DATA CENTER MARKET IN VIETNAM – POWER FROM WITHIN

(Source: Precedence Research)

(Source: Precedence Research)

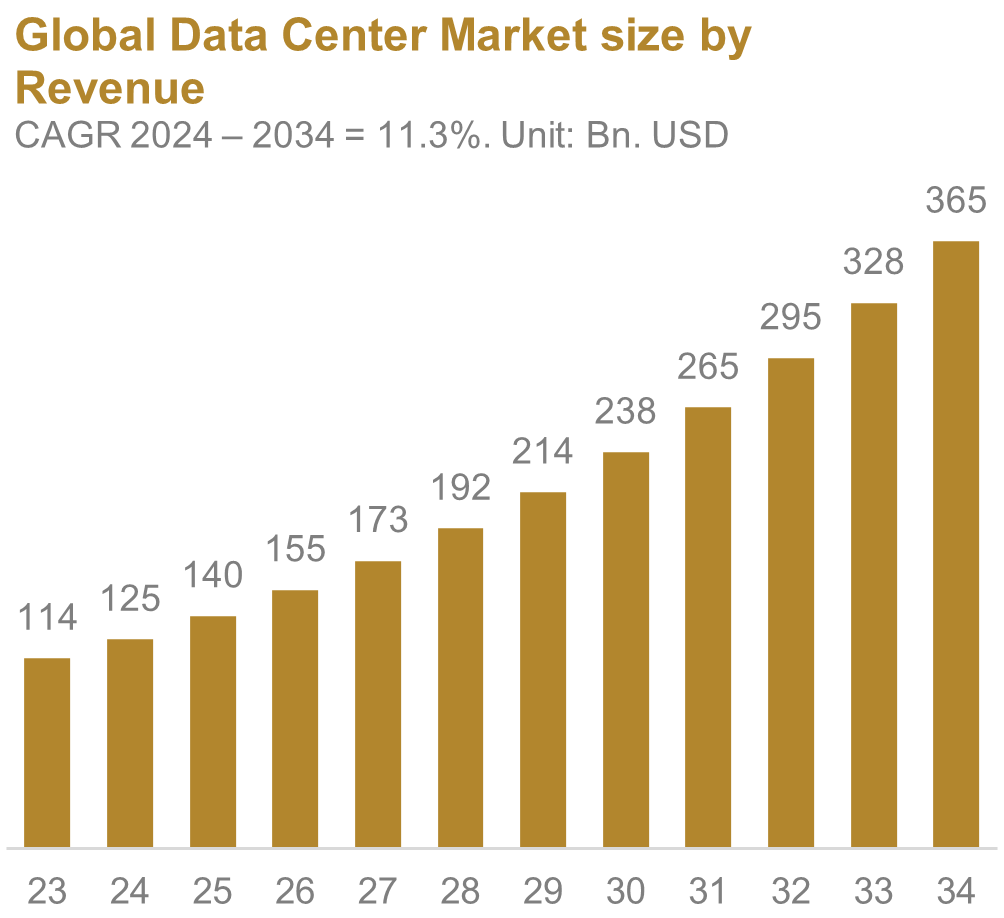

Data centers (DC), the backbone of enterprise IT, house critical servers, storage and networking equipment in secure, climate‑controlled facilities with uninterrupted power. Rising data demand is fueling rapid expansion: the global market is projected at $125.4 billion in 2024, climbing at an 11.3% CAGR to $364.6 billion by 2034.

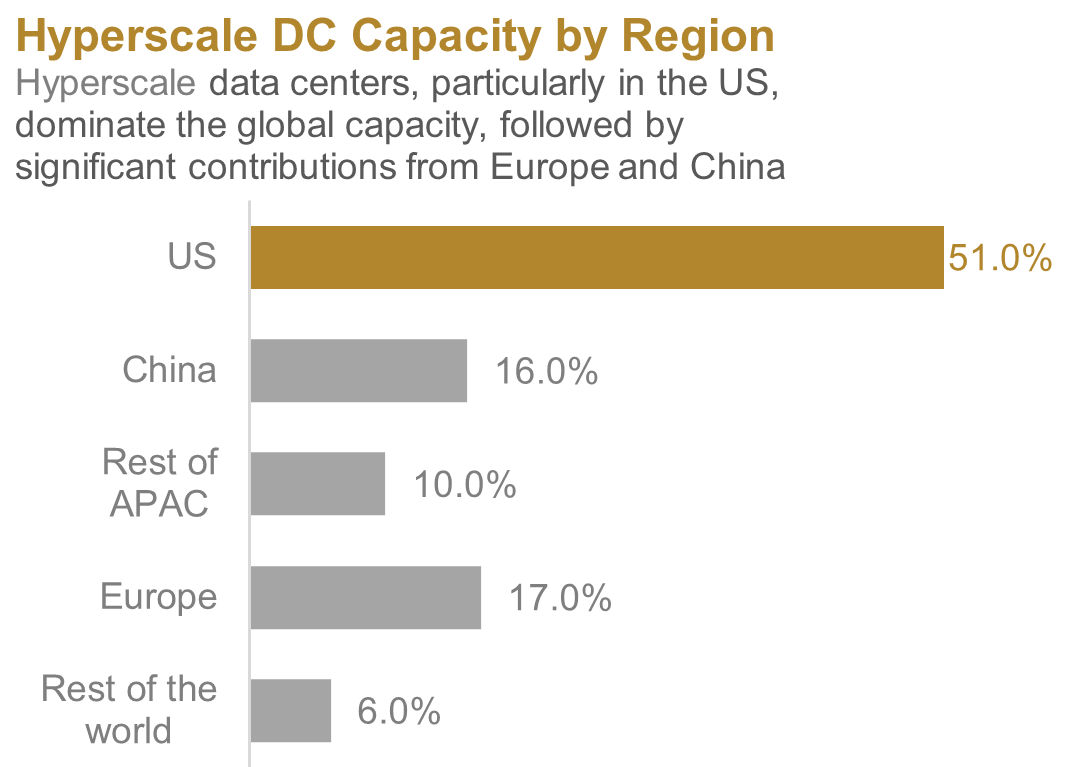

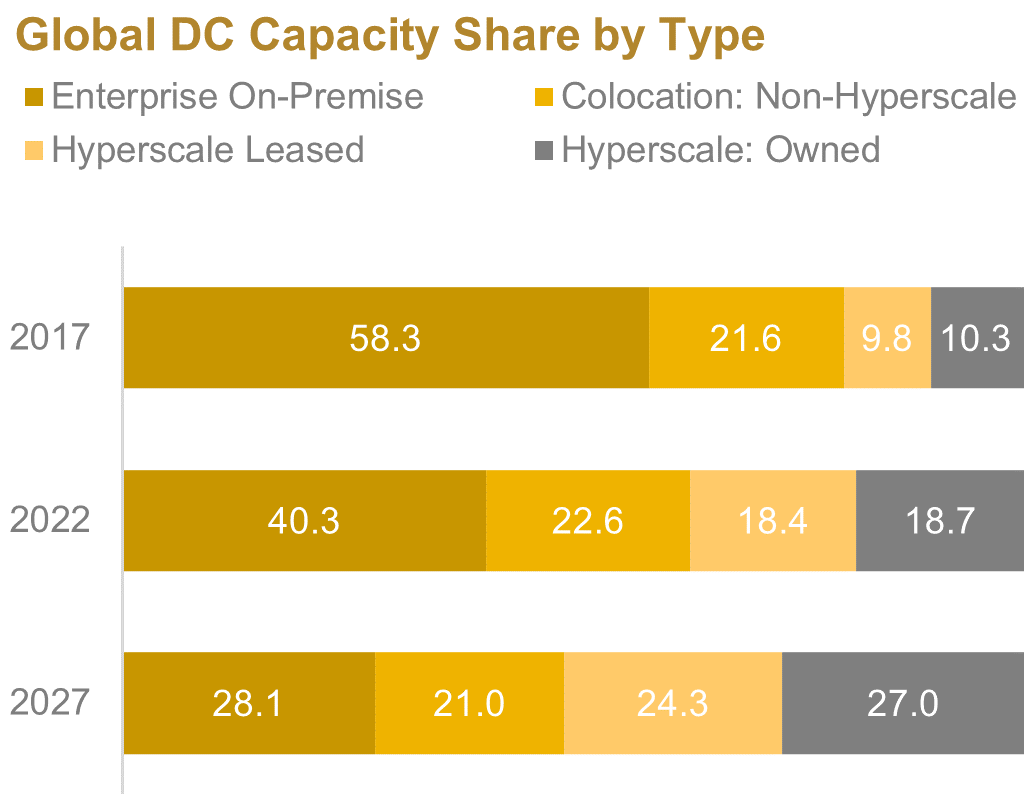

Cloud migration remains the key driver of hyperscale growth as firms abandon on‑premise models for scalable solutions. Meanwhile, edge data centers are set to gain traction, powered by IoT proliferation and consumer demand for low‑latency, real‑time processing.

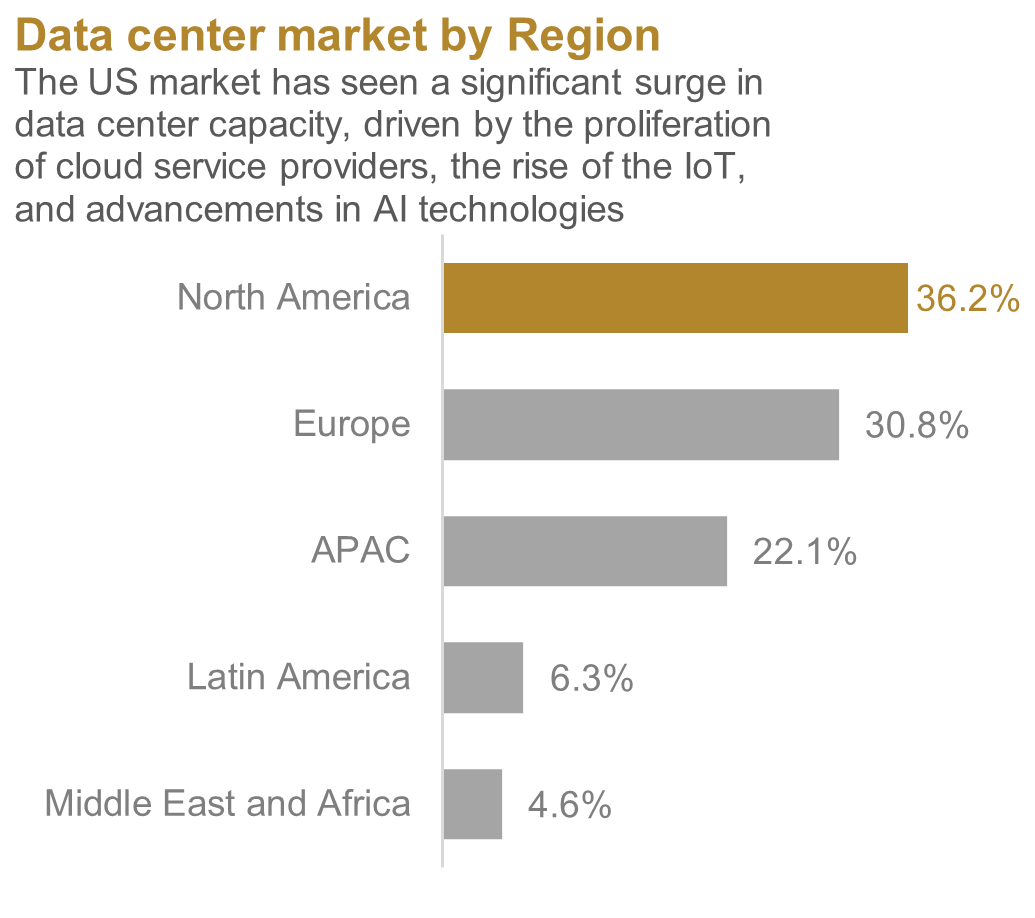

North America, the world’s largest data center market by revenue, sits at the core of the global landscape. Its appeal stems from proximity to major internet exchange points, a highly skilled workforce, a business‑friendly climate with tax incentives, abundant land and reliable power supply.

(Source: Synergy Group)

(Source: Synergy Group)

Recent headline moves — such as TikTok shifting U.S. user data to Oracle servers and Naver relocating backup data from Hong Kong to Singapore — underscore a broader trend: ASEAN is emerging as a prime destination for secure, scalable and geopolitically neutral data center investment.

Singapore remains a critical connectivity hub with 24 undersea cables, but land scarcity and energy constraints are curbing expansion. The government has tightened new approvals, prompting investors to explore alternative ASEAN markets.

Meanwhile, Indonesia, Vietnam, Malaysia and Thailand have reinforced data sovereignty laws, mandating local storage for sectors such as finance and state‑owned enterprises.

The rise of IoT, AI and edge computing is driving demand for localized data processing to secure low latency. Decentralized urbanization across ASEAN is spurring new data center deployments in tier‑1 and tier‑2 cities, catering to autonomous systems, fintech and cloud gaming.

(Source: Cloud Scene)

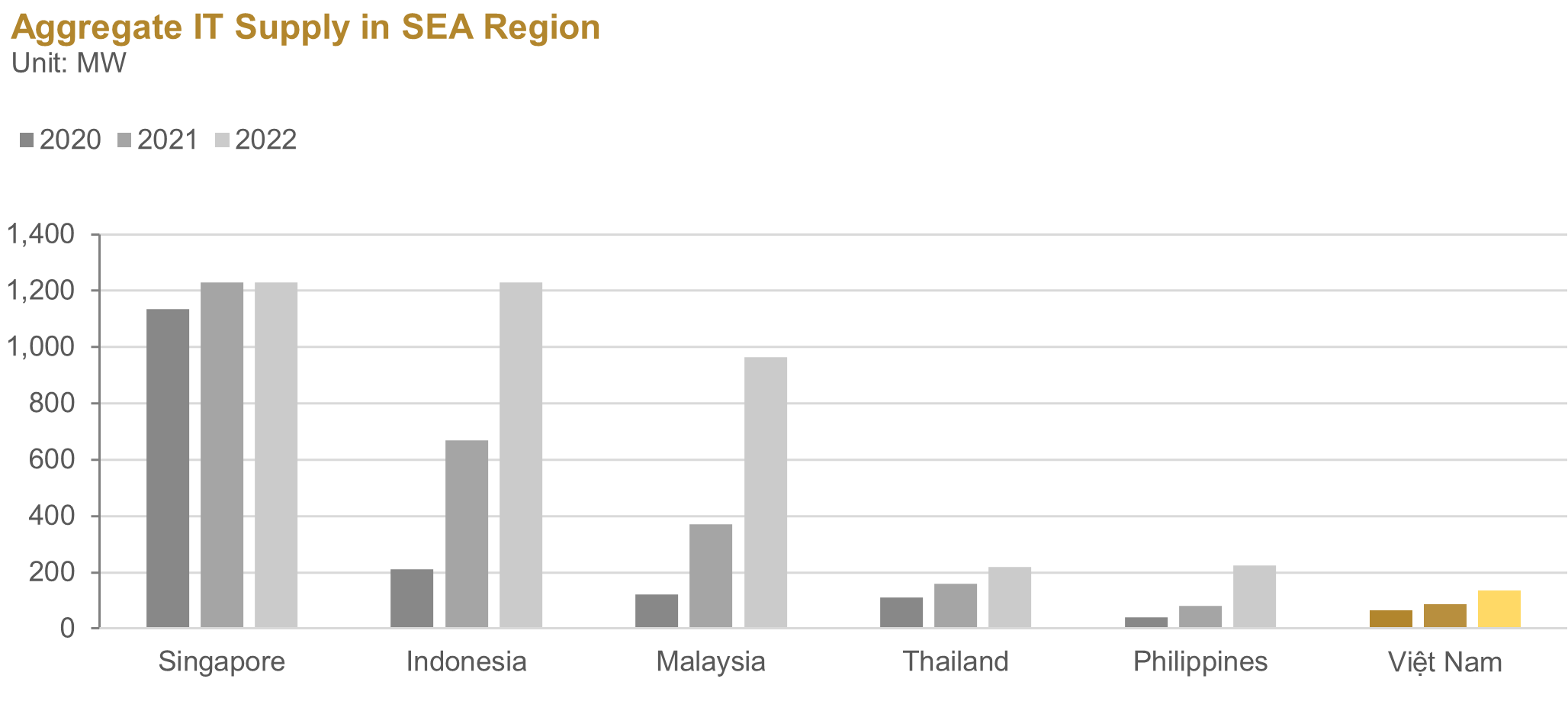

Despite advantages in power and construction costs (Cushman & Wakefield) and spillover demand from Singapore, Vietnam’s data center market remains small and has clearly lagged regional peers between 2020–2022. Planned new capacity for 2024–2030 is still underwhelming, with projected growth of just +60% versus Malaysia (+500%), Thailand (+550%) and Indonesia (+270%) (ARC Group).

A key bottleneck lies in Vietnam’s international submarine cable network, which is still being upgraded and remains less competitive. The Ministry of Information and Communications targets 15 cables by 2030, with four to be added before 2027, but this will still trail Singapore (26–28), Malaysia (23) and Thailand.

Global energy and environmental standards add further pressure. Vietnam must reduce data center PUE below 1.3 by January 2030 — a tough target given the hot, humid climate. Renewable energy is seen as critical to meeting rising demand while keeping emissions low, yet Power Development Plan VIII has so far delivered little breakthrough in expanding green supply.

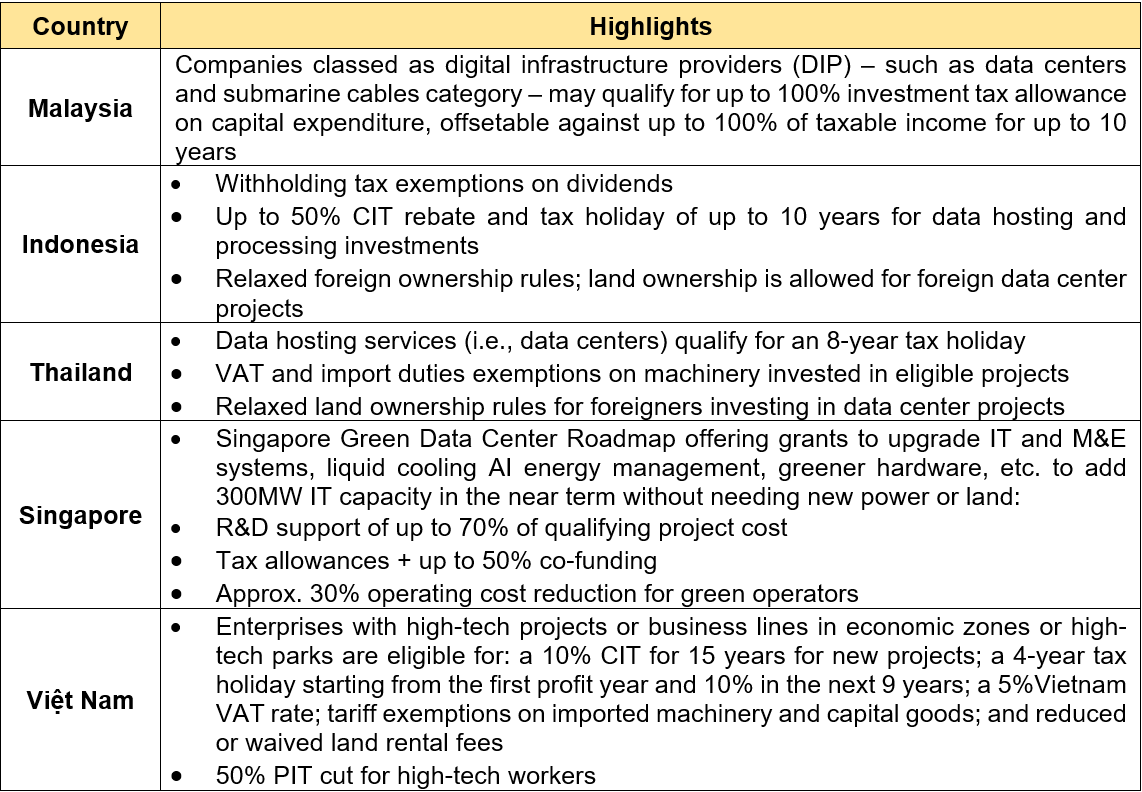

Meanwhile, ASEAN peers are pulling ahead with stronger commitments and aggressive incentives. Malaysia, for instance, offers up to 100% investment tax allowance on capital expenditure. Against this backdrop, Vietnam is unlikely to attract the world’s major hyperscalers to build data centers.

Vietnam’s data center market remains underdeveloped relative to its vast potential — a fast‑growing economy, high internet penetration and a booming digital sector with surging data demand

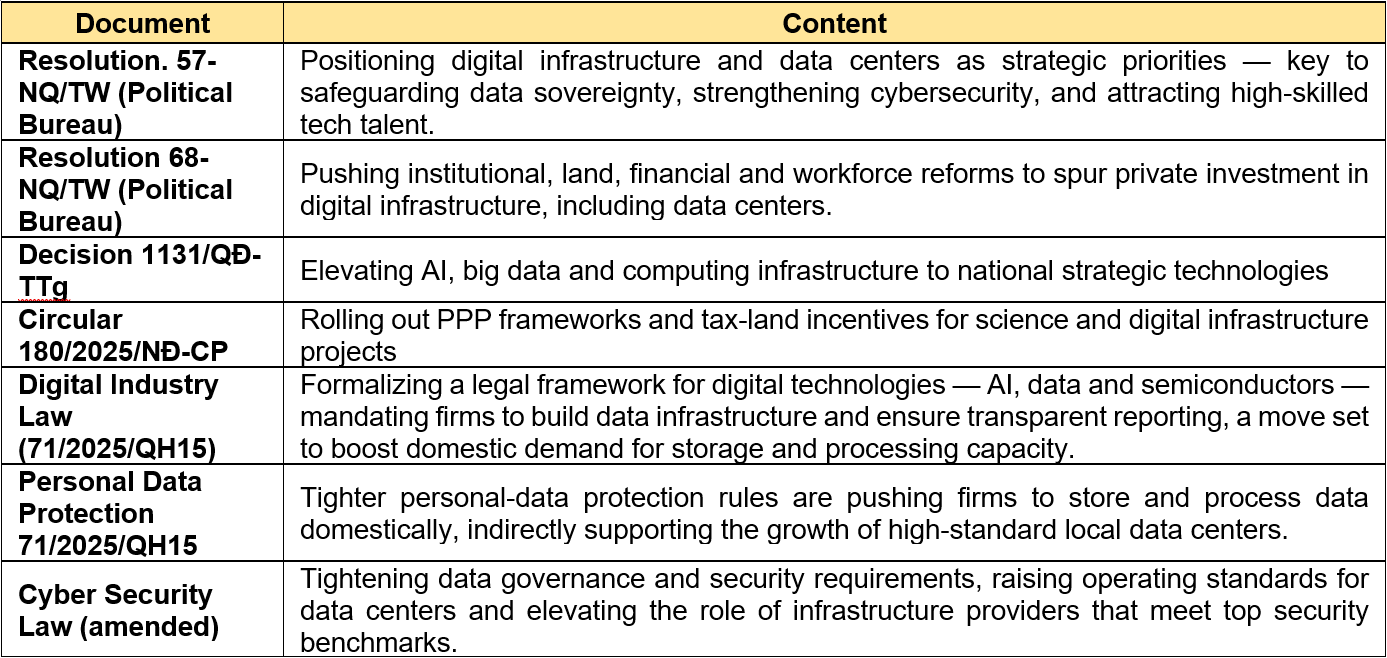

The most notable catalyst recently has been policy and institutional reform, which is beginning to unlock demand. Authorities have moved to reframe the strategic importance of digital infrastructure, tighten data governance with local storage requirements, clarify definitions and investment rules for data centers, lift foreign ownership caps, and roll out state‑led digital transformation programs. These shifts mark a turning point that could reshape the trajectory of Vietnam’s DC sector.

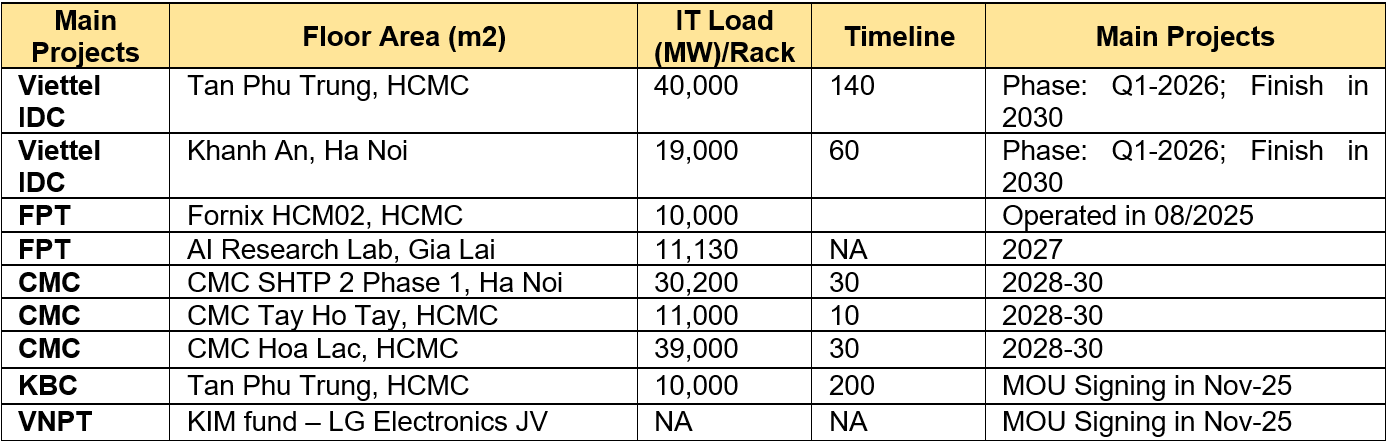

Vietnam’s data center demand is expected to remain largely domestic, serving enterprises, government agencies and the local market. A wave of hyperscaler projects is slated for 2025–2030 to support the government’s digital transformation agenda. Notably, Viettel IDC (unlisted), FPT Group (HOSE: FPT) and CMC Technology Group (HOSE: CMG) — all homegrown tech champions with strong government ties — are positioned to benefit from this build‑out.

Nguyen Minh Tri – Investment Department, PHFM