Developing Vietnam’s ETF Market: Lessons from Taiwan and Gold ETFs

At the conference, Mr. Albert Kwang-Chin Ting, Chairman of the Board of Phu Hung Fund Management (PHFM), presented a paper titled “Vietnam – The Golden Moment Has Arrived.” His presentation focused on applying international experience — particularly from Taiwan — to develop Exchange-Traded Funds (ETFs) and the broader fund management industry in Vietnam.

Mr. Albert Kwang-Chin Ting emphasized that Vietnam is now in an excellent position to attract capital inflows shifting from lower-growth economies in the region.

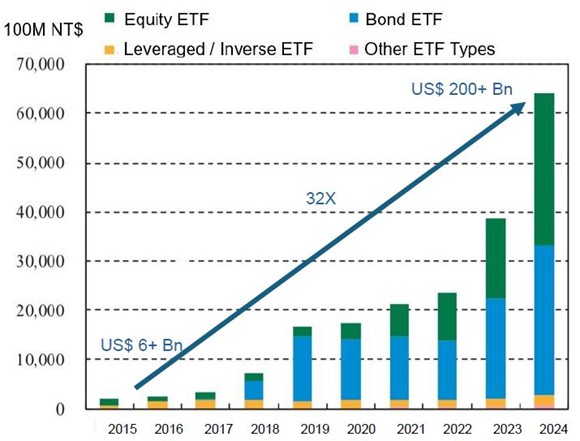

The PHFM Chairman highlighted the crucial role of ETFs in expanding the market capitalization of Vietnam’s stock market and advancing the overall fund management industry. In just a decade, the total assets under management (AUM) of ETFs on the Taiwan Stock Exchange increased 32 times, from USD 6 billion in 2015 to over USD 200 billion in 2024.

This growth was accompanied by a 60-fold surge in the number of investors, from 240,000 in 2015 to 14.3 million in 2024.

Taiwan’s ETF Market: Key Growth Drivers

Taiwan’s remarkable ETF success was built on supportive policies and structural reforms.

To facilitate index development, the Taiwan Stock Exchange (TWSE) established a wholly owned subsidiary called Taiwan Index Plus (TIP).

Simultaneously, Taiwan implemented multiple initiatives to broaden its distribution channels. One of the key factors in attracting retail investors was leveraging the extensive branch networks of commercial banks, which are far more accessible than securities companies or fund management firms. Thanks to Taiwan’s trust law, customers could open securities or fund investment accounts directly at a bank branch and start investing on the same day.

Additionally, the ETF market was boosted through collaboration with the insurance industry. Life insurance companies utilized the fund management sector’s expertise to design investment-linked insurance policies, which directly allocate capital into funds and ETFs — further channeling long-term savings into the fund industry.

Another major driver of ETF growth among retail investors was financial education, particularly promoting the concept of Systematic Investment Plans (SIPs) — investing a fixed amount monthly. Investor education played a vital role in improving financial literacy, empowering individuals to manage their savings and investment portfolios more effectively.

Developing Physical Gold ETFs

Speaking at the conference, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission of Vietnam (SSC), revealed that the regulator is currently amending Circular No. 98 on fund operations. The revisions aim to diversify fund types, including ETFs and bond funds, while also strengthening and diversifying distribution channels and enhancing transparency in the online distribution of fund certificates.

In parallel, the SSC is researching a new fund type — the Gold ETF. Developing gold derivatives and physical gold ETFs is expected to reduce the need for physical gold holdings, thereby helping stabilize the foreign exchange balance and enhance the efficiency of gold market management.

(Sources: Funan Securities, PHFM Compilation)