Drilling market – Stepping into a new cycle

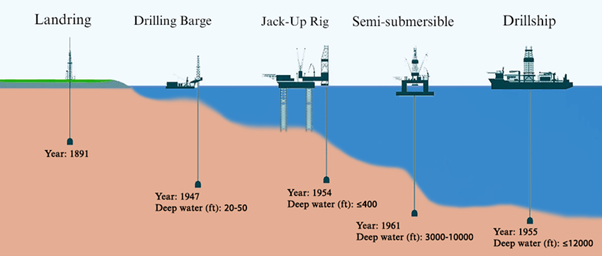

A drilling rig is a complex equipment used to drill holes for the purpose of extracting oil and gas. Drilling rigs come in a variety of sizes and types, depending on: (i) the depth of the well; (ii) the type of rock that is being drilled through; and (iii) the location of the well. In which Jack-up rig is the most popular due to its flexibility, typically used for drilling in shallow water at a reasonable cost. Thus, the Jack-up rig accounts for over 70% number of the rigs globally.

Types of drilling rigs

Global’s E&P activities to recover and accelerate

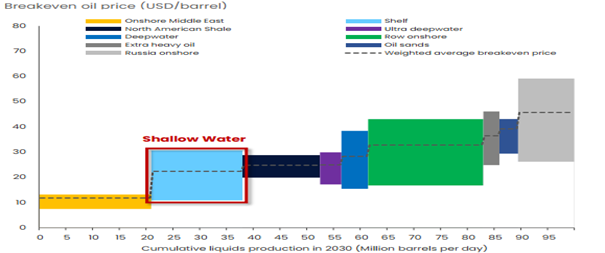

As oil prices have remained stable around USD 70/barrel for the past three years, global drilling activities have improved significantly compared to the COVID pandemic period. And the focus shifted toward shallow-water projects, among the largest resources with low break-even costs. As a result, demand for jack-up rigs, particularly from Middle Eastern operators, has risen notably. For nearly a decade, the jack-up market had been distressed and oversupplied, with little expectation that marketed utilization would exceed 90%. However, this began to change in 2022-23, marking the start of a new cycle as a significant wave of exploration and production (E&P) projects commenced globally.

Large resources at low breakeven cost

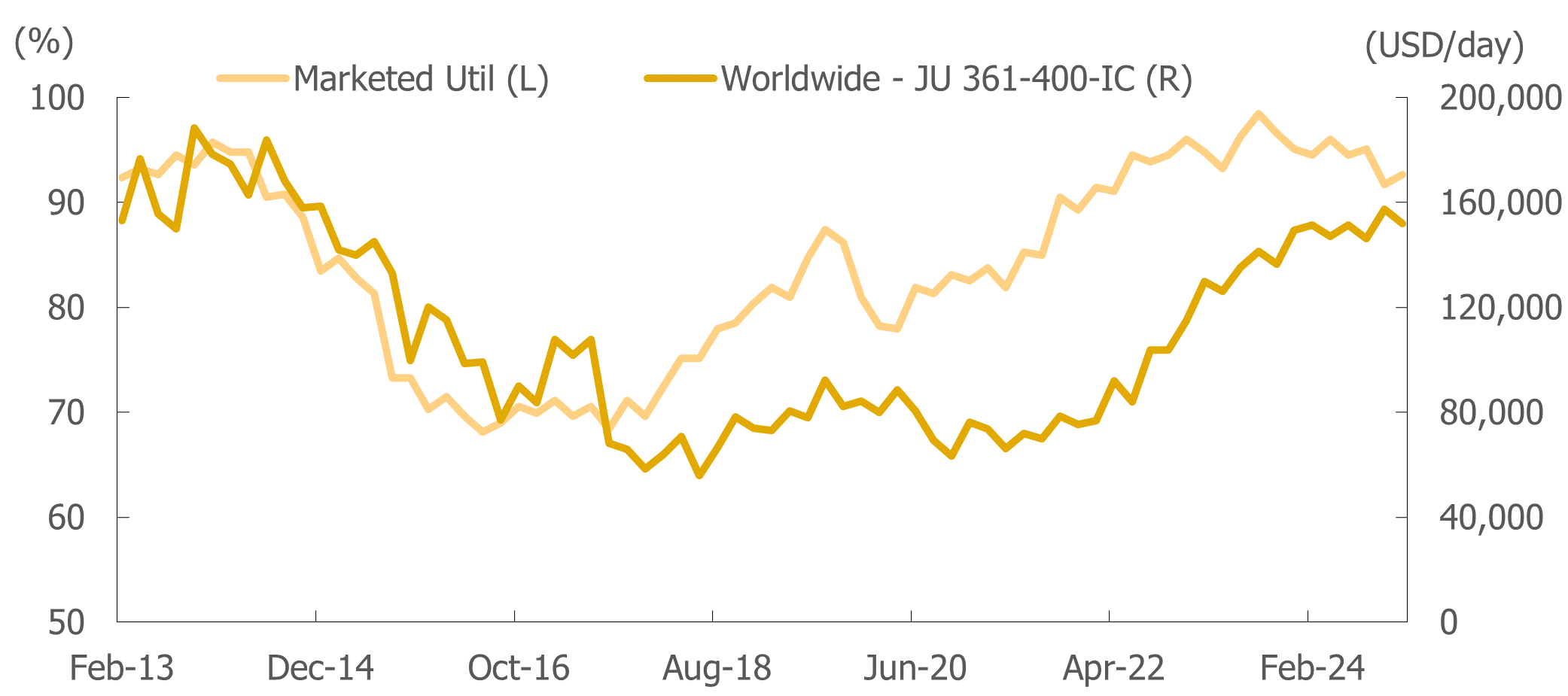

Furthermore, according to IHS and Westwood Energy, the global demand for jack-up rigs recovered significantly last three years, while rig supply increased slowly. Areas busy with E&P activities Middle East accounted for a large proportion of the global demand for jack-ups. Additionally, many jack-ups have been turning over 30 years of service and decommissioned during the period of 2023-25. Thus, the marketed utilization recovered strongly and remained above 90% last 3 years, which would lead to average rig rent prices (day rates) doubling to nearly USD120,000 – USD150,000 in the period of 2023-25, these levels are profitable for drilling companies.

Global jack-up day rates in the period 2013- 2025

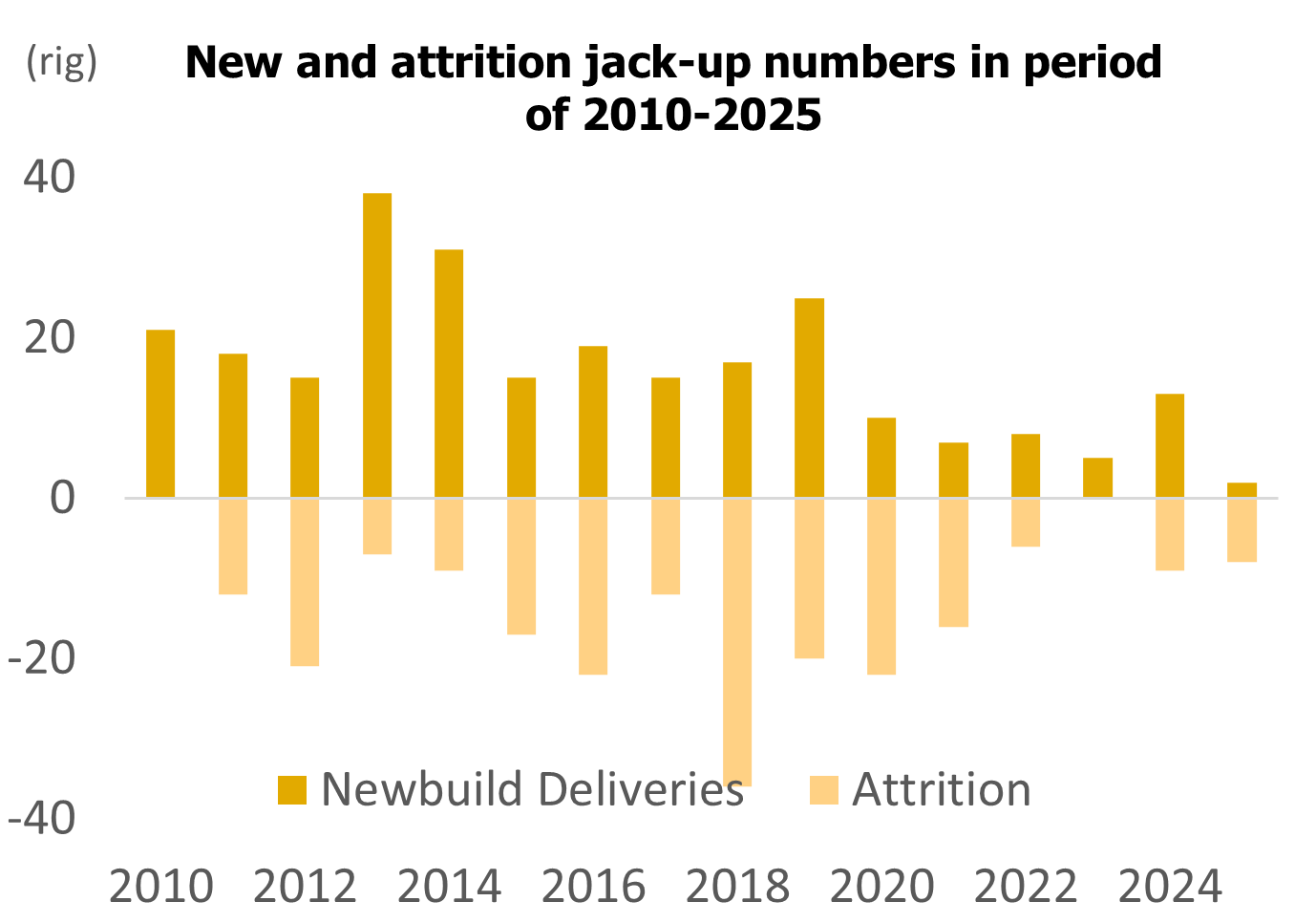

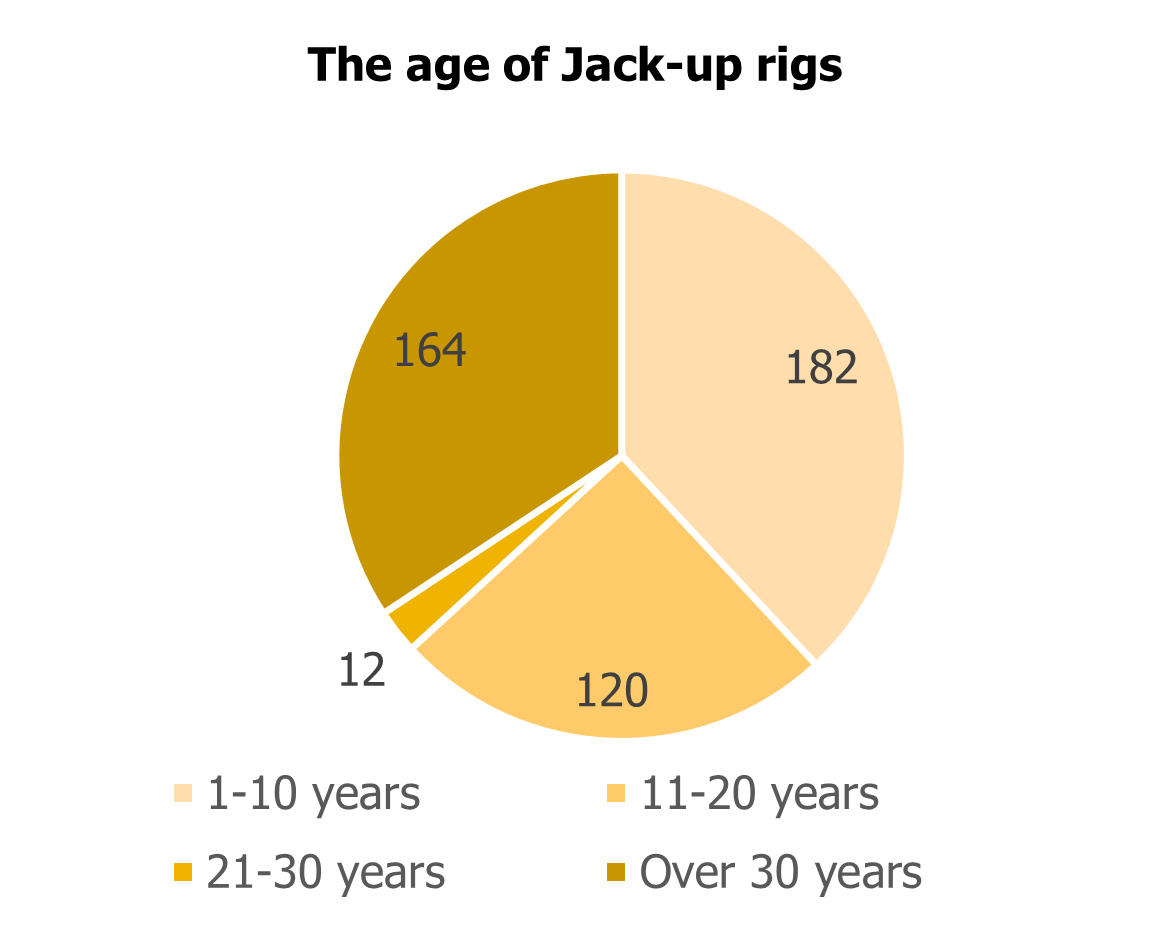

The supply of new jack-up rigs has tightened significantly, with only half remaining under construction, compared to the Covid pandemic period. Many of these rigs will require more than 2 years to complete, limiting new capacity in the near term. The current orderbook has fallen to a record low, with rigs under construction representing just around 3% of the total global fleet. Furthermore, limited new orders are on the horizon, as construction costs are expected to surpass previous cycle levels and approach USD 300 million per unit. While around 180 jack-ups have been retired from the global fleet over the last decade, and one-third of the global jack-up fleet is over 30 years old could retire in the coming years.

Source: S&P Global, PHFM

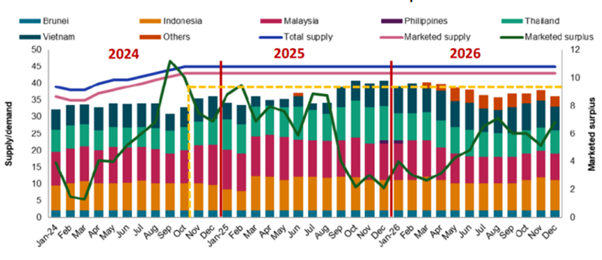

Southeast Asia remains resilient

The total number of jack-up rigs at the end of 2024 in Southeast Asia is 45, accounting for over 10% of the total global jack-up rigs. In the Southeast Asia market, rig utilization efficiency was improved in 2023- 2025 following the global market trend, and some rigs from the region moved to fill the high demand of the Middle East and partially improved demand in the Southeast region. Southeast Asia’s outlook for drilling remains solid as well, Southeast Asia’s national oil companies will increase aggregate capex in 2025-27, the most active countries in E&P include Malaysia, Indonesia, and Vietnam. And the utilization rate of jack-up drilling rigs in Southeast Asia has continuously remained at high levels since 2022 and reached nearly 95%. Looking ahead, we expect Jack-up rig prices to continue to remain at high levels, underpinned by a resilient Southeast Asia rig market. We project day rates to remain above USD 100,000/day, which is very good for the drilling companies in the region.

Forecast of the number of jack-up rigs in Southeast Asia

Vietnam’s E&P spending to recover

Vietnam’s exploration and production (E&P) activities are expected to accelerate from 2025 onward, driven by a significant increase in capital investment during the 2025–2030 period, reaching an estimated over USD 10 bn, significantly higher than the previous period. The official groundbreaking of the Block B – O Mon project in late 2024 has laid the foundation for a new growth phase in upstream activity. In addition, the Su Tu Trang (White Lion) Phase 2B and Lac Da Vang (Golden Camel) developments are expected to further fuel momentum, we also expect that domestic E&P spending will accelerate strongly in the next 3 years.

Phung Minh Hoang – Invesment Department, PHFM