Vietnam FDI: Staying Competitive in the Global Relocation

Vietnam has become the third country—after the UK and China—to reach an agreement with President Donald Trump regarding the ‘reciprocal tariffs’ announced on April 2, 2025. Initially, Trump imposed a 46% tariff on Vietnamese exports to the U.S., the fifth highest rate among the measures introduced on what he called ‘Liberation Day.’ Although these tariffs were suspended shortly after being announced, they were scheduled to be reinstated within 90 days. That deadline has now been extended to August 1, 2025.

In a statement on July 2, 2025, Trump announced that the U.S. will impose a reduced 20% tariff on many Vietnamese exports. In addition, trans-shipments from third countries passing through Vietnam will be subject to a 40% levy. In return, Vietnam will allow U.S. products to enter duty-free under the agreement.

Is the new tariff deal with the United States good news for Vietnam? With the tariff on Vietnamese exports reduced to 20%, the agreement shows some positive signs. But can Vietnam still stay competitive in attracting foreign investment under this new setup? In today’s article, we take a closer look at what this means for Vietnam’s position in the global market.

I. Interpreting the Tariff Rate: What It Really Means for Vietnam

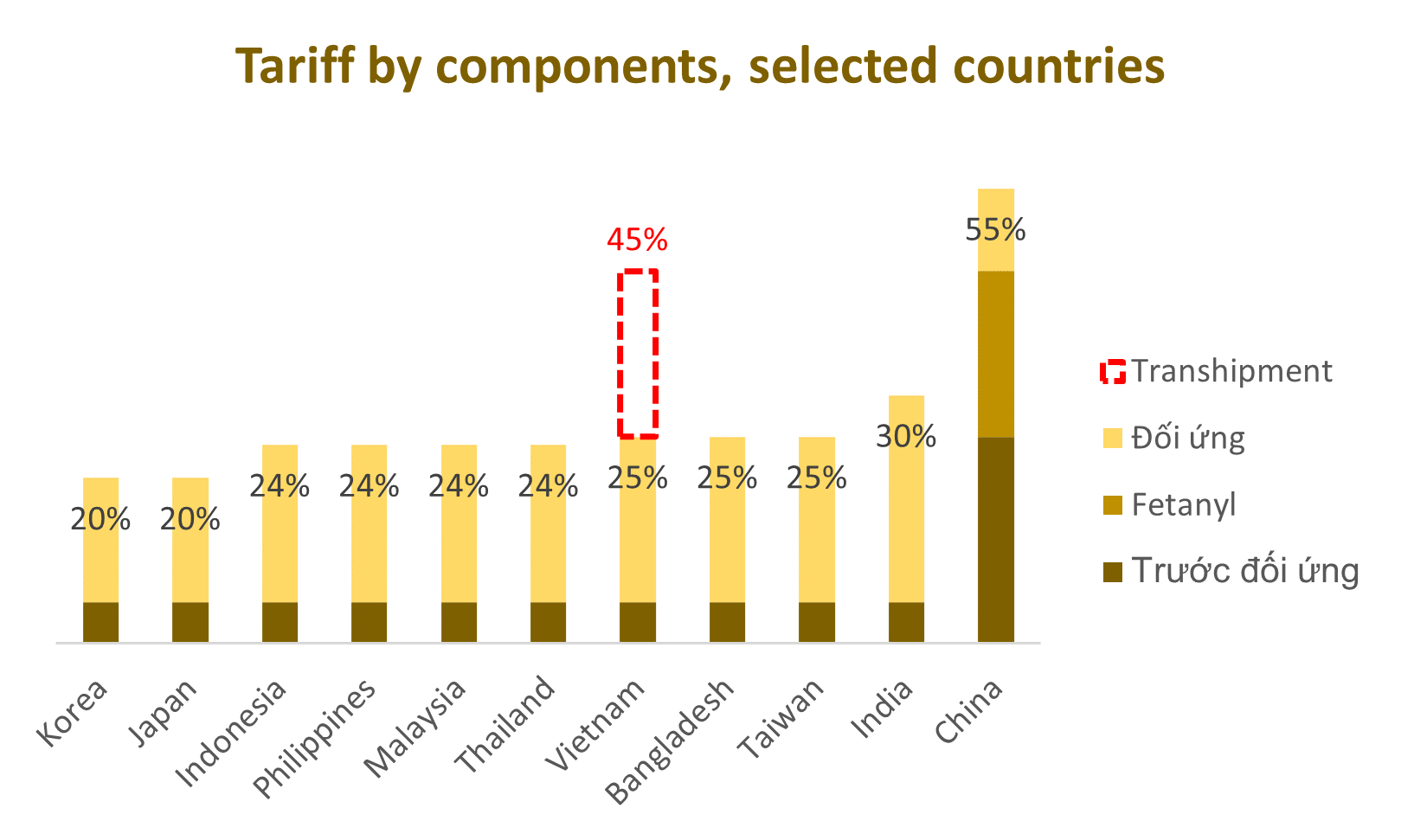

The actual tariffs applied to various countries include:

- Pre-retaliatory tariffs: These include Most-Favored-Nation (MFN) tariffs and those imposed as part of the trade war.

- Fentanyl tariff: A tariff imposed by the U.S. on countries it believes are sources of fentanyl imports into the U.S.

- Reciprocal tariff: A tariff imposed by the Trump administration following the so-called “Liberation Day.”

- Transshipment tariff: A tariff applied to goods involved in origin fraud or transshipment schemes.

With a 20% reciprocal tariff (resulting in a total effective rate of 25%), Vietnam will remain competitive to other FDI destinations. However, the U.S. has yet to finalize its definition of transshipment, leading to a significant gap between the two tariff levels. As a result, determining what constitutes transshipment has become a key focus in the tariff negotiations.

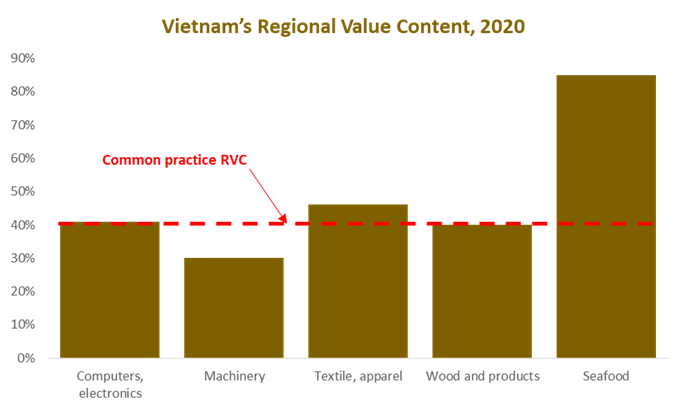

The Rules of Origin allows goods using imported material, but are processed sufficiently (or substantially transformed) to be consider originating. 3 methods include (1) Change in HS Code, (2) Regional Value Content, and (3) Specific Processing. Previously, the Certificate of Origin (CO) was issued by VCCI or the Ministry of Industry and Trade authority based on self-declarations. As a result, CO approval remains a grey area and a potential point of negotiation.

Several studies indicate that transshipped products may have accounted for up to 16.5% of Vietnam’s exports to the U.S. in 2021. However, we believe this share is likely to decline due to stronger enforcement efforts by both governments. As a result, the U.S. may offer concessions and ease the issuance of Certificates of Origin for Vietnamese products.

II. Beyond Tariffs: Vietnam’s Underlying Advantages in Attracting FDI

Beyond favorable tariff treatment relative to competing economies, Vietnam benefits from a range of structural and strategic advantages that continue to enhance its appeal to foreign investors. These include a high level of economic openness, a strategic geographic location at the heart of key regional supply chains, a competitive logistics network, and a stable political environment. In addition, Vietnam offers a cost-effective labor force that is increasingly skilled and adaptable.

- High level of economic openness

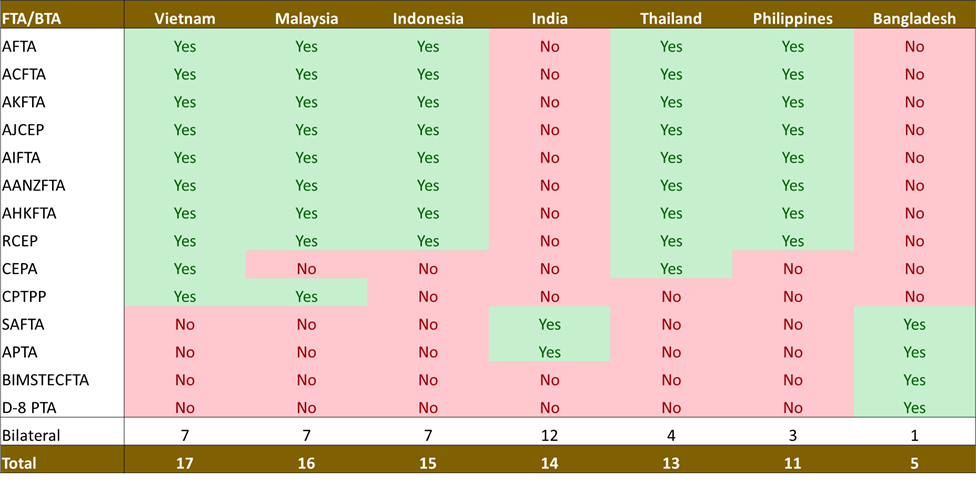

A Free Trade Agreement (FTA) is an arrangement between two or more countries that sets the terms of trade, including the tariffs and duties applied to imports and exports.

While FTAs are widely recognized for boosting trade flows and making a country more attractive to exporters and importers, they also offer strategic benefits that support Vietnam’s broader economic development.

By facilitating greater market access and encouraging investment, FTAs help Vietnam move beyond low-tech manufacturing and primary goods exports, enabling a gradual transition toward more complex, high-tech sectors such as electronics, machinery, vehicles, and medical devices.

Vietnam currently has 10 FTAs and 7 bilateral trade agreements with its trading partners—the highest among all selected countries. This reflects the high level of economic openness of Vietnam compared to its competitors.

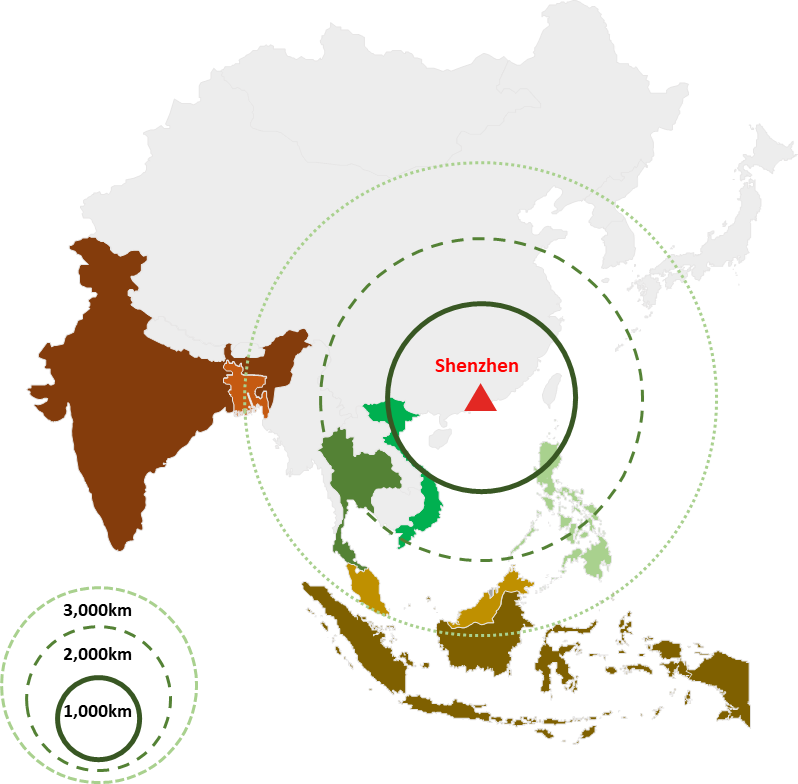

- Strategic geographic location at the heart of key regional supply chains

Vietnam occupies a strategic position in Southeast Asia, bordering China and lying along major maritime trade routes in the South China Sea. This geographic advantage places Vietnam at the heart of key regional supply chains, making it an ideal hub for manufacturing, assembly, and distribution activities. Its proximity to major markets such as China, Japan, and ASEAN countries allows for reduced transportation costs and shorter lead times, which are critical factors for global investors seeking to optimize logistics and supply chain efficiency. As global firms diversify production away from China under the “China+1” strategy, Vietnam’s location further strengthens its role as a preferred destination in the regional and global value chain.

- Competitive logistics performance

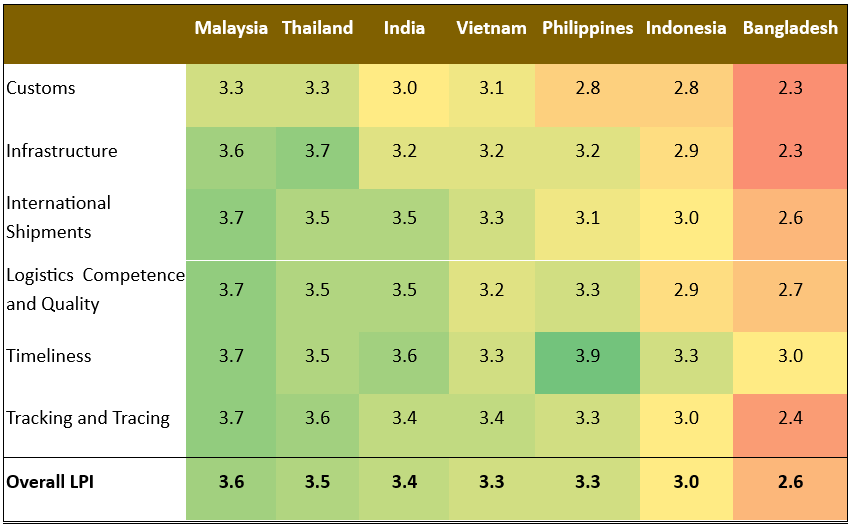

Vietnam ranks competitively in logistics among emerging economies, with an overall LPI score of 3.3, placing it close behind India (3.4) and on par with the Philippines (3.3), while outperforming Indonesia (3.0) and Bangladesh (2.6). Vietnam demonstrates relatively balanced performance across key dimensions, such as Tracking and Tracing, International Shipments, and Logistics Competence and Quality—all reflecting the country’s growing capability in handling cross-border trade efficiently. While still trailing regional leaders such as Malaysia and Thailand, Vietnam’s logistics infrastructure and customs systems signal a maturing logistics environment that supports FDI attraction. Overall, these indicators underscore Vietnam’s position as a cost-effective yet operationally viable logistics hub in the region.

- Stable political environment

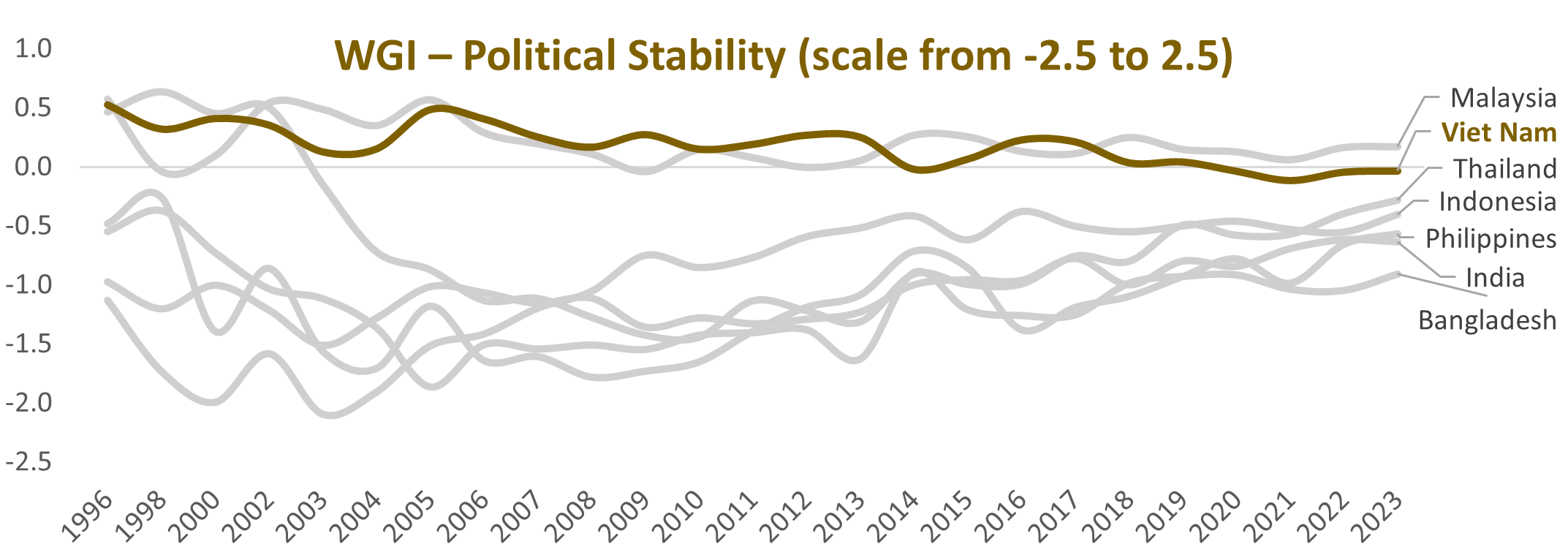

Vietnam’s political stability stands out as a key factor behind its sustained economic growth and attractiveness to foreign investors. According to the World Bank’s Worldwide Governance Indicators (WGI) – Political Stability Index, Vietnam ranks second among the selected countries in terms of political stability. A consistent policy direction and a predictable governance framework serve as key pillars of investor confidence, helping to facilitate more informed and efficient business decision-making.

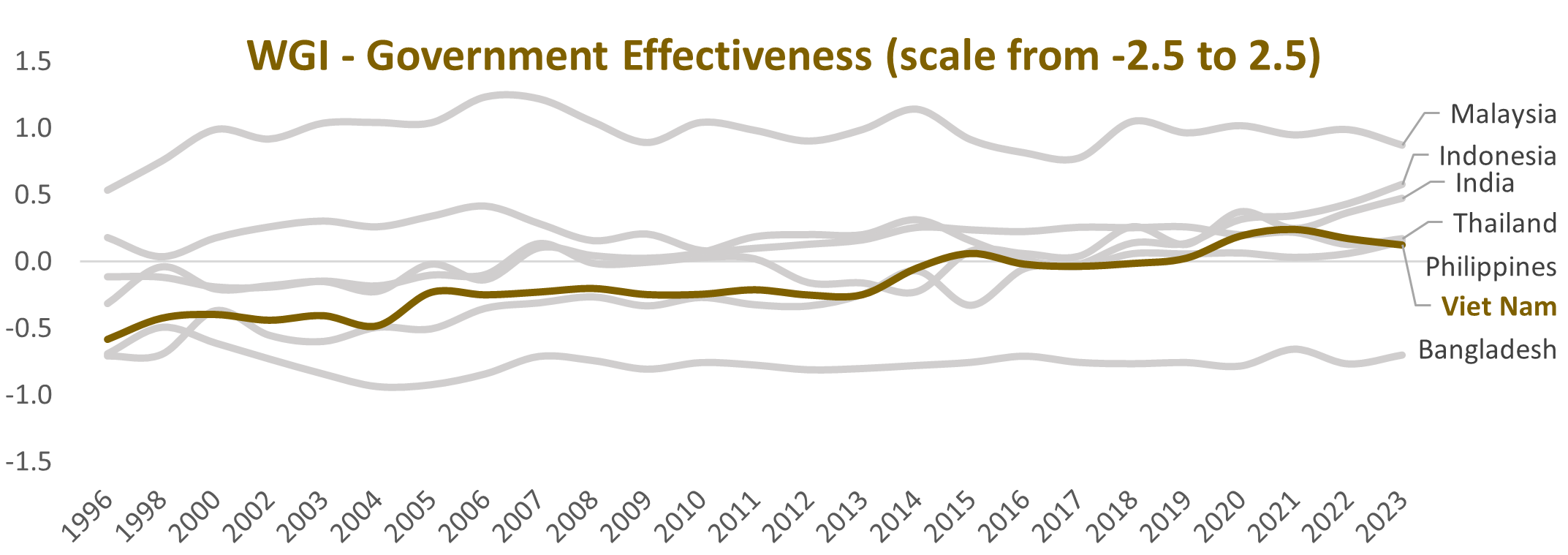

Moreover, Vietnam is gradually improving its Government Effectiveness. While the current score remains competitive compared to other countries, historical trends show that periods of reform often lead to noticeable improvements in this indicator. Resolution 68, issued by the Politburo, reflects Vietnam’s strategic push toward enhancing the effectiveness and efficiency of its governmental and public administrative systems.

- Low Labor Cost and Rapid Productivity Growth

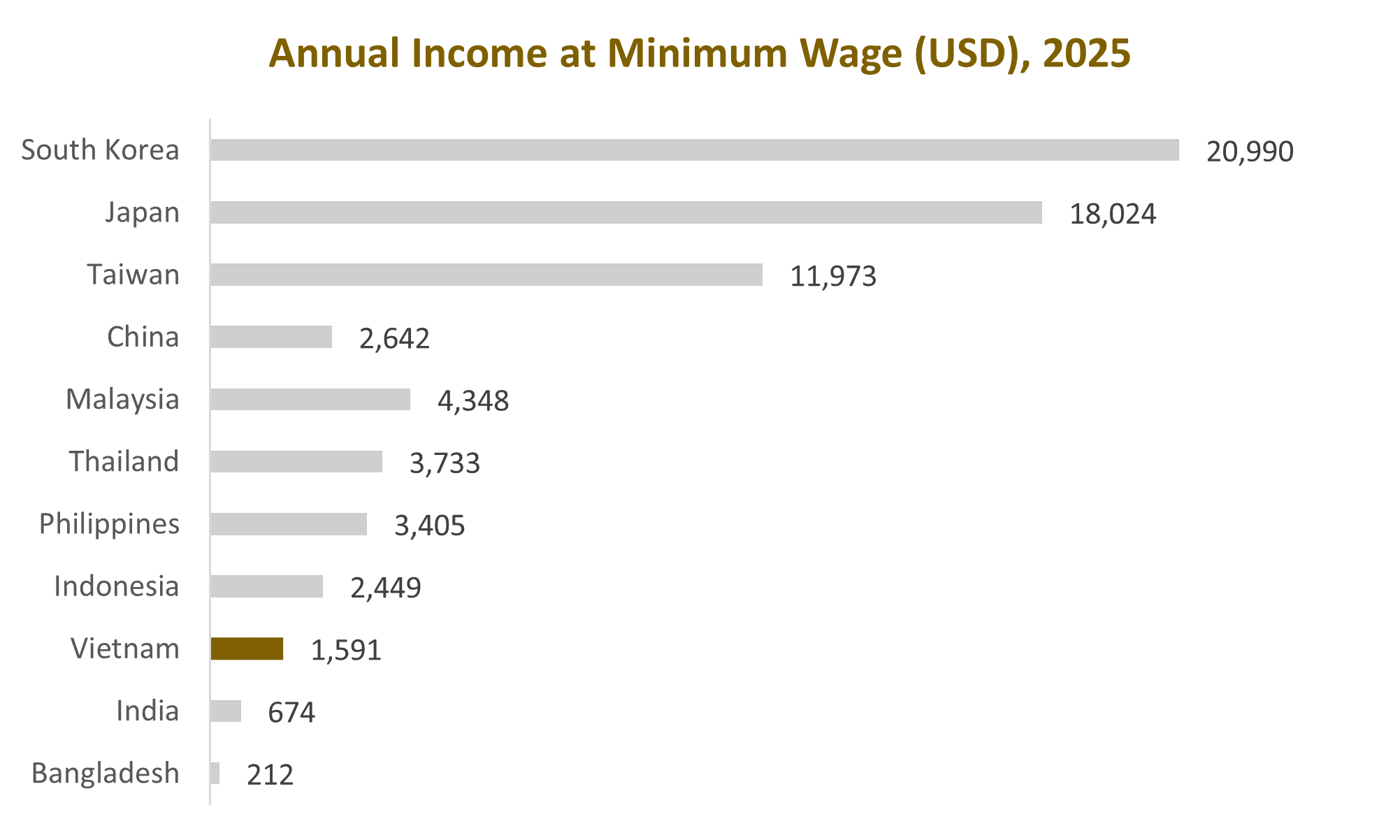

Vietnam’s low labor cost remains one of its most compelling advantages for foreign investors. With annual minimum wage income at just USD 1,591, it is significantly lower than that of most major FDI source countries and ranks as the third lowest among peers—trailing only Bangladesh and India.

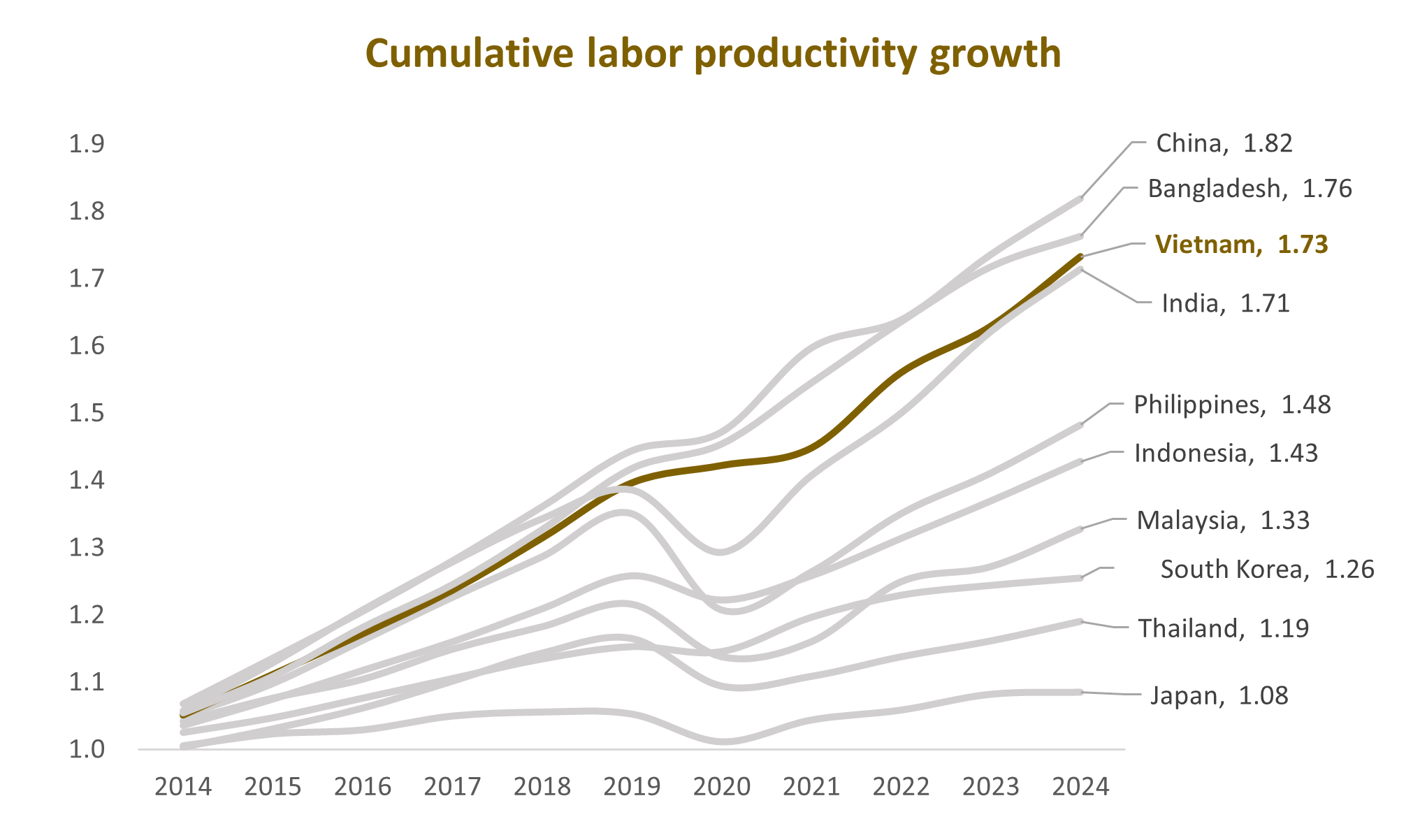

However, Vietnam has recorded impressive cumulative labor productivity growth, ranking third after China and Bangladesh. This suggests that the Vietnamese workforce is generally quick to adapt and benefits from a short learning curve.

III. Conclusion

In conclusion, while favorable tariff arrangements provide Vietnam with a relative advantage, it is the country’s broader structural and strategic strengths that truly solidify its long-term appeal to foreign investors. Vietnam’s high level of economic openness, strategic location within regional supply chains, improving logistics infrastructure, and stable political environment create a solid foundation for sustained investment. Coupled with a cost-effective and increasingly skilled labor force, these factors position Vietnam as not only a competitive alternative in the region but also a resilient and forward-looking destination for global FDI.

Le Thang Anh Tuyen – Invesment Department, PHFM