Why Does Real Estate Remain a Key Pillar Among Vietnam’s Growth Drivers?

Real estate has long been regarded as one of the most influential sectors in Vietnam’s economy, given its deep linkages with construction, finance, materials, and household consumption. A single shift in the property market often ripples across multiple industries, from banking credit flows to labor demand, making it a barometer of both short-term sentiment and long-term structural growth.

In this article, we take a closer look at how real estate has shaped Vietnam’s economic development to date, why it remains a critical pillar among growth drivers, and what this means for the market moving forward.

Real Estate: An Essential Pillar of Growth

- Impact on the Real Economy

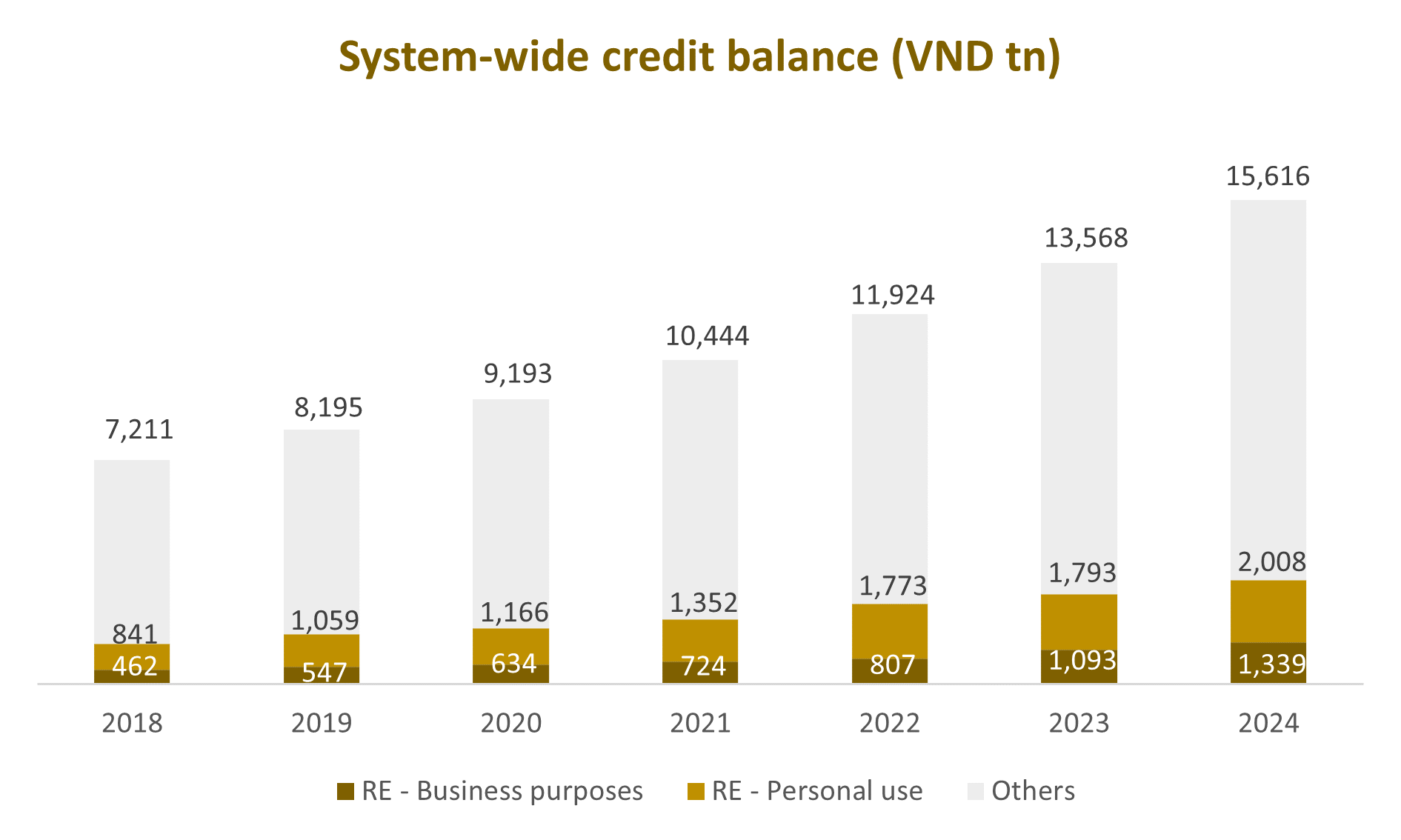

Real estate accounts for a substantial share of Vietnam’s credit system, with outstanding loans for business and personal use in the sector reaching VND 4.3 quadrillion in 2024, up 16% year-on-year and representing 21.4% of total credit balance.

Beyond direct lending, however, the influence of real estate extends even further. In many other sectors, property assets continue to serve as the primary form of collateral, underpinning access to financing for a wide range of business activities. Our observations suggest that real estate is used as collateral for at least 40–50% of total loan value, highlighting its outsized impact on credit flows and economic activity.

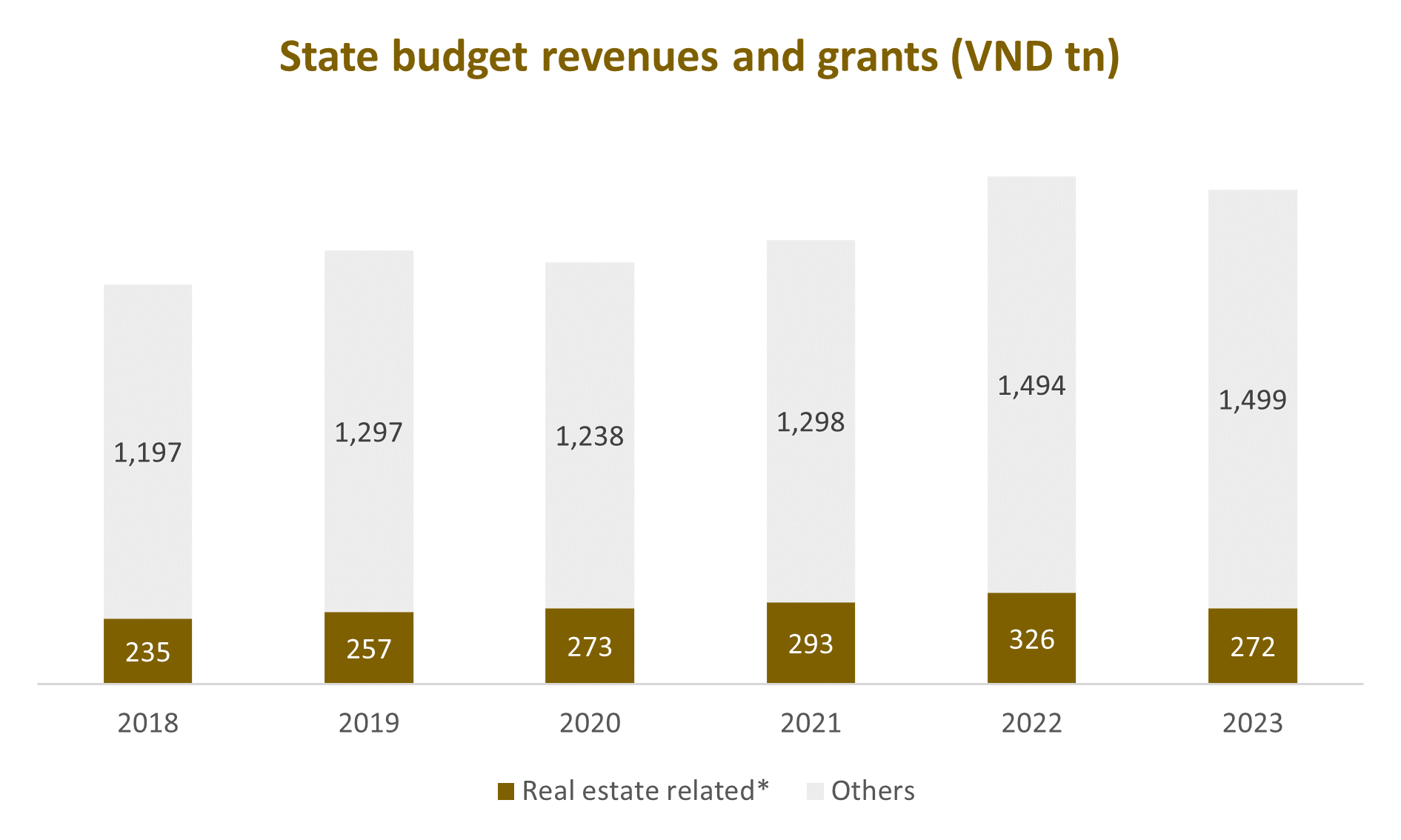

Real estate also makes a notable contribution to fiscal revenues. In 2024, taxes and fees from the sector totaled VND 272 trillion, equivalent to 15.4% of state budget collections — ranking third after corporate income tax and value-added tax. Within this, land-use right fees alone accounted for 56.9% of total real estate revenue, underscoring their importance as a stable source of government income. Other real estate–related taxes, such as VAT on final products and CIT from property developers, also contribute significantly, though they are harder to measure precisely.

- Impact on the Securities Market

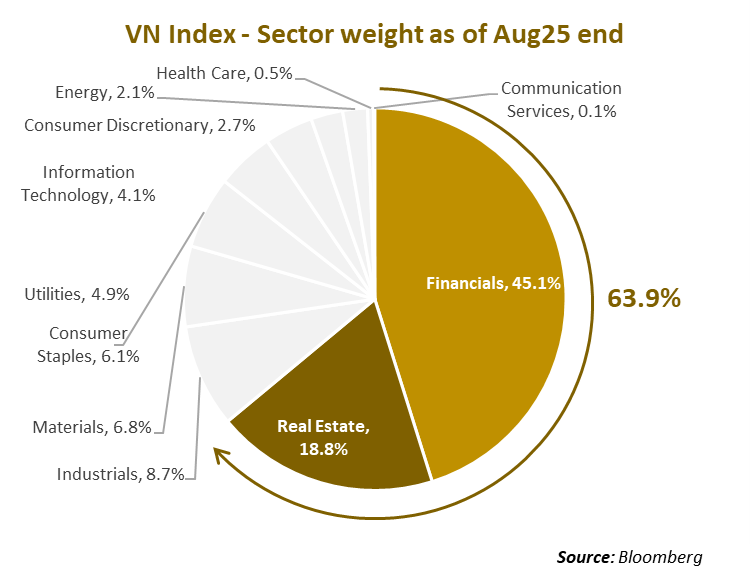

The VN Index remains heavily concentrated in two sectors — Financials (45.1%) and Real Estate (18.8%) — which together account for nearly two-thirds of the market capitalization (63.9%). While Real Estate stands as the second-largest sector on its own, its true influence is even greater. Financials, which dominate the index, are largely tied to property-related lending and often rely on real estate assets as collateral. This close interdependence means the real estate cycle has an outsized impact not only on its own sector performance, but also on the stability and valuation of the financial sector — effectively shaping the broader market’s dynamics.

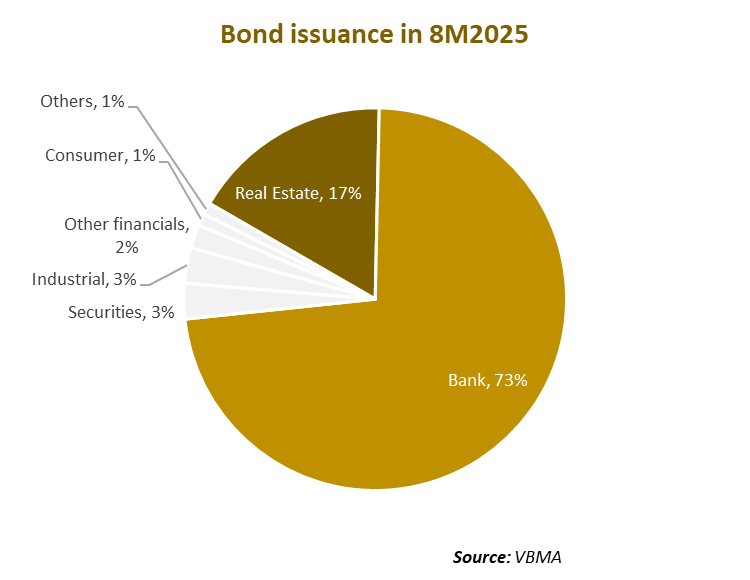

Beyond equities, the bond market also reflects the dominance of these two sectors. In the first eight months of 2025, bond issuance from Financials and Real Estate accounted for as much as 80% of total issuance, further underlining the property sector’s central role in Vietnam’s capital markets.

Recent Developments in Real Estate

- Recent Developments in Policies

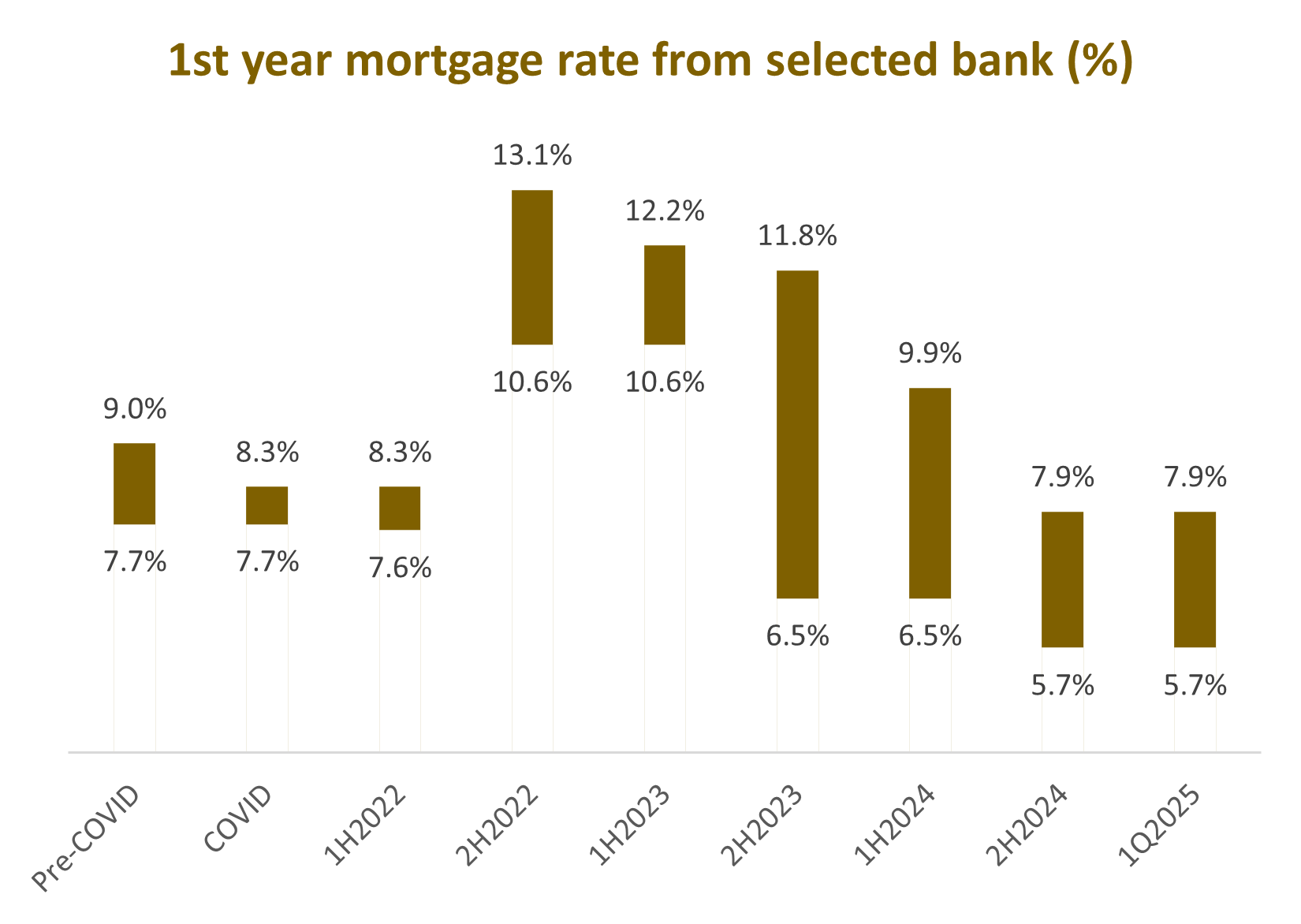

In terms of policy, Vietnam’s mortgage schemes have gradually eased following the COVID period. Mortgage rates at major banks declined from 7.7–9.0% before COVID to 5.7–7.9% by the first quarter of 2025, reflecting the State Bank of Vietnam’s accommodative monetary stance. Additionally, the easing of upfront cash flow requirements allows homebuyers to make lower equity disbursements—ranging from 8.6% to 20%—before property handovers.

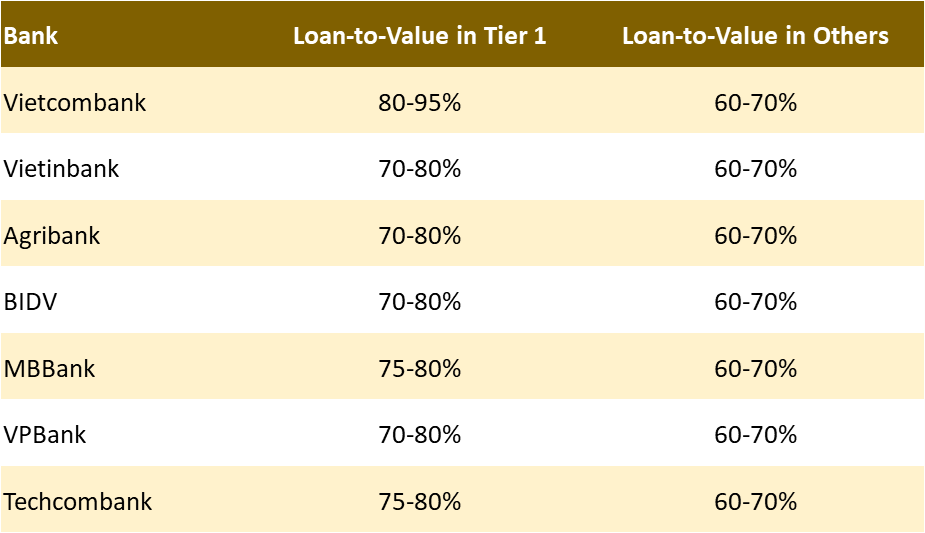

Additionally, the provincial mergers have enhanced credit accessibility in Tier 2 provinces. Most banks offer higher loan-to-value (LTV) ratios in Tier 1 cities, typically ranging from 70–80%, depending on borrowers’ credit profiles. In contrast, LTV ratios in other provinces and secondary cities are generally lower, averaging around 60–70%. Overall, these developments contribute to improving credit accessibility and financial inclusion across a broader range of provinces.

- Recent Developments in Real Estate Market

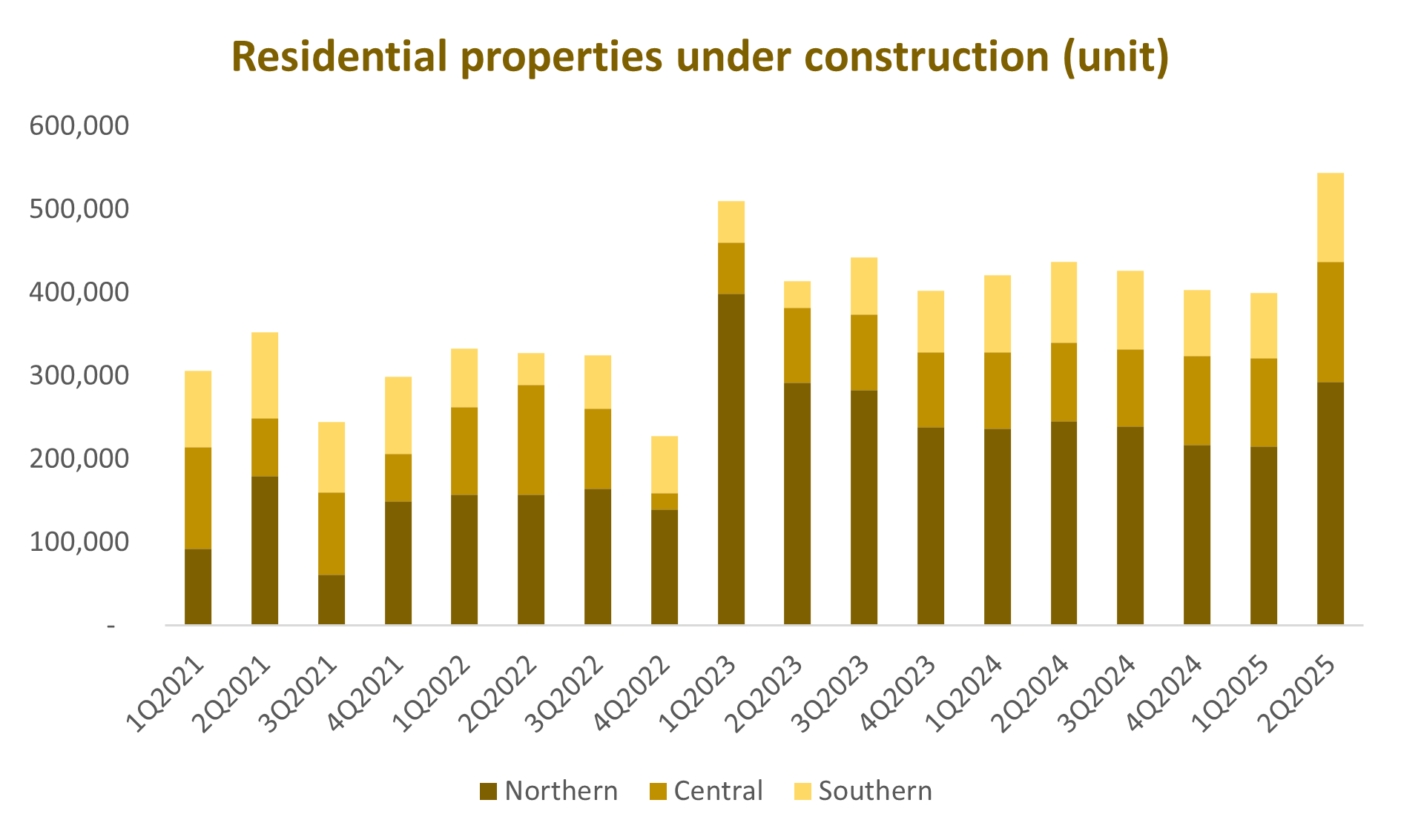

Real estate construction is regaining momentum, with residential activity rising sharply in 2Q25. A total of 1,517 projects—equivalent to 544,000 units—are under construction, up 36% quarter-on-quarter. The North leads the recovery, driven by Vingroup’s mega projects that have faced no legal hurdles since 2022.

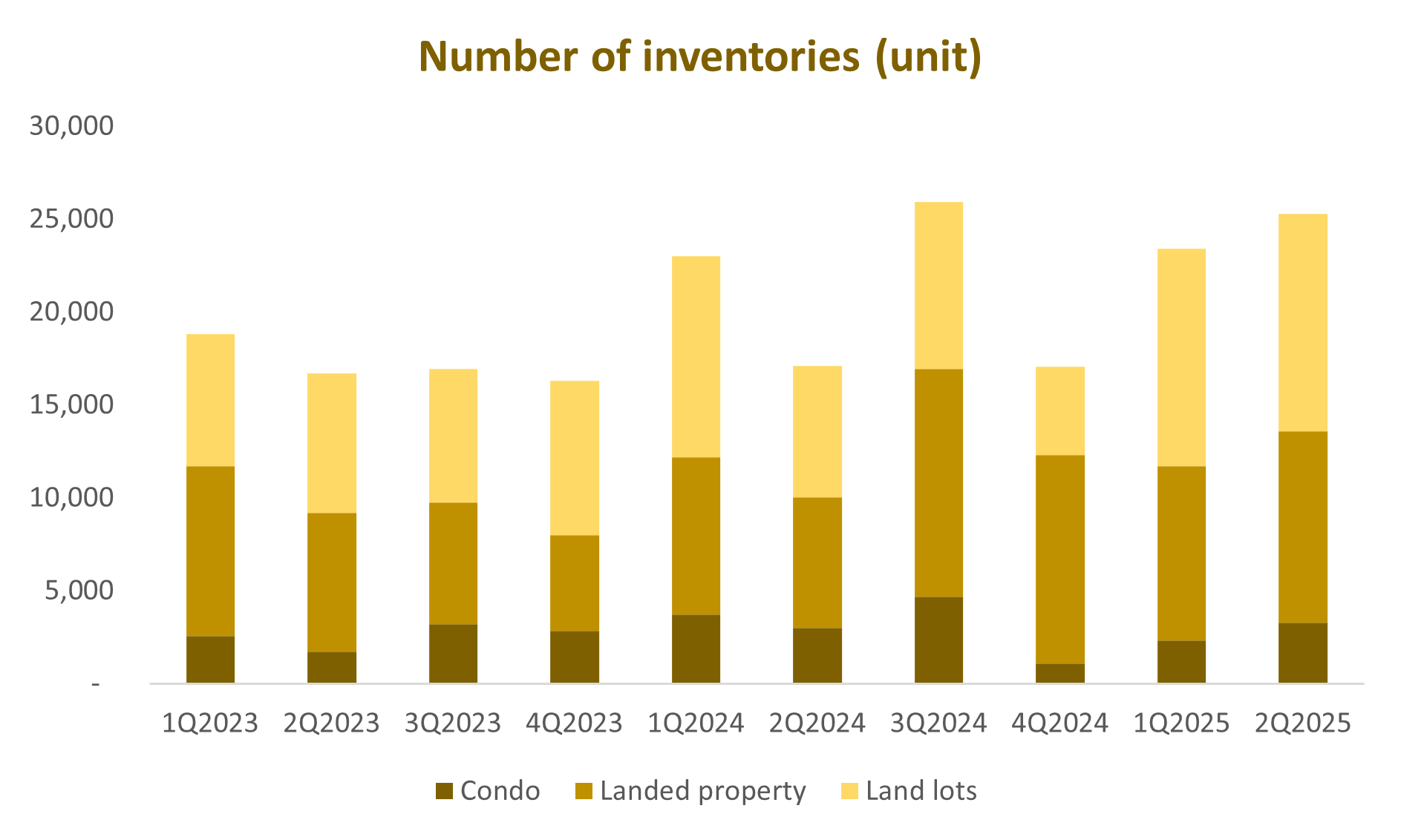

Inventory has surged since 3Q24 following the implementation of the new law. As of 2Q25, total inventory reached over 25,294 units, including 3,287 condominiums, 10,290 landed properties, and 11,717 land plots. Compared with 1Q25, inventories rose modestly, with individual houses up 9%, land plots up 0.3%, and condominiums up 40.5%. The new regulation, effective from July 1, 2024, has boosted developers’ confidence, prompting a notable buildup in inventory levels.

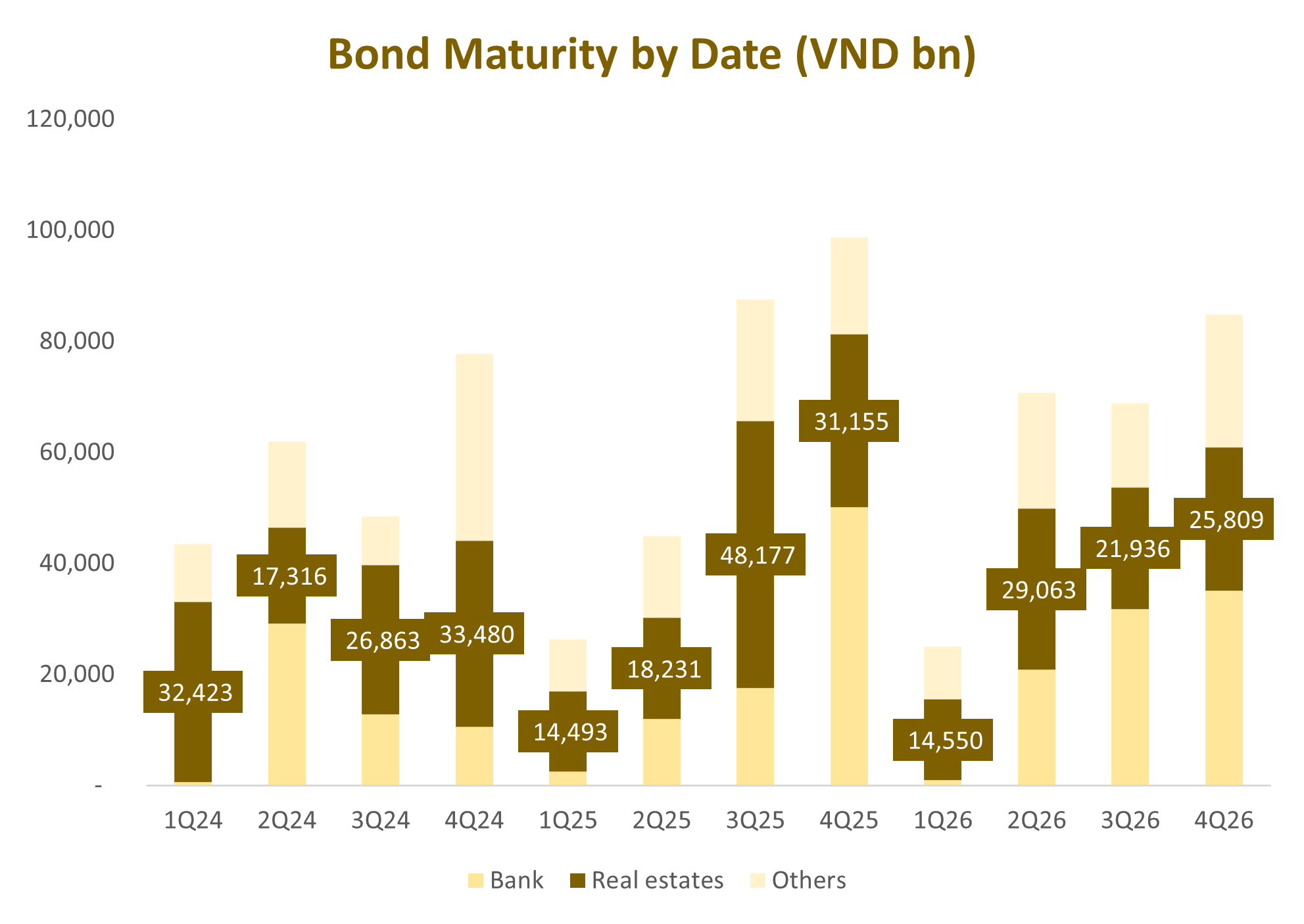

Bond market pressures are expected to concentrate mainly in the first half of 2025. By now, most developers with problematic bonds have successfully raised funds to roll them over. As a result, cash flow pressure on real estate companies is expected to ease significantly, paving the way for a new cycle.

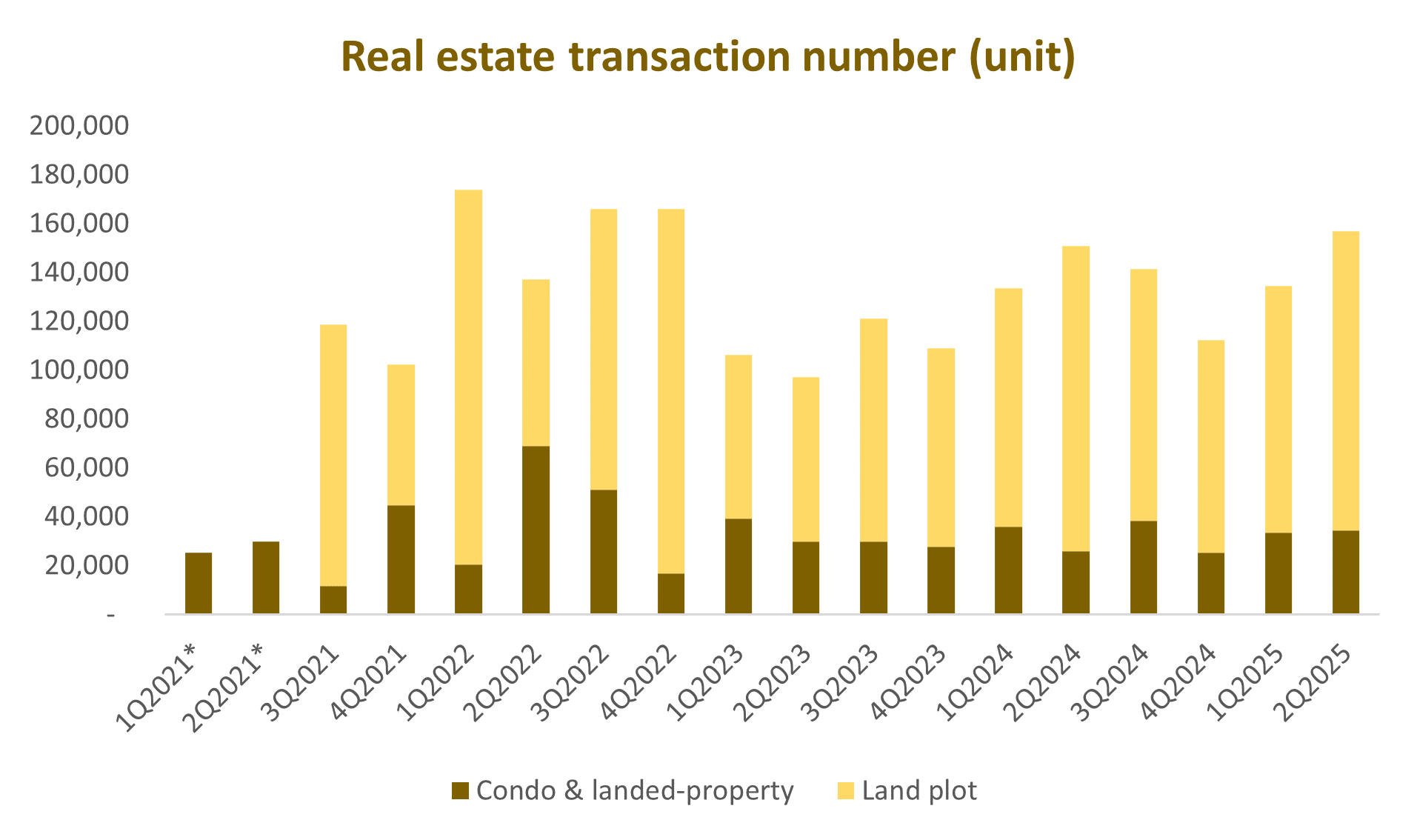

Condominium and landed property transactions surged as market bottlenecks eased. In 2Q25, total transactions reached 34,461 units—up 33.1% year-on-year and 2.6% quarter-on-quarter—driven by improved supply conditions. Meanwhile, land plot transactions totaled 122,560 units, a slight 1.9% decline year-on-year but a strong 21.3% increase quarter-on-quarter, reflecting recovery momentum from last year’s high base.

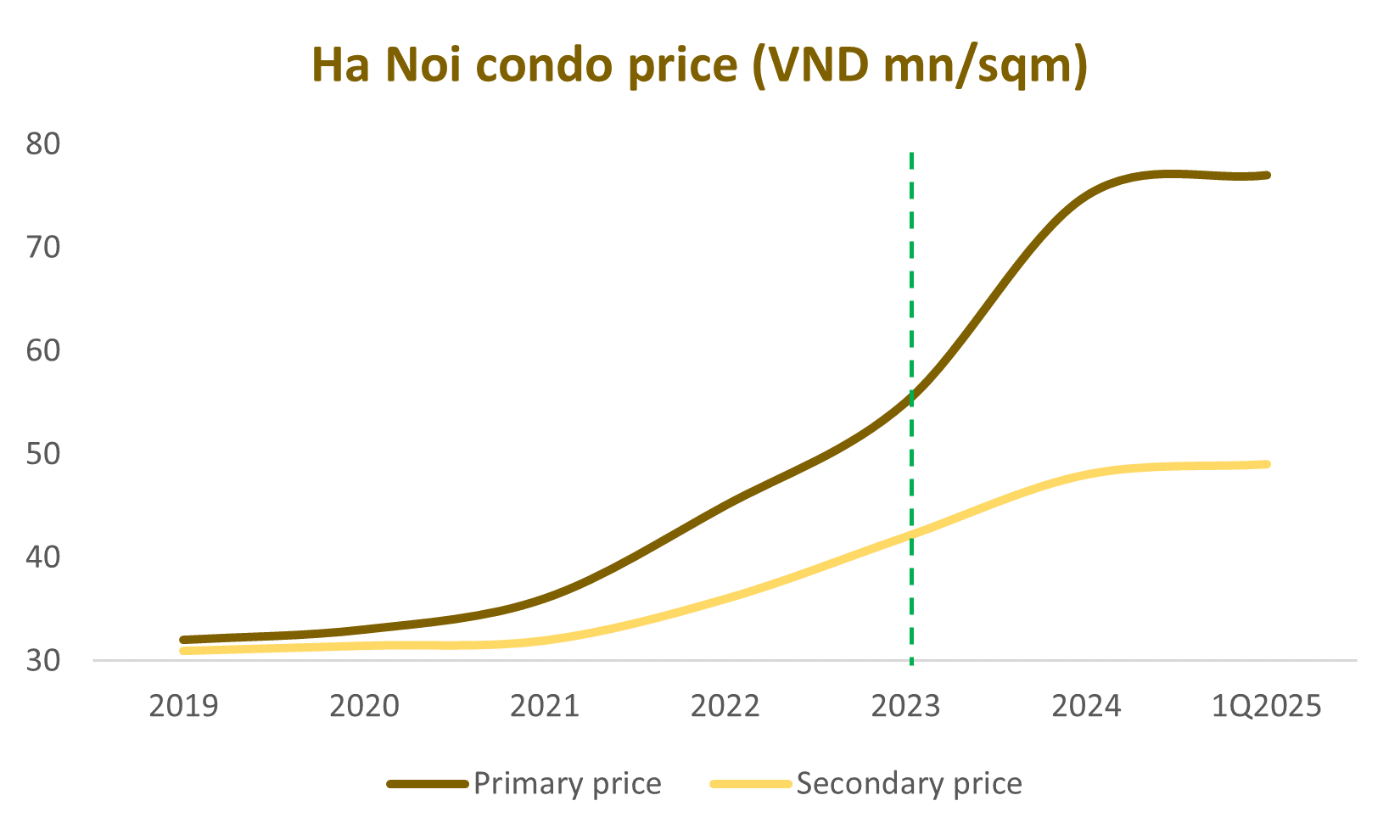

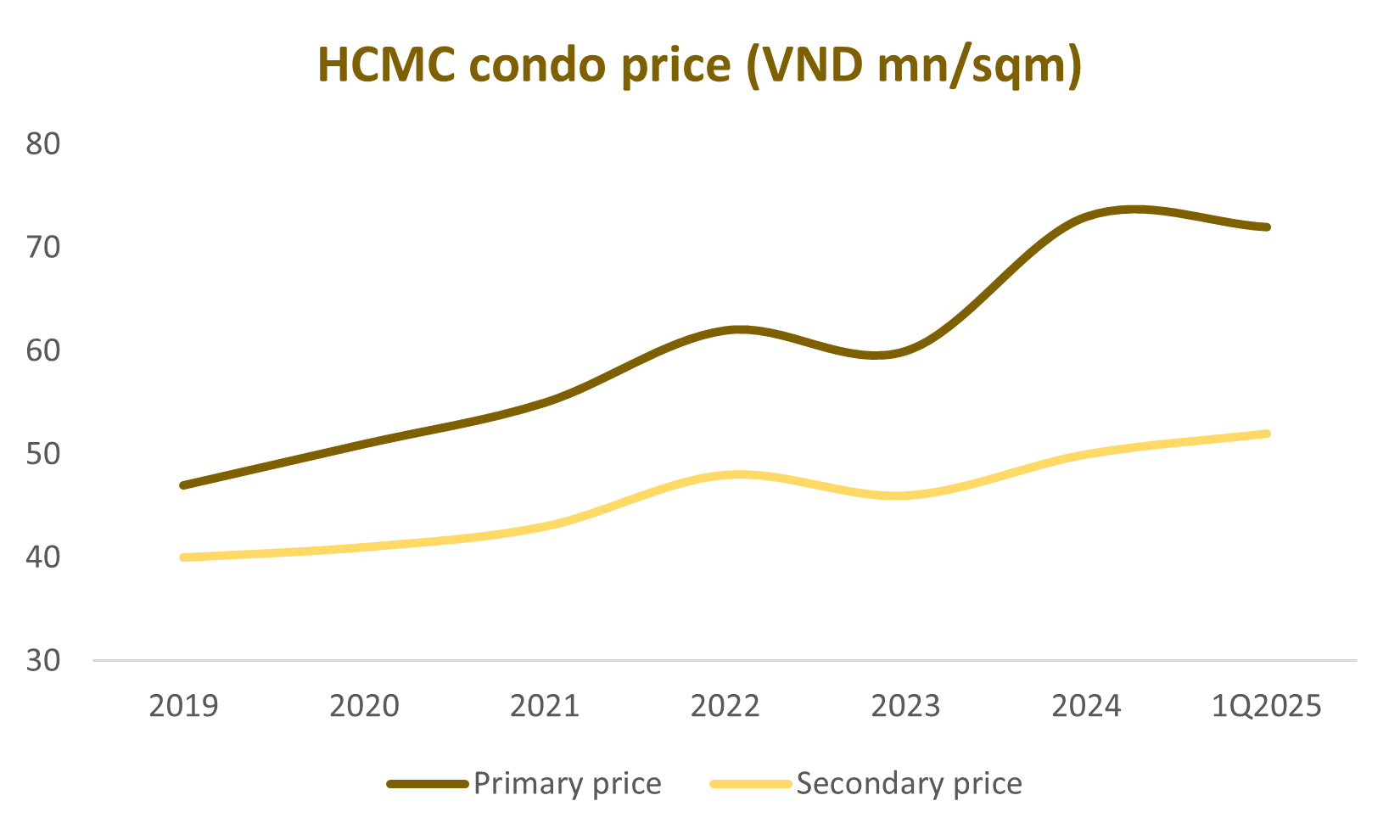

Condo prices rebounded after the 2023 decline, marking the start of a new cycle. In HCMC, primary prices rose 22% from 60 to 73 mn VND/sqm in 2024 before easing slightly in 1Q25, while secondary prices also recovered. In Hanoi, primary prices jumped 36% from 55 to 75 mn VND/sqm in 2024 and continued rising to 77 mn VND/sqm in 1Q25, with secondary prices trending moderately higher.

Conclusion

The real estate sector continues to play a pivotal role in Vietnam’s economic landscape, acting as a key driver of growth and capital circulation across industries. After an extended period of adjustment and challenges, market conditions have shown clear signs of stabilization, supported by improving liquidity and stronger investor confidence.

Looking ahead, newly implemented policies and regulatory reforms are expected to provide solid momentum for the next growth cycle. With supportive credit conditions, easing legal bottlenecks, and proactive government measures, the real estate market is poised to enter a new phase of sustainable recovery and expansion.

Le Thang Anh Tuyen – Invesment Department, PHFM