Exporting Tilapia To The U.S.: In Danger Lies Opportunity

- Seafood Export Situation in the First Half of the Year:

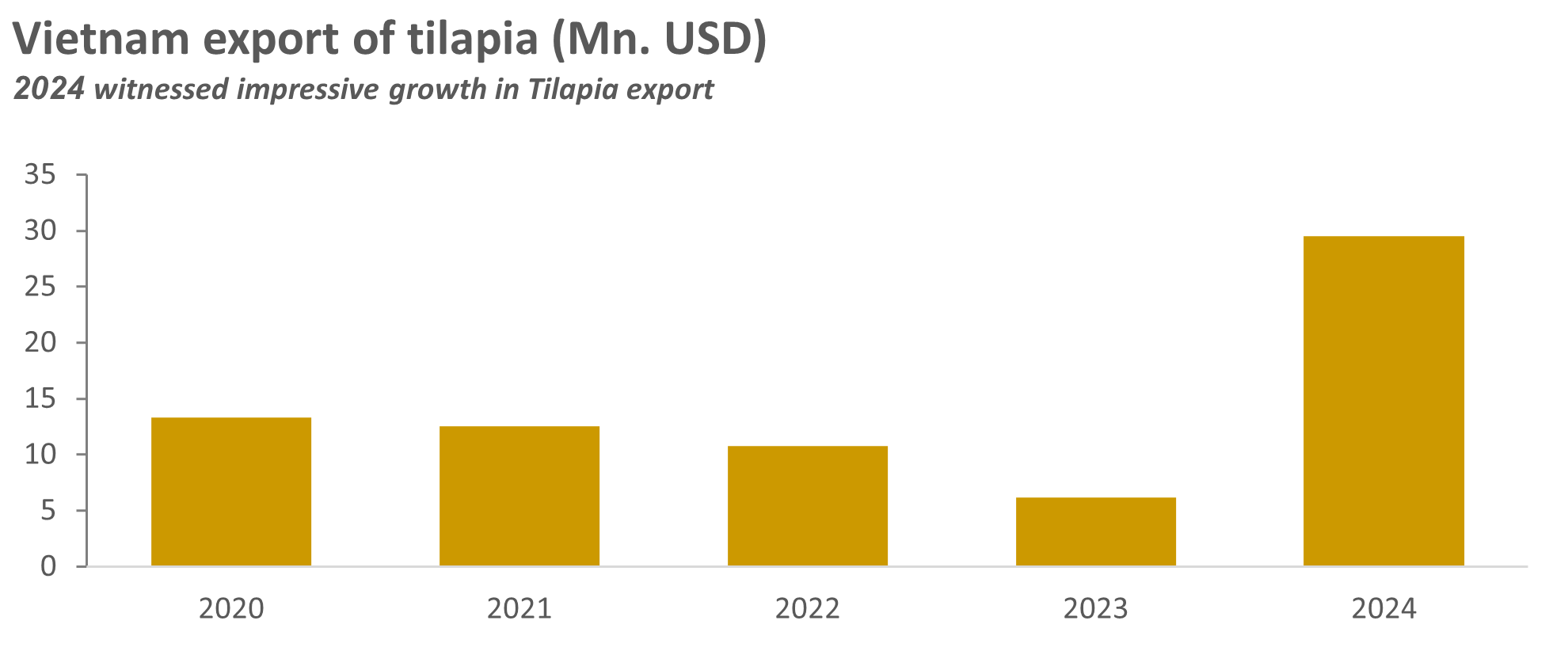

In the first half of 2025, Vietnam’s seafood industry has shown a positive recovery after a prolonged downturn. According to VASEP, total seafood export revenues reached approximately $5.3 billion, slightly up from the same period last year, driven by improved exports of catfish, shrimp, and notably, tilapia—emerging as a strategic alternative in the U.S. market.

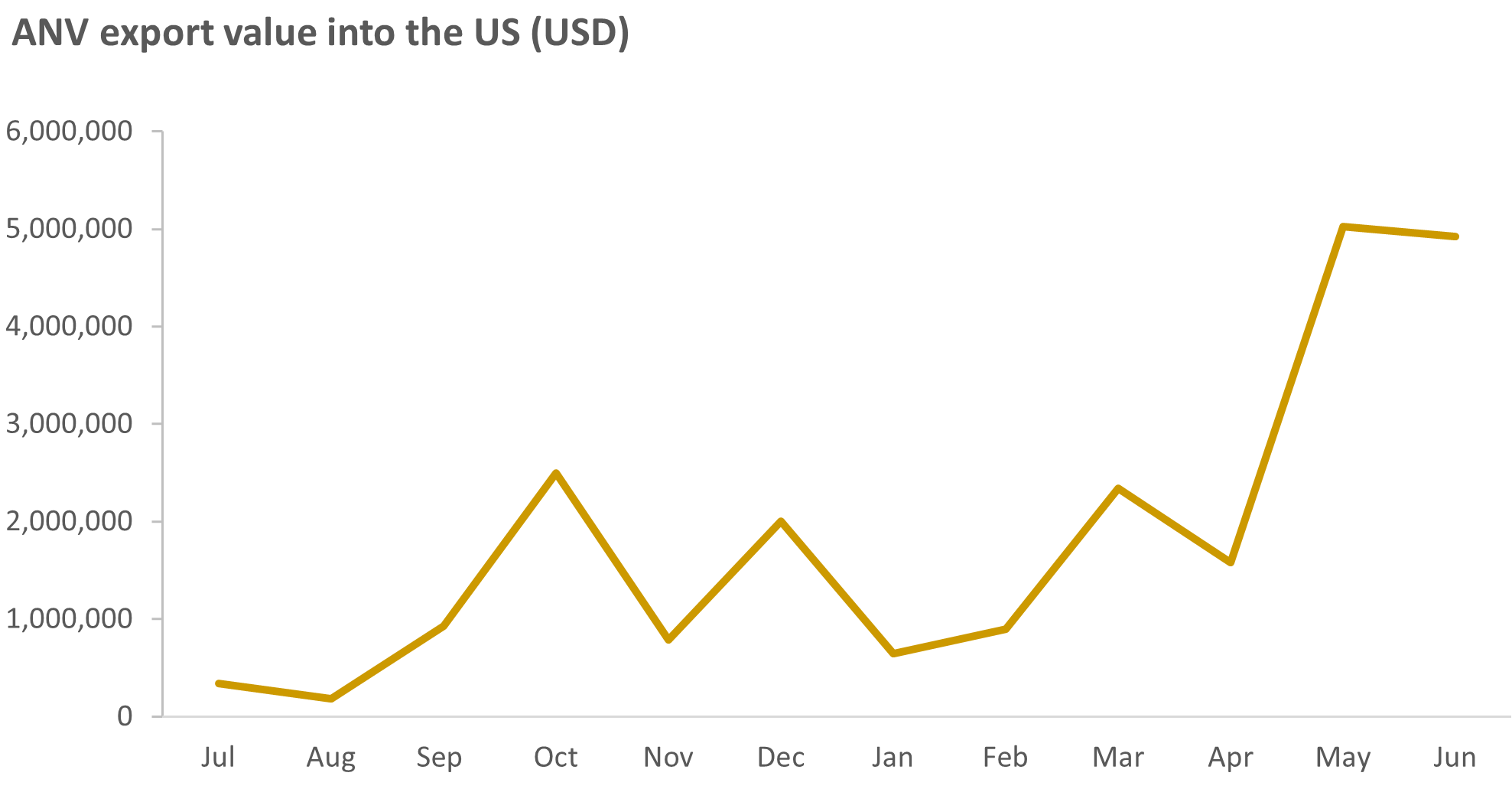

Specifically, exports of tilapia and red tilapia in Q1 2025 surged to nearly $14 million, marking a 131% increase year-on-year. The U.S. accounted for 46% of this total, equating to over $6 million, indicating a clear shift in U.S. import trends towards Vietnamese supply.

- Tilapia: A Promising Market:

Tilapia is emerging as one of Vietnam’s most promising seafood products. According to VASEP, the global tilapia market is projected to reach $10.6 billion in 2024, with expectations to grow to $14.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of approximately 3.52% per year.

Global tilapia production is set to reach 7 million tons in 2024, with Vietnam contributing around 300,000 tons, or 4.3% market share. By 2025, global production is expected to rise to 7.3 million tons, driven by increasing consumer demand due to its nutritional benefits, affordability, and alignment with healthy eating trends. Nam Viet Joint Stock Company (HOSE: ANV) is a pioneer in developing floating tilapia farming systems on rivers, diversifying its product range beyond traditional catfish offerings.

Source: VASEP, PHFM compilation

- Notable competitors:

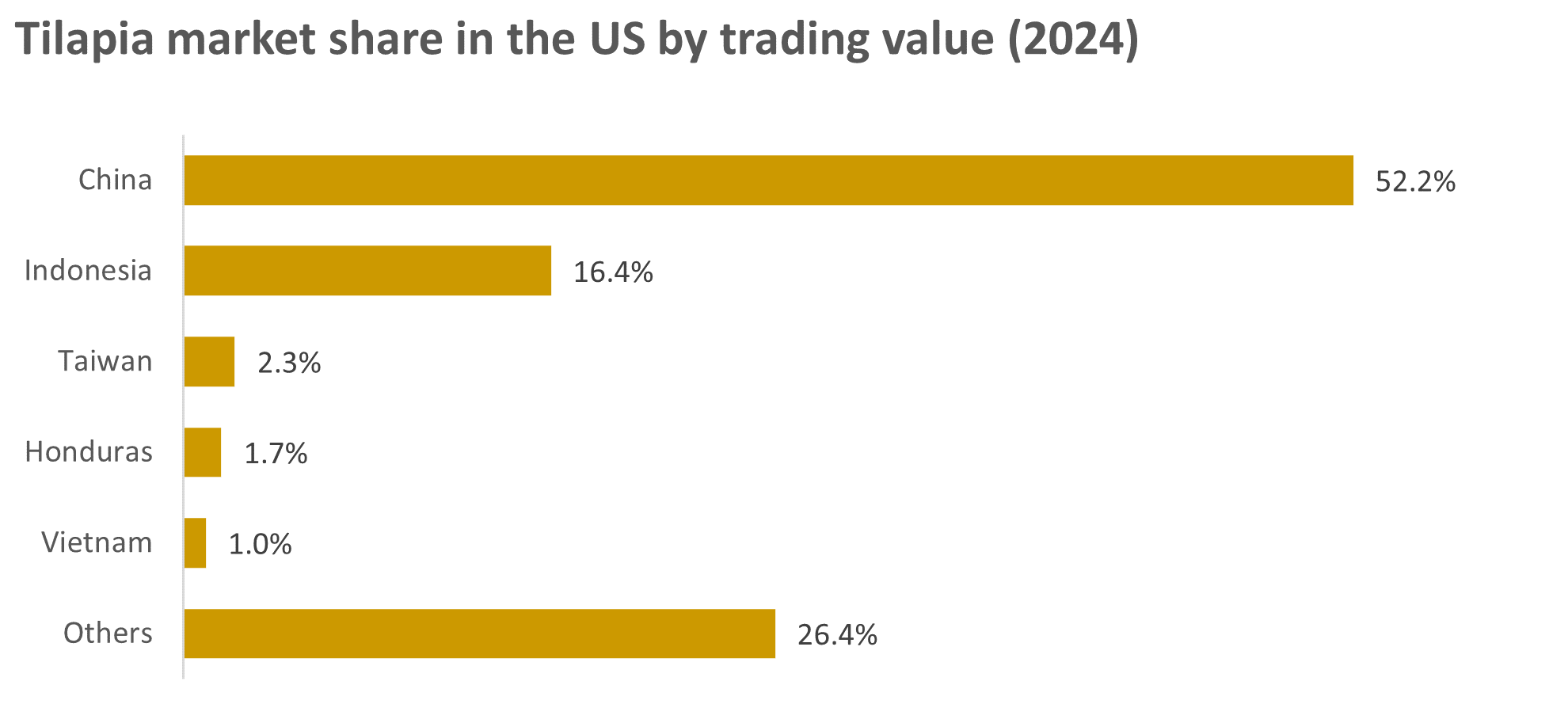

China is currently the largest supplier of tilapia in the world, with the U.S. being the primary import market for this product for many years. In 2024, China is expected to supply nearly 84,000 tons of frozen tilapia fillets to the U.S., far surpassing the 7,830 tons from Indonesia and 874 tons from Honduras, which is the largest Latin American supplier.

Meanwhile, Indonesia, Brazil, Honduras, and Colombia are strengthening their positions as direct competitors to Vietnam, thanks to significant production and rapid growth in recent years. Indonesia maintains an annual production of about 1.35 million tons, accounting for 23% of the global market, with an average growth rate of 6.61% per year and export revenues reaching $92 million in 2024. Brazil is also showing notable growth, with production expected to reach 662,000 tons in 2024, a 14% increase from 2023, primarily targeting the U.S. market (which represents 92% of its exports).

Source: Trademap, PHFM compilation

- Opportunities from U.S. Tariffs :

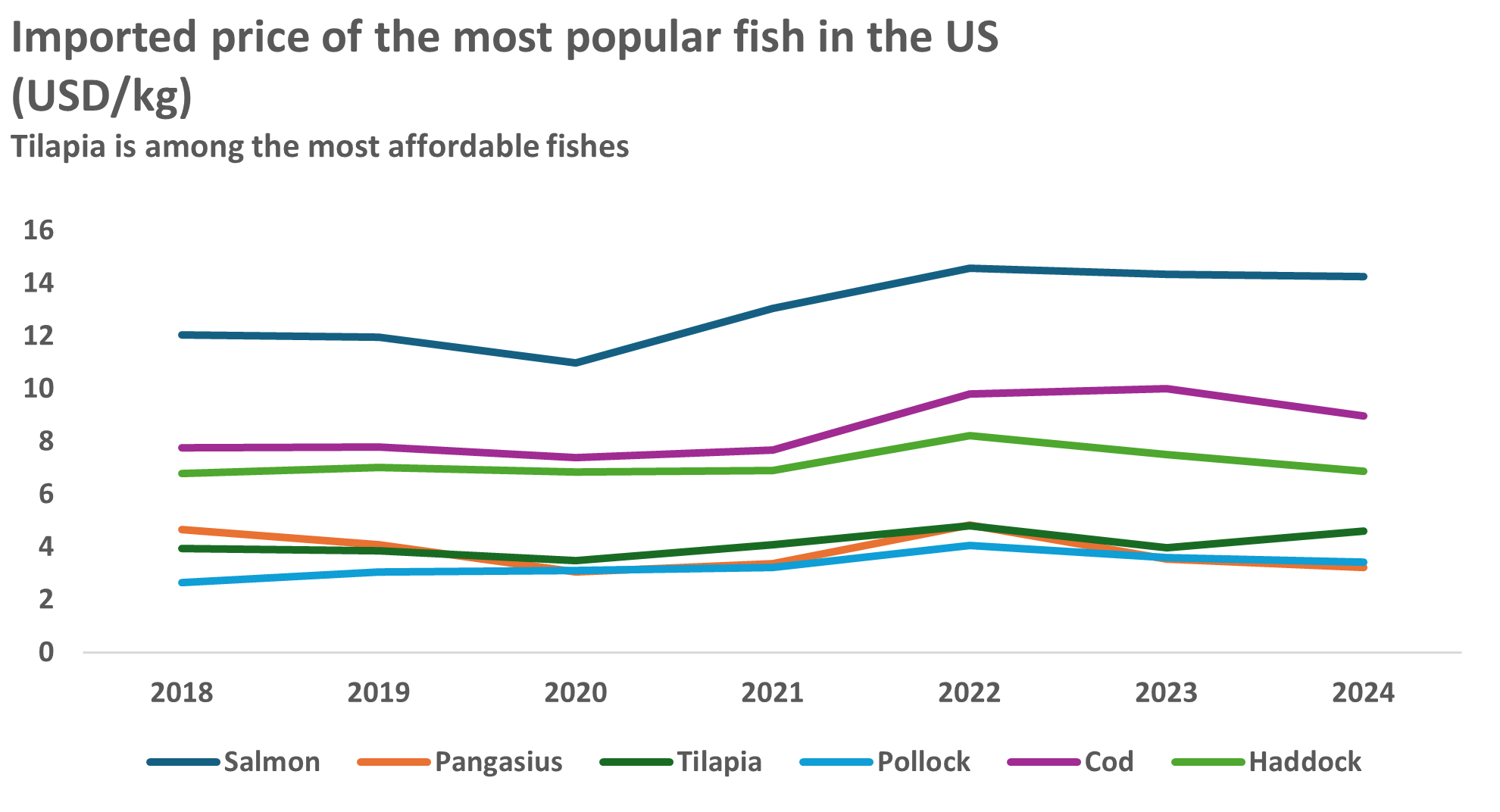

In the first five months of 2025, the average export price of Vietnamese tilapia reached approximately $4.9/kg, significantly higher than the $2.05/kg for catfish, representing a 141% premium. This price differential highlights tilapia’s potential for considerably higher gross margins, especially when processed and exported to high-value markets like the U.S. Currently, the U.S. market is facing a tilapia supply shortage due to a countervailing duty of up to 55% on products from China, the primary supplier, which accounts for nearly 50% of total import value.

Source: NOAA, PHFM compilation

While the tilapia market is highly competitive, with participation from countries like Brazil, Indonesia, Colombia, and Egypt, Vietnamese companies must invest systematically in quality, logistics, and branding to secure sustainable market share. With the total U.S. tilapia import value reaching $800 million annually—of which $390–400 million comes from China—the necessity for U.S. importers to diversify their supply sources presents a clear opportunity for Vietnam.

Source: Customs data, PHFM compilation

Nguyen Minh Tri – Invesment Department, PHFM