Beating the Bear: Analyzing Resilient Stocks In A Bear Market

Throughout history, periods of rising and falling prices have alternated in the stock market. However, will all industry groups and stocks decline during a bear market? We have conducted research and identified industry groups and stocks that exhibit better “resilience” than the market. This article will focus on researching and exploring stocks and industry groups that have performed well in the past. Additionally, we will study the characteristics of these stocks.

We define a bear market as a market with a decline greater than 20% from peak to trough, and stocks with better “resilience” than the market will be those that experience a smaller decline than the market during that period and recover better after bottoming out. We conducted our research across three bear market periods.

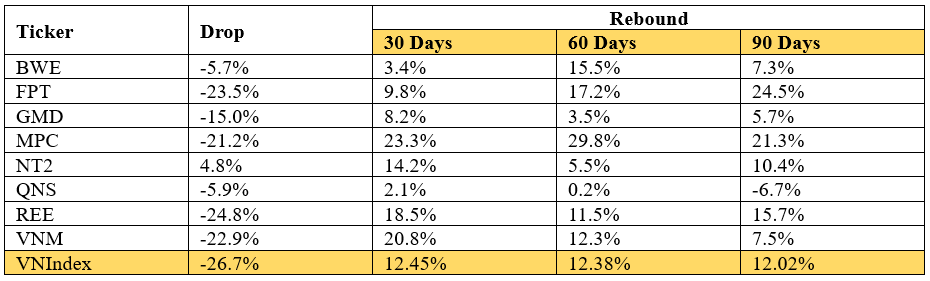

In 2018, when the trade war occurred, the Vietnamese stock market entered a downturn with a decline of approximately 27%.

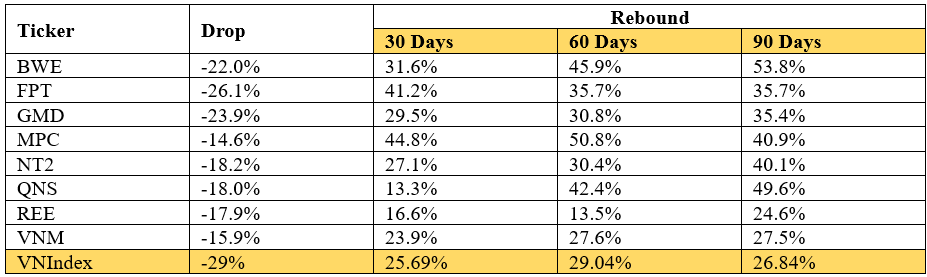

In 2020, when Vietnam recorded its first Covid-19 cases, the market fell by about 30%.

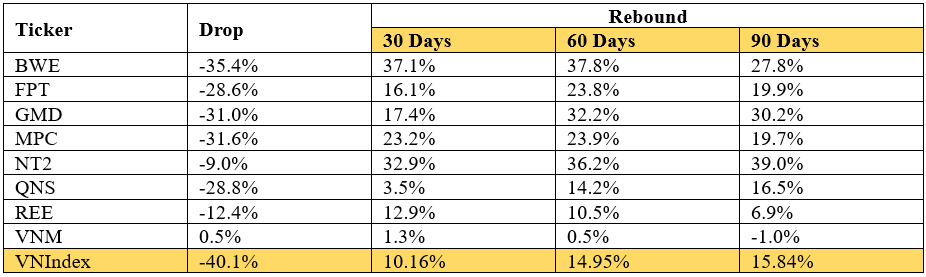

In 2022, when the real estate and credit markets faced a crisis, the market declined by approximately 40%.

In the list of stocks we tracked, there are 8 stocks that have shown better strength than the market during these bear market periods: BWE, FPT, GMD, MPC, NT2, QNS, REE, VNM. The majority of the aforementioned companies have solid and defensive business models. Many of these stocks belong to essential goods sectors (VNM – dairy, BWE – water, REE – electricity, QNS – sugar, MPC – shrimp exports), information technology (FPT – IT services), and logistics (GMD – seaports).

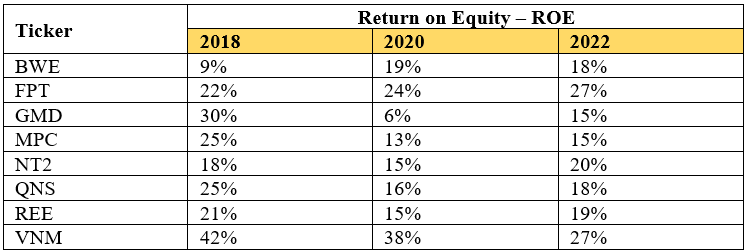

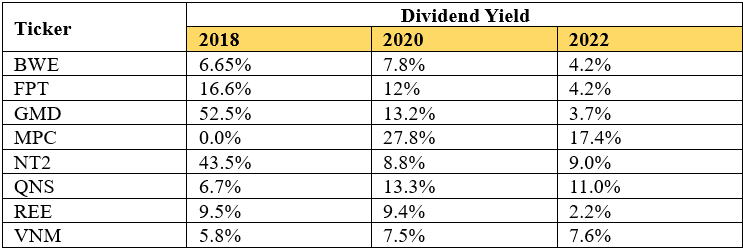

Furthermore, these companies possess strong financial health, demonstrated by low debt ratios, ample cash reserves, and good solvency. As a result, they have a solid foundation to weather challenging market periods. Their ability to generate stable cash flow from core business operations is also a significant strength, enabling them to maintain efficient operations even in unfavorable economic environments. Notably, statistics show that the average return on equity (ROE) for these companies across the three bear market periods was approximately 20%, accompanied by an attractive dividend yield during these downturns, averaging around 12% over the same period.

Note: All the information above is for research and reference purposes only and should not be considered investment advice. We use historical data for analytical purposes, but this does not guarantee that the future performance of these sectors or stocks will be similar. The market always carries potential unexpected factors, and investors must take full responsibility for their own decisions.

Many people tend to choose stocks based on a story or theme. This method is more suitable for short-term speculators, and investors need to judge whether the company’s profits will really benefit from the news. It is easy to find the characteristics of high-quality stocks from these resilient stocks mentioned in this article. These stocks are characterized by high profit margins, reasonable debt ratios, and ample cash. Especially in a year with high uncertainty like 2025, choosing high-quality stocks can allow investors to survive in a volatile market. Although these companies may not have eye-catching themes and stories and may appear very boring, they can bring stable returns to investors in the long run. Here in PHFM, we do not invest stocks solely based on themes and stories. Instead, we check companies’ historical track records, analyze their financials, and try to find out their sustainable advantages.

Tran Minh Tri – Invesment Department, PHFM