Vietnam Banking: Reflecting on the past decade and looking ahead to a new cycle.

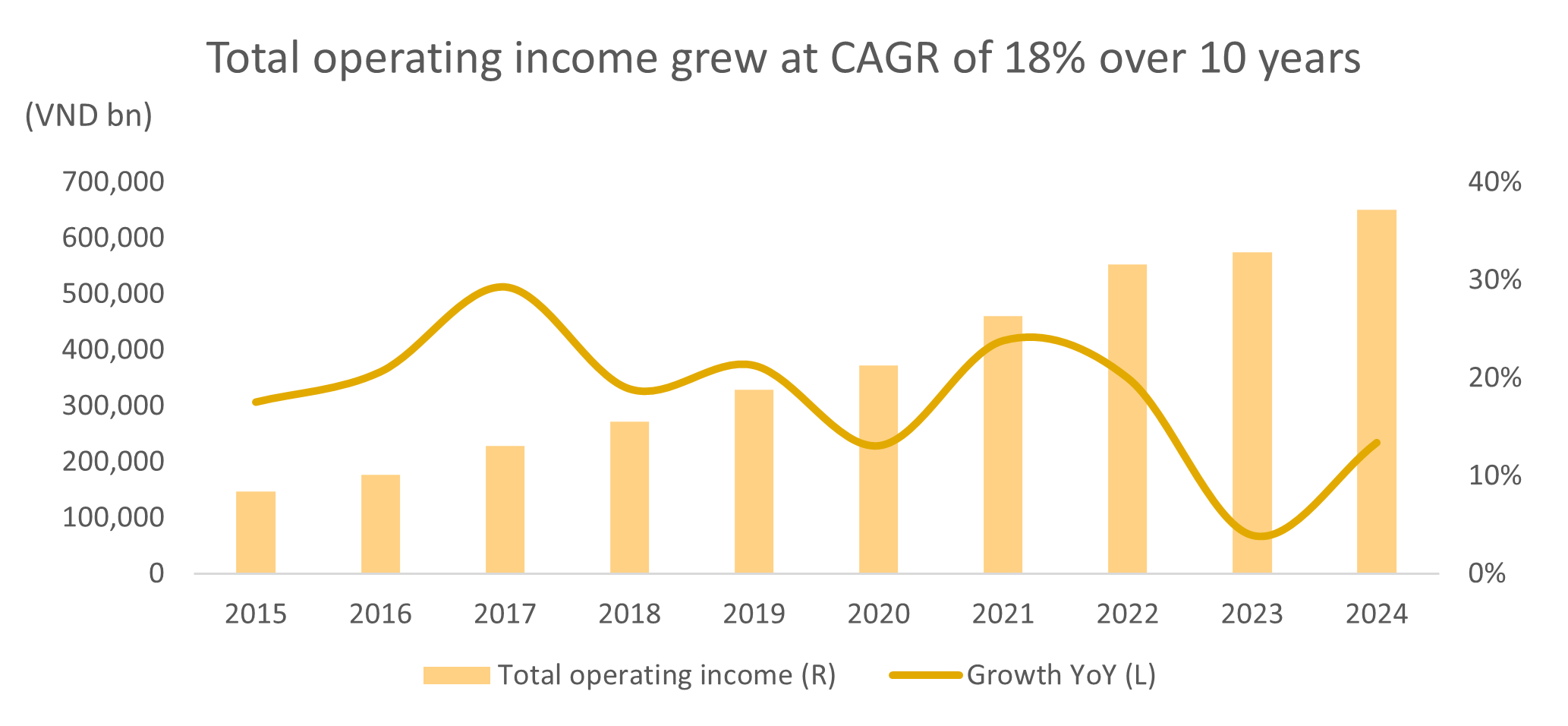

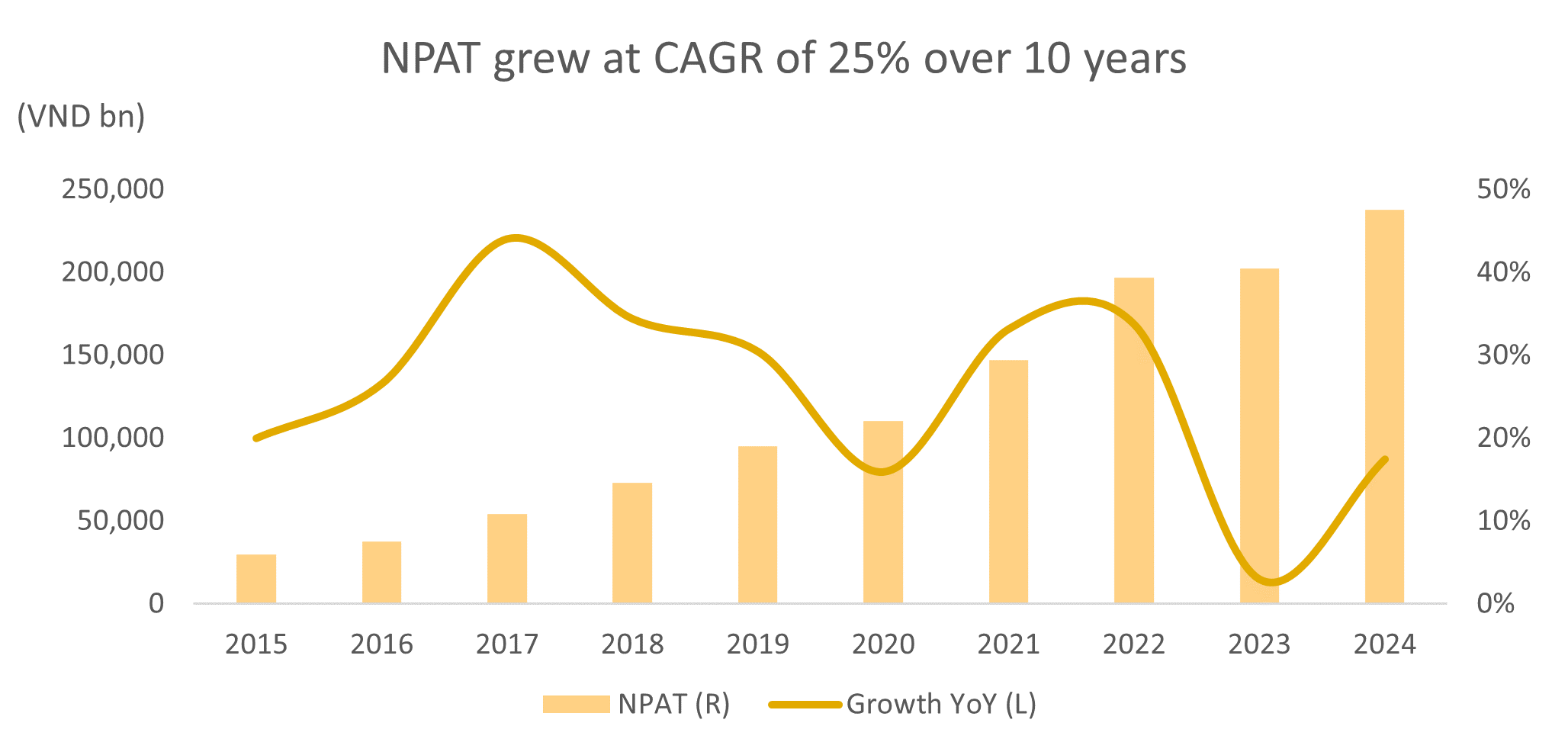

The banking sector is the backbone of the economy as well as the stock market, accounting for over 30% of market capitalization and more than 50% of total market profits. Looking back over the past ten years of the economic cycle, the sector has achieved average annual growth of 18% in operating income and 25% in net profit after tax, driven by steady credit growth of 14% per year and marked improvements in cost control and high fee income growth.

If we look only at the past five years, during which the economy has faced significant challenges from COVID-19 and the 2022 banking-sector liquidity crisis triggered by difficulties at SCB and the Vạn Thịnh Phát Group, the banking industry remains exceptional, with industry revenue and profit growth remaining and averaging 15% and 20% per year, respectively. On the Vietnamese stock market, very few sectors can match the banking sector’s high and consistent growth.

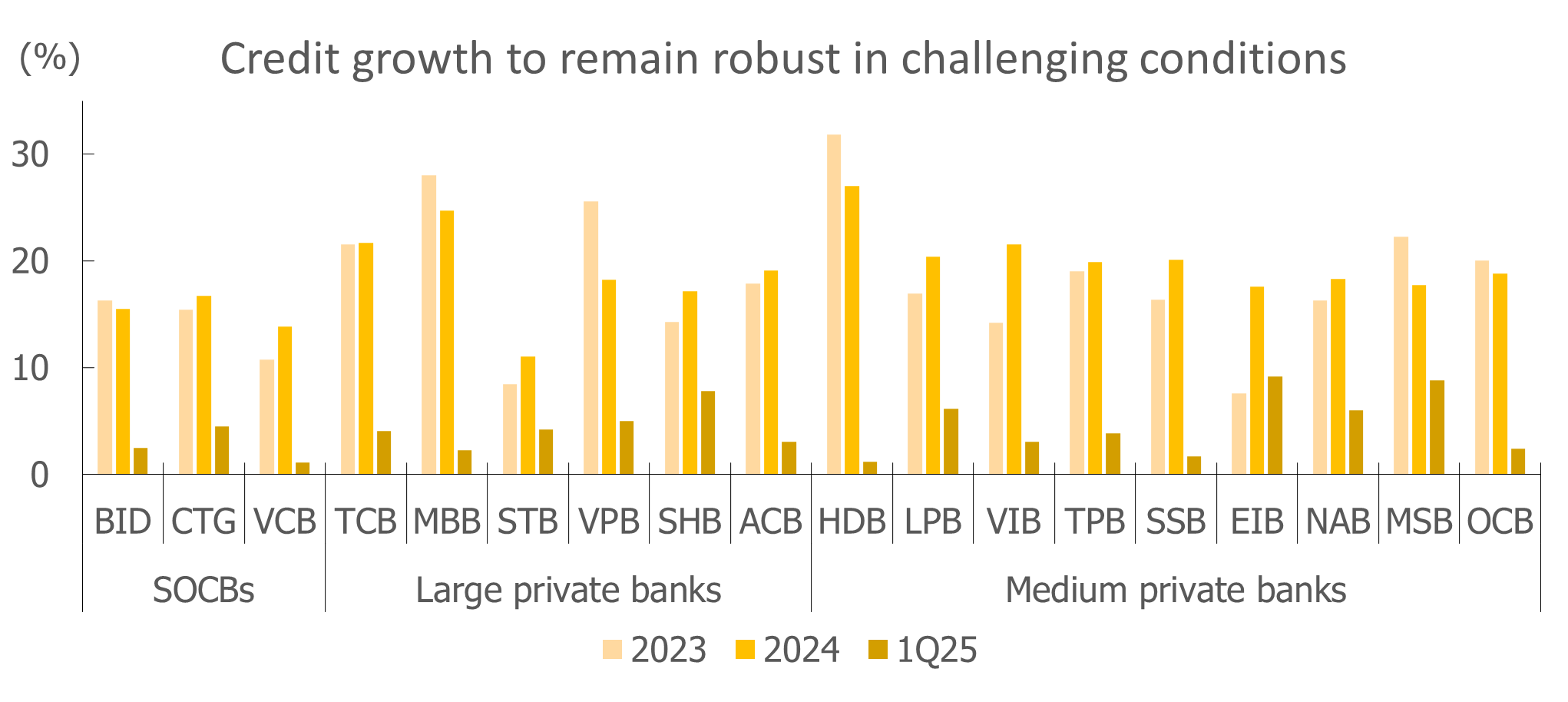

Over the past two years, the banking sector has bottomed and recovered, fueled by the economy’s recovery. After the liquidity crisis at the end of 2022, credit growth hit its low point in 2023 but rebounded strongly in 2024. The robust growth in 2024 was supported by both expansionary monetary and fiscal policies, the State Bank of Vietnam cut its policy rates sharply from the very high levels of 2023, helping to thaw the real estate market, while export revenues surged and, in turn, spurred consumer spending. As a result, banks saw marked improvements in profitability and credit growth in 2024.

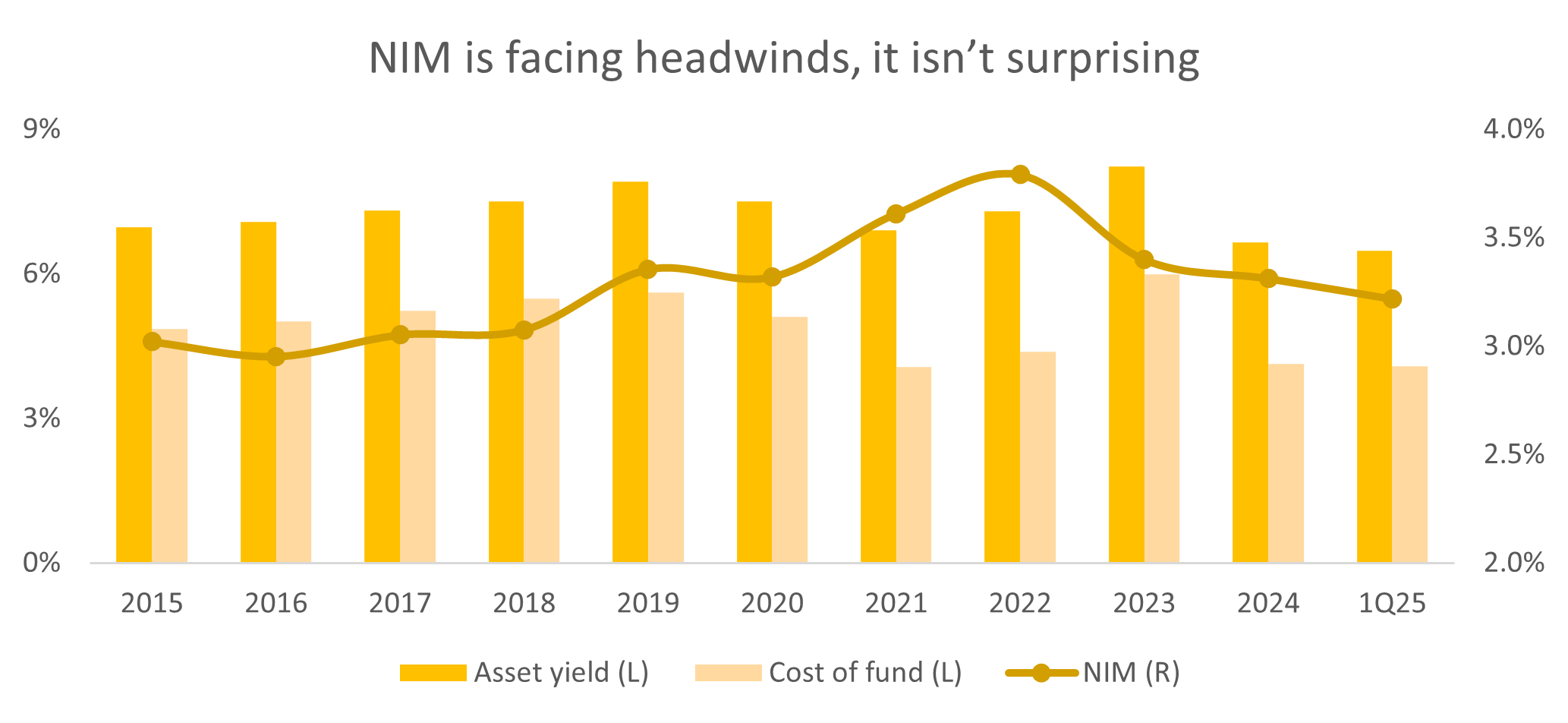

Despite facing headwinds, NIM compressed but in line with expectations

In early 2025, NIM (net interest margin) continued the downward trend seen in the 2023-24 period. It came under significant pressure as funding costs edged higher amid deposit growth lagging credit growth. On the output side, banks have been forced to keep lending rates low, partly to comply with government directives supporting the economy and partly due to fierce competition amid weak loan demand. Meanwhile, high-yield segments such as consumer and mortgage lending have yet to recover as expected, prompting banks to favor shorter-term, lower-risk loans. However, it isn’t surprising, NIM surged in 2021–2022 alongside the real-estate bubble and has now reverted to its pre-COVID norm. In our view, state-owned banks with their cost-advantaged funding and private banks with robust asset quality are best positioned to withstand the current situation.

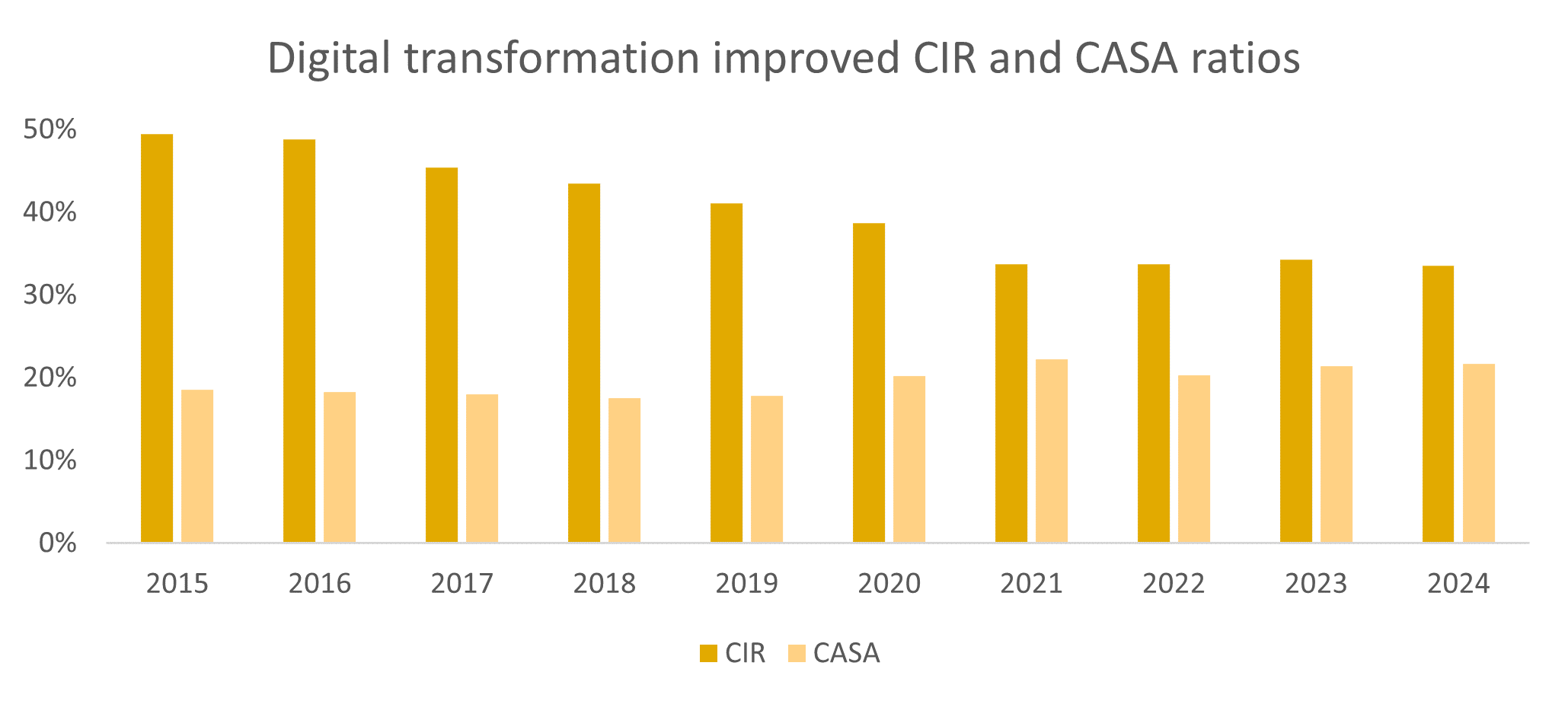

Digital transformation has driven significant cost savings

By strengthening governance and upgrading IT infrastructure, banks have reduced their cost-to-income ratio (CIR) from 50% to 33% and improved the CASA ratio (current account savings account) last decade. The pandemic further accelerated this shift, and in 2020, the State Bank of Vietnam formally approved eKYC, allowing banks to deliver end-to-end digital services without requiring branch visits. This digital integration has attracted a surge of new customers. Rapid digitization has fundamentally changed how people carry out everyday payments. By 2024, 87% of adults nationwide held a bank account, up from just 31% in 2019, and e-wallet users jumped from 12 million to 50 million by year-end 2024. This remarkable growth highlights the move toward digital interactions, with banks forging fintech partnerships and developing innovative, mobile-based revenue models to boost customer engagement and financial performance. Additionally, Vietnamese banks are increasingly deploying artificial intelligence to enhance marketing effectiveness and customer experience.

Attractive valuations with solid outlook

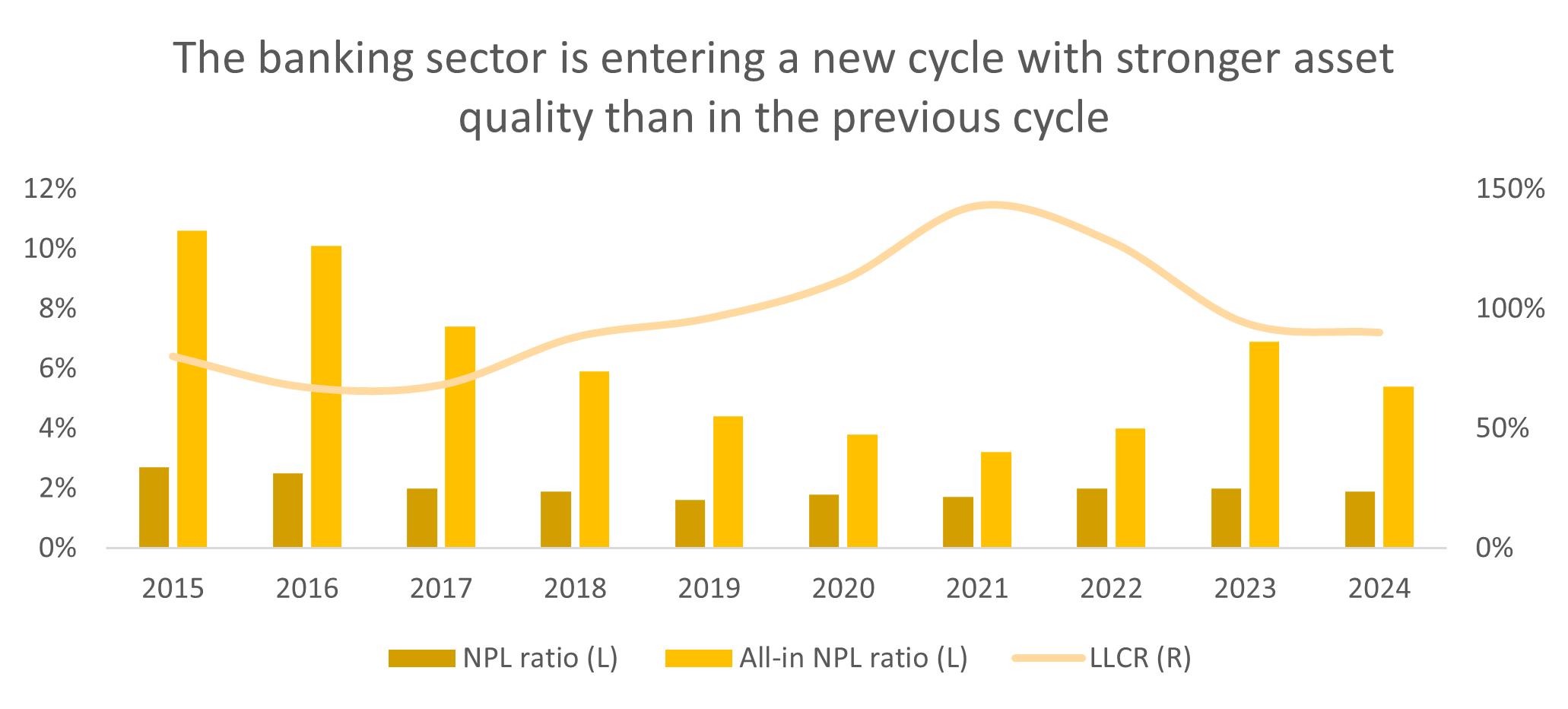

The NPL (non-performing loan) ratio and restructuring debts increased significantly in 2023-24 due to the COVID-19 pandemic, the 2022 crisis, and real estate bubble consequences. Although the NPL environment may resemble 2013–2015, stronger loan-loss coverage ratios and a healthier economic backdrop should drive better earnings growth for the new cycle. Robust credit expansion, enhanced operational platforms, and a higher LLCR (loan life coverage ratio) position banks to get high earnings growth in 2025-27.

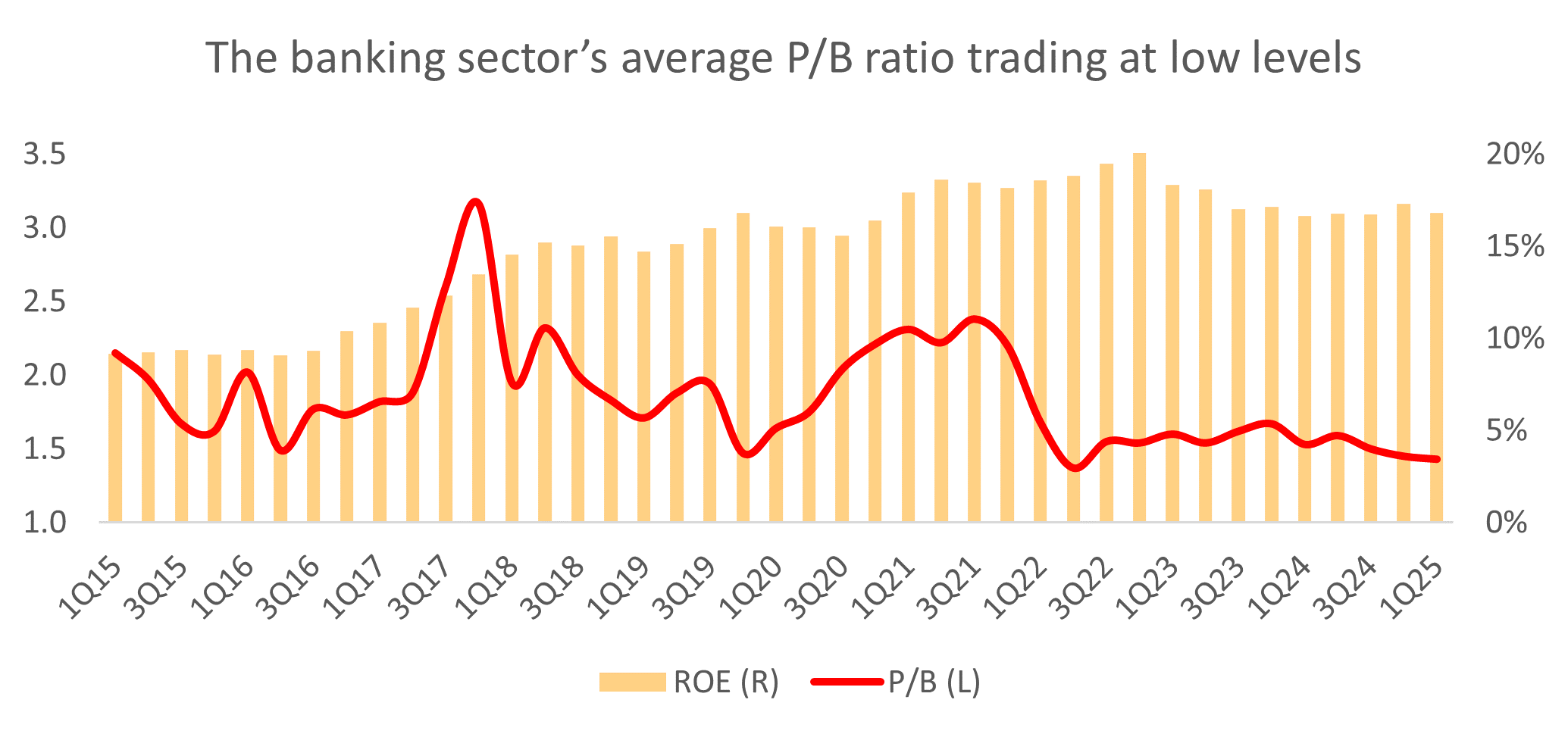

We see some difficulties in the banking sector in the short term, but the economy is recovering well, so we expect a better outlook for Vietnam’s banking sector. In the long term, Vietnam’s banking sector still offers high growth potential over the next 3-5 years, with average profit growth of around 20% p.a, underpinned by: strong credit expansion, diversification into fee-based services, and Ongoing cost efficiencies. Currently, although Vietnam’s banking industry P/B ratio has been a little bit higher than its Asian countries, its valuation remains attractive due to: (1) significant potential earnings growth in the next 5 years (2) impressive return on equity (ROE), (3) better NPL and LLCR compared to last cycle.

Phung Minh Hoang – Invesment Department, PHFM