After the covid-19 pandemic is under control, the real estate market began to recover. However, in 2022, the market experienced a decline in supply and demand due to the government’s tight policies on credit and corporate bonds following the scandals of corporations such as Tan Hoang Minh and Van Thinh Phat. The main reason is the lack of strict regulations and specific instructions on bond issuance. Therefore, the government also made guidelines and changes in bond issuance through Decree 08 and the law that will take effect on January 1, 2024, to help the market improve and grow steadily. In this article, we think of 2 scenarios that may happen to the real estate market.

* Title meaning: Following the scandals, we anticipate that the financial market regulations will become more comprehensive and the Land Law (amended) will be improved. This will facilitate the sustainable development of the real estate market.

Contents

A. 2022 – THE TURBULENT YEAR OF THE REAL ESTATE MARKET

I. Rising Interest Rate

II. Tighter bond issuance control – Issue Decree 65/2022

B. REAL ESTATE DEVELOPERS ARE CHOKING

I. Difficulties for real estate developers – Hard to raise capital

II. The pressure of bonds to maturity – Struggling to meet the payment

III. Supply and demand do not meet in some particular segments – Difficulties in Sales

IV. Typical case of NVL

C. SOLUTION FROM THE GOVERNMENT

I. Support for the Supply Side

II. Support for the Demand Side

D. WHAT WILL HAPPEN?

A. 2022 – THE TURBULENT YEAR OF THE REAL ESTATE MARKET

I. Rising Interest Rate

Since the start of 2022, a risk warning for investors has been raised by the persistent rise of land prices in various regions of Vietnam, especially in rural areas, prices were pushed up by 200-300%, partly because of the speculative activities. The low-interest rates, thanks to the package to support businesses to recover production, have led to a land fever. However, the capital flows into the speculative real estate market only in the short term.

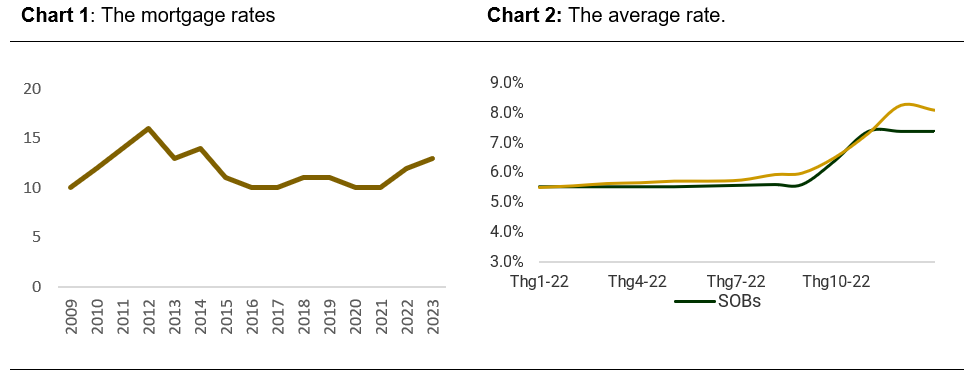

The SBV has directed to strictly control credit for some real estate product segments which have high speculative risk to ensure the safety of the banking system. As of early December 2022, the average mortgage rate of state-owned banks and private banks has risen sharply from 10% to 12% in 2021-2022, following rising deposit rates.

The interest rate of commercial banks also rises simultaneously. Mortgage rates are picking up following rising deposit rates. Currently, the deposit rate for a 12M tenor has increased to around 8.5% p.a at the non-state-owned bank, which drags the mortgage rates up to 14%-15%/year. This will hinder housing purchasing decisions, and somehow slowly stop the speculative activities in the real estate market.

Source: Local banks, PHFM collected

II. Tighter bond issuance control – Issue Decree 65/2022

Many real estate companies use bonds as the main resources in the booming market, but some of the companies were using bonds fraudulently. Many scandals happened, and the “drop in bond market confident” is a matter of concern.

In February 2022, one member of Tan Hoang Minh Group paid a deposit of almost 600 billion for 4 prime land plots in Thu Thiem, District 2 at an auction event, with the highest land price up to about USD 102,000 /m2. In September 2022, the authorities investigated cases related to the group that discovered fraudulent behavior in the issuance and trading of bonds… As a result, the group canceled all 9 bond issues, worth over VND 10 trillion, from July 2021 to March 2022. The company could not make the payment for the auction.

In September 2022, Van Thinh Phat Group – a real estate tycoon – faced criminal charges for bond issuance and fraud violations. The main reasons for these criminal cases are mistakes in issuing and distributing bonds and debt reversal among group subsidiaries for using several purposes.

To protect the investor, on 16/09/2022, the Government issued Decree 65/2022 (referred to hereafter as Decree 65) to supplement and amend the old Decree 153/2020 (referred to hereafter as Decree 153), which regulates the private placement and trading of privately placed corporate bonds in the domestic market and offering of corporate bonds in the international market. There are 3 important points in Decree 65:

- Enhancing the standards of qualified investors. Previously, the old Decree 153 did not have this standard. Decree 65 supplements regulations on individual qualified investors. To qualify as an individual professional investor, they must maintain a portfolio of at least VND2.0bn on a 180-day moving average basis. Additionally, a professional retail investor certificate is valid for only three months. In the short term, this point will reduce the number of investors. However, when investors have enough knowledge, it can improve their ability to identify risks from issued bonds, which can help the market become more professional and sustainable in the long term.

- Buying back bonds before maturity to protect the bondholder and deter companies from breaching bond commitments. Previously, Decree 153 did not have this standard. Decree 65 supplements regulations on individual qualified investors. Cases of bond buybacks prior to maturity include:

- Buyback prior to maturity according to the agreement between the issuer and the bondholder.

- Compulsory buyback at the request of the investor when: (1) the issuer violates the law under the decision of the governing authority and where the breach cannot be remedied, or the remedy is not approved by bondholders who represent 65% of the total number of bonds issued. (2)The issuer violates the bond issuance plan but the offense cannot be remedied or the remedy is not approved by bondholders who represent 65% of the total number of bonds issued.

- No stricter conditions for bond offering, but more requirements on the bond offering dossiers and issuance methods. Compared to Decree 153, Decree 65 enhances the requirement for bond offering documentation, which increases the transparency of the status of issuers and the corporate bond market for investors. This regulation allows enterprises with sufficient capacity and transparent records to issue bonds and restructure debts in accordance with their financial structure.

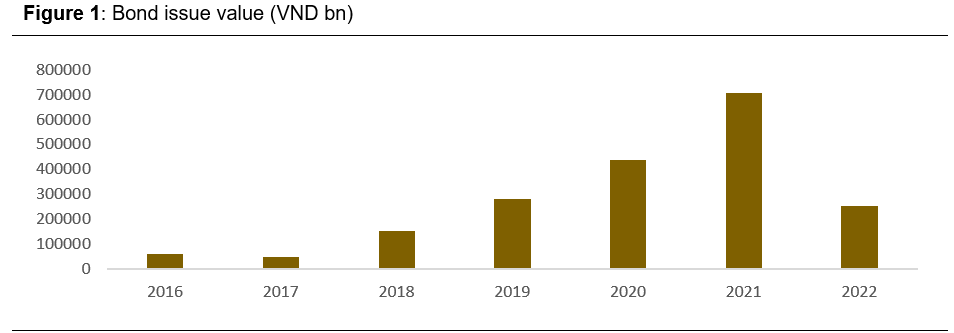

Immediately, the issued bond value sank to VND 251 trillion (-65% YoY) due to the new issuance of decrees. The real estate market experienced a purge of weak companies that lack the capability and qualifications to develop real estate projects. However, we think that only be temporary. In the future, the legal improvement of the corporate bond issuance process will make it more controllable and professional.

Source: HNX, PHFM collected.

B. REAL ESTATE DEVELOPERS ARE CHOKING

I. Difficulties for real estate developers – Hard to raise capital

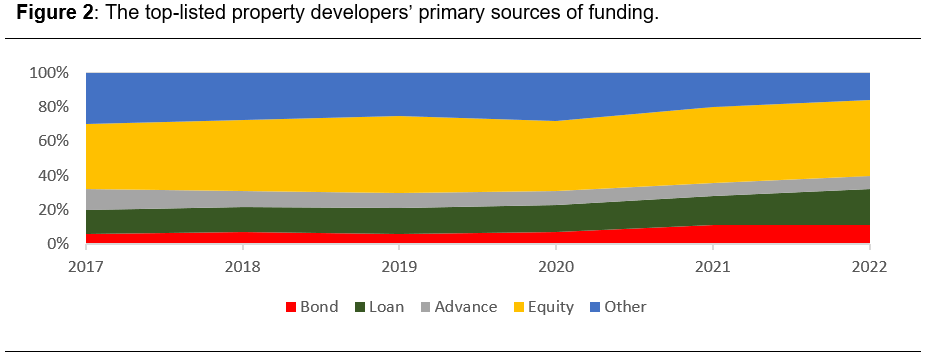

Activities of real estate enterprises have the specific characteristics of using large capital, in which bonds, loans, and advances from customers account for about 10%, 20%, and 10% of the capital raising structure, respectively. Amid tightening bank loans, halting the bond market, and subdued presales, many real estate developers face cash flow problems. As a result, enterprises lack the capital to implement projects on schedule. This, in turn, makes businesses ineligible to collect money from customers, thereby disrupting the financial structure of the project. These factors make the real estate market difficult and add to the panic of homebuyers in fragile market sentiment.

Source: Finpro, PHFM collected.

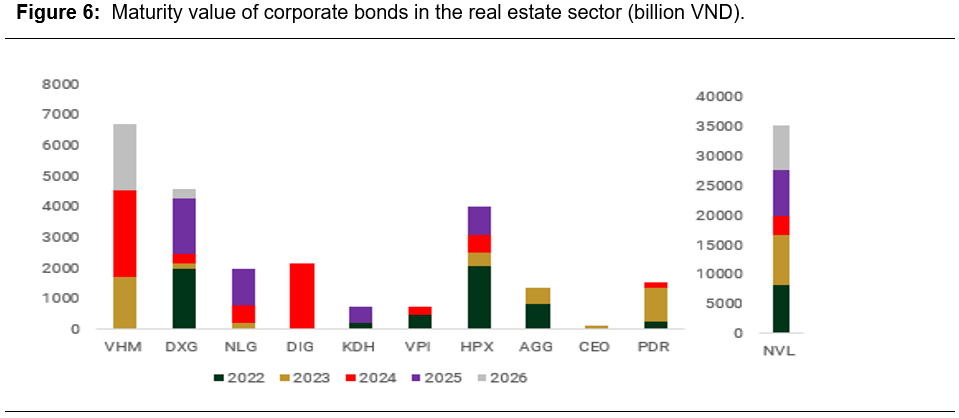

II. The pressure of bonds to maturity – Struggling to meet the payment

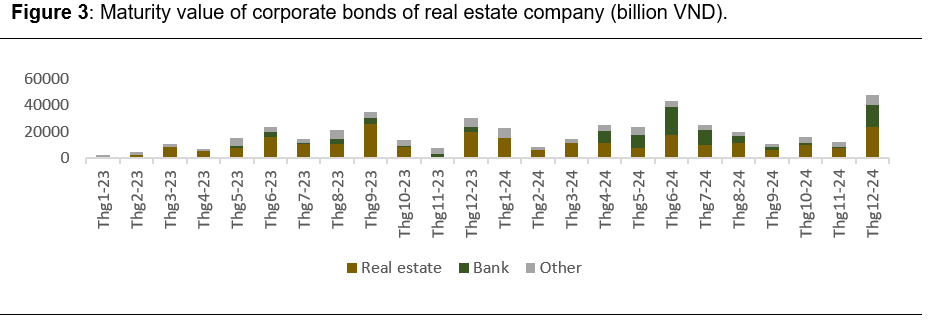

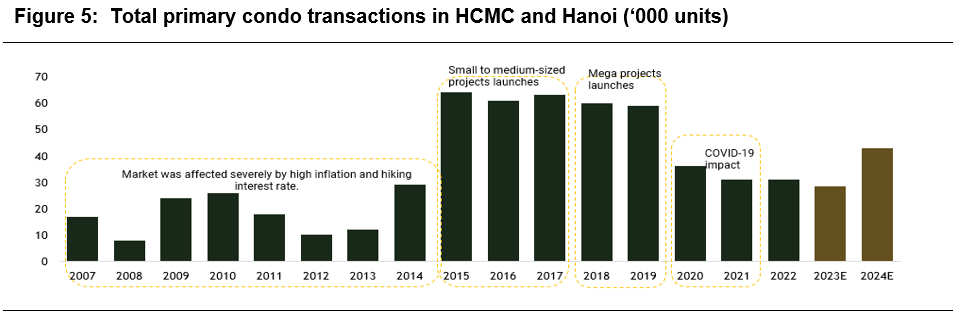

According to SBV, the total outstanding loans related to real estate is around VND 2,330 trillion (16.9% listed and 83.1% non-listed), equivalent to nearly 21% of the total outstanding loans of the economy. The total value of corporate bonds maturing in 2023 is estimated at VND 235 trillion, of which the maturity value of real estate businesses is about VND 100 trillion. In more detail, 2Q2022 and 3Q2023 will be the “climax” periods of real estate bond maturity, with a value of VND 36,200 billion and VND 35,400 billion, respectively. This will pressure the cash flow of real estate businesses amid tightly controlled credit and weak homebuyer sentiment.

Source: HNX, PHFM collected.

III. Supply and demand do not meet in some particular segments – Difficulties in Sales.

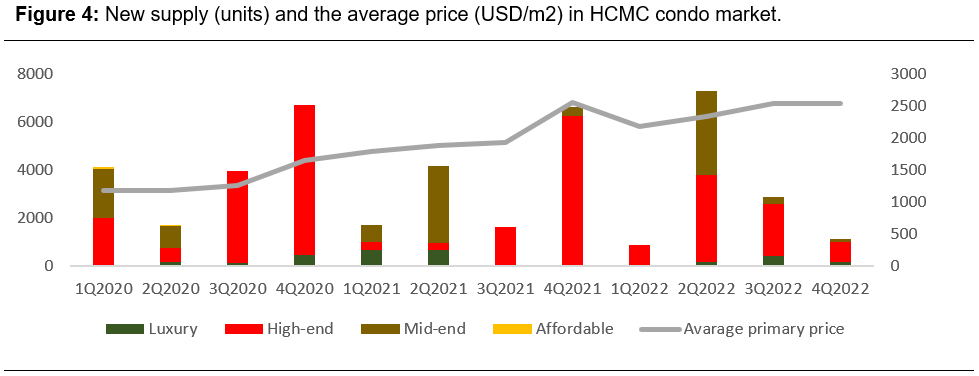

There is an asymmetry between housing supply and real housing demand. In 2022, the number of launched apartments in HCMC reached 12,000 units (-16% YoY), in which luxury, high-end, and mid-end segments account for 6%, 62%, and 32% of supply. In addition, the average price level continued to increase significantly from USD 1,118/m2 to USD2546 m/2 in 1Q2020-4Q2022 due to the lack of an affordable segment. Meanwhile, Vietnam’s GDP per capita reaches $4,160. The population structure is composed of 37% urban areas and 63% rural areas. The real house demand does not meet the supply from the affordable housing segment.

Source: CBRE, PHFM collected.

Given the fact that regional and global markets have become more unstable as macroeconomic factors are being tightened. The specific manifestations, such as bank and debt financing restrictions, interest rate increases, and ongoing licensing issues, are shifting quickly. The uncertainty of the future has caused property developers to be more cautious about launching new projects in 2023. In addition, we see a drop in new supply as the project approval process likely be delayed on waiting for the amended law of the land.

Source: CBRE, PHFM collected.

IV. Typical case of NVL

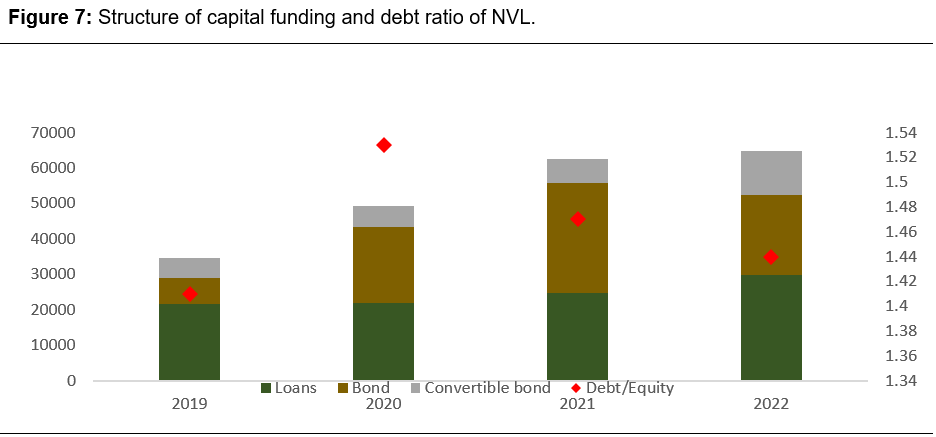

NVL is a hospitality real estate tycoon, besides owning a large land bank in the center of Ho Chi Minh City. According to the financial statements for 2022, the total debt obligation of NVL is VND 64,577 billion (+6.7% YTD), accounting for about 40% of the total outstanding loans of listed real estate companies. Therefore, when NVL is not able to repay the debt, it will seriously affect the creditors.

In addition, NVL has a high capital mobilization structure from bonds, (35% of the debt structure in 2022). Capital mobilization from this channel is limited when the bond market has tight policies on private placement.

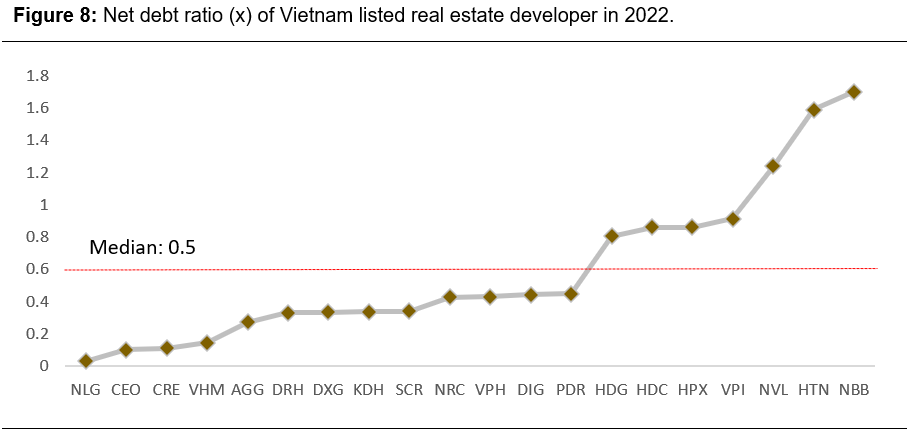

NVL’s debt/equity ratio is 150%, one of the companies with the highest debt ratio in the industry. Therefore, higher interest rates increase financial costs for the company.

Source: Finpro, PHFM collected.

Source: Finpro, PHFM collected.

Moreover, NVL’s two main product segments, residential real estate in HCMC and hospitality in satellite cities, have encountered difficulties. In particular, most of NVL’s projects in HCMC have faced legal problems, such as difficulty in determining the amount owed for land use, which has delayed the progress of the projects. In the hospitality real estate segment: NVL’s products belong to the high-end segment, which is affected by the high-interest rate environment, leading to its expected weak business performance. Hence, together with the dim operational result, difficulties in raising capital and cash flow management would make NVL unable to pay off bond debt.

C. SOLUTION FROM THE GOVERNMENT

I. Support for the Supply Side

Following a national meeting led by the Prime Minister on February 17, the Government issued a draft resolution on some measures for the real estate market: (1) suggesting to prolong loan payments of principal and interest for real estate businesses; (2) keeping providing credit to real estate projects with viable loan plans, eligible customers for loans, and reduce lending interest rates.

The most prominent recent government solutions include the issuance of Decree 08/2023/ND-CP on issuing private corporate bonds and the plan to complete the land law by 2023.

Solving the difficult issue of private bond issuance

The government has continued Decree 08/2023/ND-CP on issuing private corporate bonds. We note the benefit of this decree is 2 key points:

- Allow bond issuers more time to adjust. Specifically, shifting the implementation period of this Decree from the start of 2023 to the start of 2024. This will help businesses have more time to reorganize bonds and reduce the risk of default.

- This lays the foundation for future resolution through negotiation, restructuring, or asset exchanges for bonds nearing maturity and distressed issuers. This helps lower the risk of default for businesses.

Remove the legal bottlenecks

According to the National Assembly’s timeline, the amended Housing Law and Land Law will get approval in May and October 2023, respectively, after submissions to National Assembly and public feedback. The finalized amended Land Law will follow the guidance of Resolution 18-NQTW, dated June 16, 2022, with the most noticeable change being the removal of a land price frame.

In particular, the most notable highlights that we hope will help remove the difficulties of the real estate market:

- Completing the revision of the Land Law 2013 and other related laws will help resolve issues about land allocation and land leases through auction. The law will specify the cases of land allocation or land leases requiring the auction of land use rights or bidding for projects using land in accordance with the law. This will ensure transparency and fairness in land allocation and leases, leading to improved efficiency of land use. Additionally, the resolution of issues arising from projects involving public land will be addressed completely. As a result, the remaining problems in some projects will be solved, bringing in revenue for businesses and increasing the supply for the market.

- Removing the land price table and using the market-based method of the land price will help improve the quality of land valuation and ensure the independence of the land price appraisal council. Previously, the project progress was delayed due to difficulties in determining land use fees and long evaluation procedures. Therefore, this will speed up project development and help reduce business financial costs.

Notably, in 2023, the amending Law of the land is expected to complete. Therefore, we expect the legal ‘bottlenecks’ to be removed step by step.

II. Support for the Demand Side

Social housing credit packages are designed to support demand for the real estate market. The government assigned the State Bank to lead in implementing a credit program of about VND 120,000 billion, equivalent to 12% of capital needs. This supports achieving the goal of having at least one million social housing apartments in 2021-2030. The State Bank directs commercial banks, and the main four banks are Agribank, BIDV, Vietcombank, and Vietinbank to deploy the credit package. Thereby, we expect the real housing demands could be solved.

D. WHAT WILL HAPPEN?

In our opinion, we will see the rising stars from the new players in the affordable housing segement, typical names Becamex Infrastructure Development JSC (ticker: IJC), Le Thanh Trading – Construction Ltd. The market may grow thanks to this segment in the short term. Given the 10% cap on net profit margin, we anticipate that real estate developers will only consider developing this segment to a certain extent. The remaining land bank will be allocated to develop more profitable segments.

Related to the current choking developers, there are two scenarios that we think will happen. We think scenario 2 will be more likely happen in the future.

Source: Finpro, PHFM collected.

Negative – Scenario 1: Many big real estate companies are struggling to overcome and pay their due debts. NVL and HPX have been very aggressive in leveraging over the past several years. They have maintained net debt/equity ratios above one for several periods. We have observed that the developers have defaulted on several bond interest and principle payments. The current giants in the real estate market may fall.

Positive – Scenario 2: The real estate companies will overcome the difficulties. The real estate market will recover thanks to the bond support decree and the effect of the land law in 2024, as mentioned above. They are undergoing a restructuring process that includes liquidating assets to alleviate cash flow pressure.

Recently, one of the key staff members, who had worked at Gamuda Land, a real estate developer from Malaysia, became the new CEO of NVL. This move highlights the importance of the partnership between NVL and Gamuda, particularly in the project purchase and sale process.

In another deal, Singapore real estate giant CapitaLand Group is in talks to acquire assets worth roughly $1.5 billion from Vietnam’s biggest listed property firm Vinhomes JSC (ticker: VHM). Besides, VHM announced that they have transferred all shares in 2 subsidiaries Phat Dat and Truong Loc. The transfer value and partner have not been disclosed.