despite the first half of the year typically being a low season. In the first half of 2024 alone, monthly average imports reached 1 million tons—when annualized, this equates to 2 million tons, representing 120% of the 2024 domestic production capacity and 80% of the projected 2025 capacity.

- Dumping is occurring

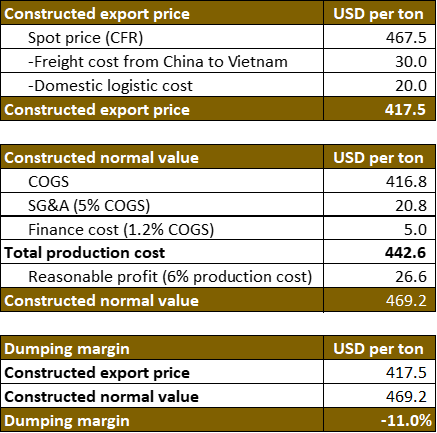

Constructed Export Price is the adjusted export price of the China’s HRC being sold at 417.5 USD/ton into the Vietnam market, accounting for freight, insurance, and domestic handling.

Constructed Normal Value reflects the full cost of production, including a reasonable profit, as would be expected in the ordinary course of trade at 469.2 USD/ton.

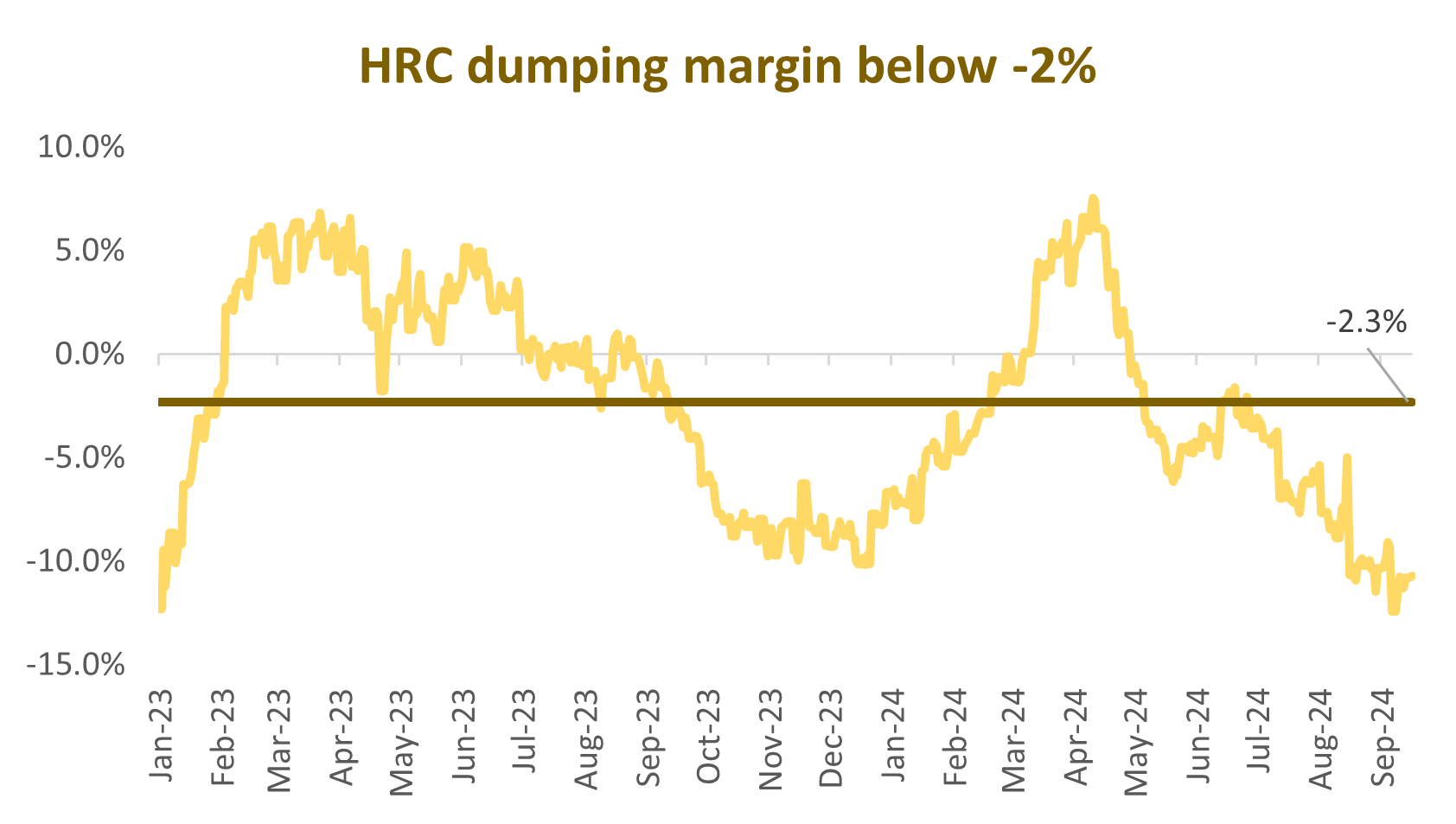

Based on the estimation, the export price is 11% lower than the normal constructed value, indicating a dumping margin of 11%. This suggests that the exporter is undercutting the fair market value, and dumping has occurred.

Furthermore, the average dumping margin had remained below -2% for a continuous period of 18 months, exceeding the duration threshold of 6 months set by WTO guidelines.

- Causal link

The sustained dumping margin of -11%, combined with a persistent undercutting of domestic prices, has led to falling selling price, shrinking market share, and reduced profitability for domestic HRC producers. This pattern aligns temporally and statistically with the surge in dumped imports, establishing a clear causal link and justifying the imposition of anti-dumping duties under WTO provisions.

Impact on steel industry

On February 21, 2025, the Ministry of Industry and Trade issued Decision 460/QD-BCT on the imposition of a provisional anti-dumping duties (AD20) on hot-rolled steel products originating from China with ADD from 19.38% to 27.83%, applicable from March 8, 2025. This is an important decision of the Ministry of Industry and Trade to protect the domestic steel production industry against the increasing dumped steel imports.

In the long run, this structural change in the industry will significantly strengthen the position of domestic HRC producers, enabling them to enhance production capabilities, maintain competitive advantages, and mitigate the impact of unfair trade practices.

Le Thang Anh Tuyen – Investment Department – PHFM