Consumption – picking the right winners” thắng cuộc

Overall consumption:

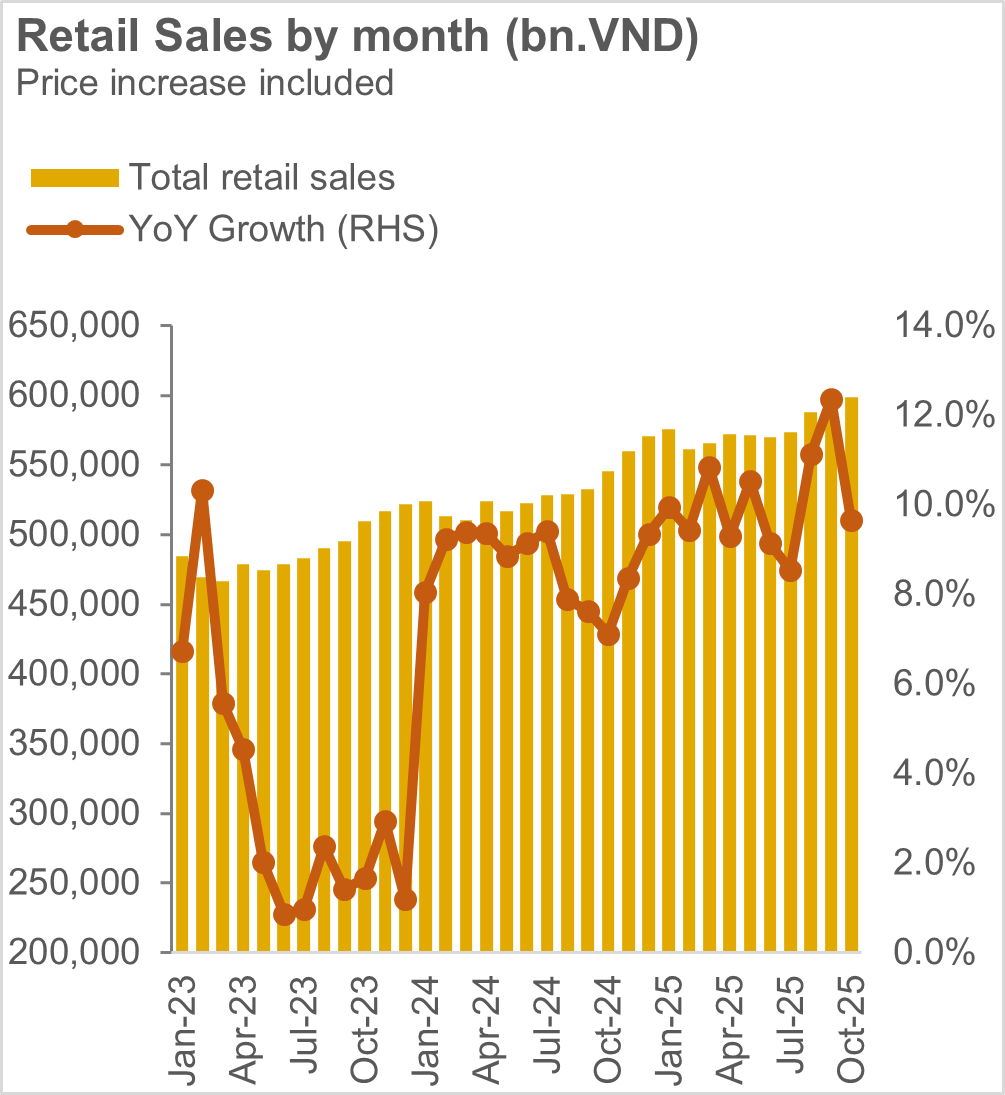

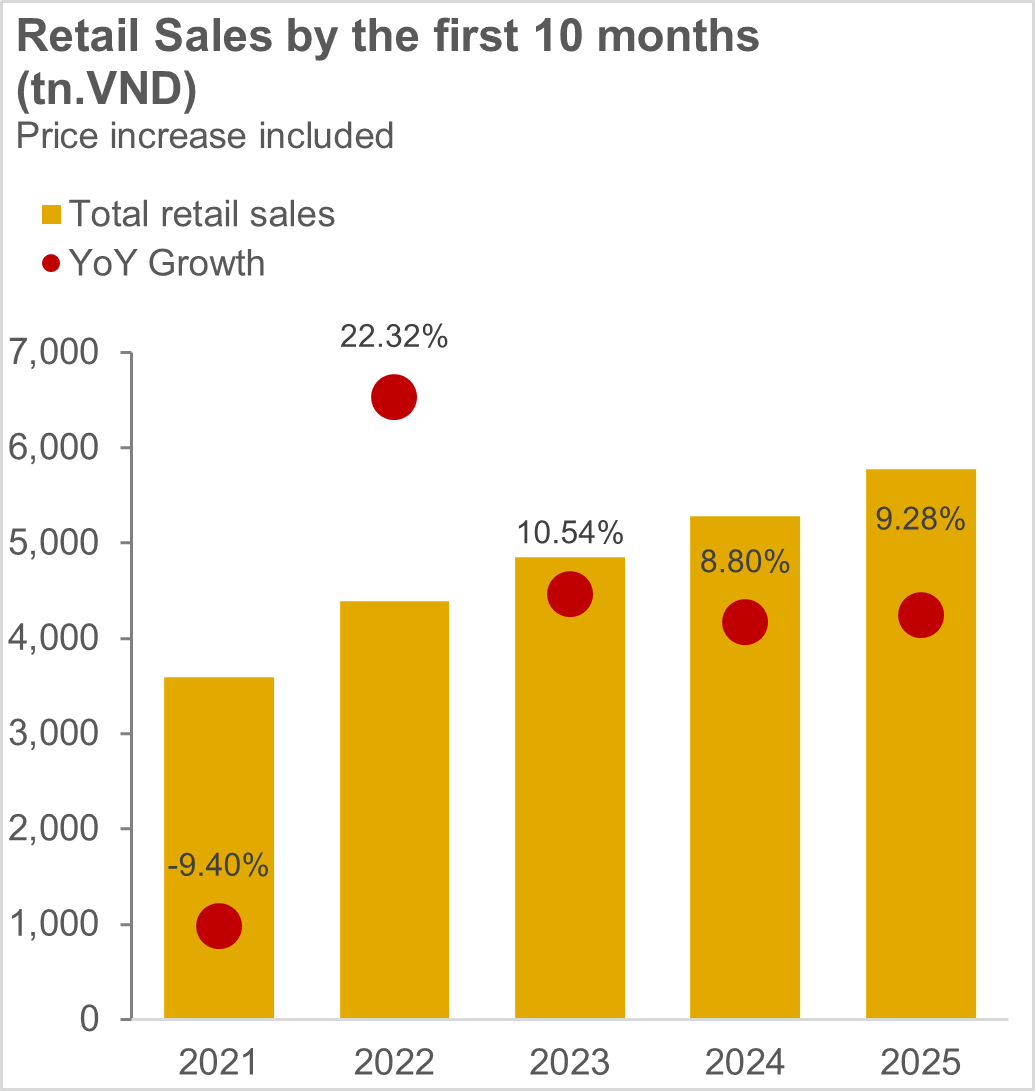

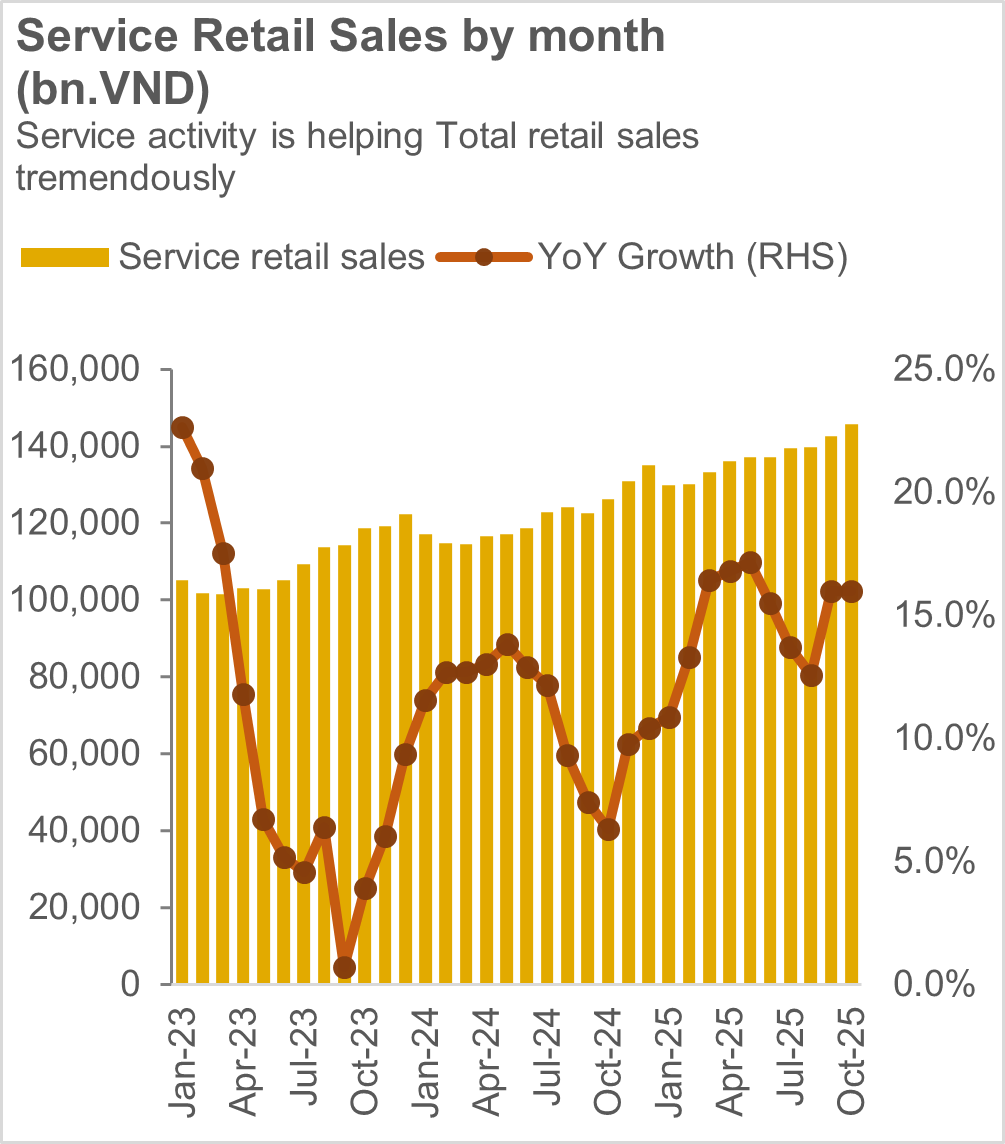

Vietnam’s retail sales rose 9.3% y/y in the first ten months of 2025, reaching VND 5.77 quadrillion at current prices. Adjusted for inflation, growth was 7% y/y. Retail goods revenue climbed 8% y/y, while hospitality and dining surged 14.6% y/y and travel services jumped 19.8% y/y.

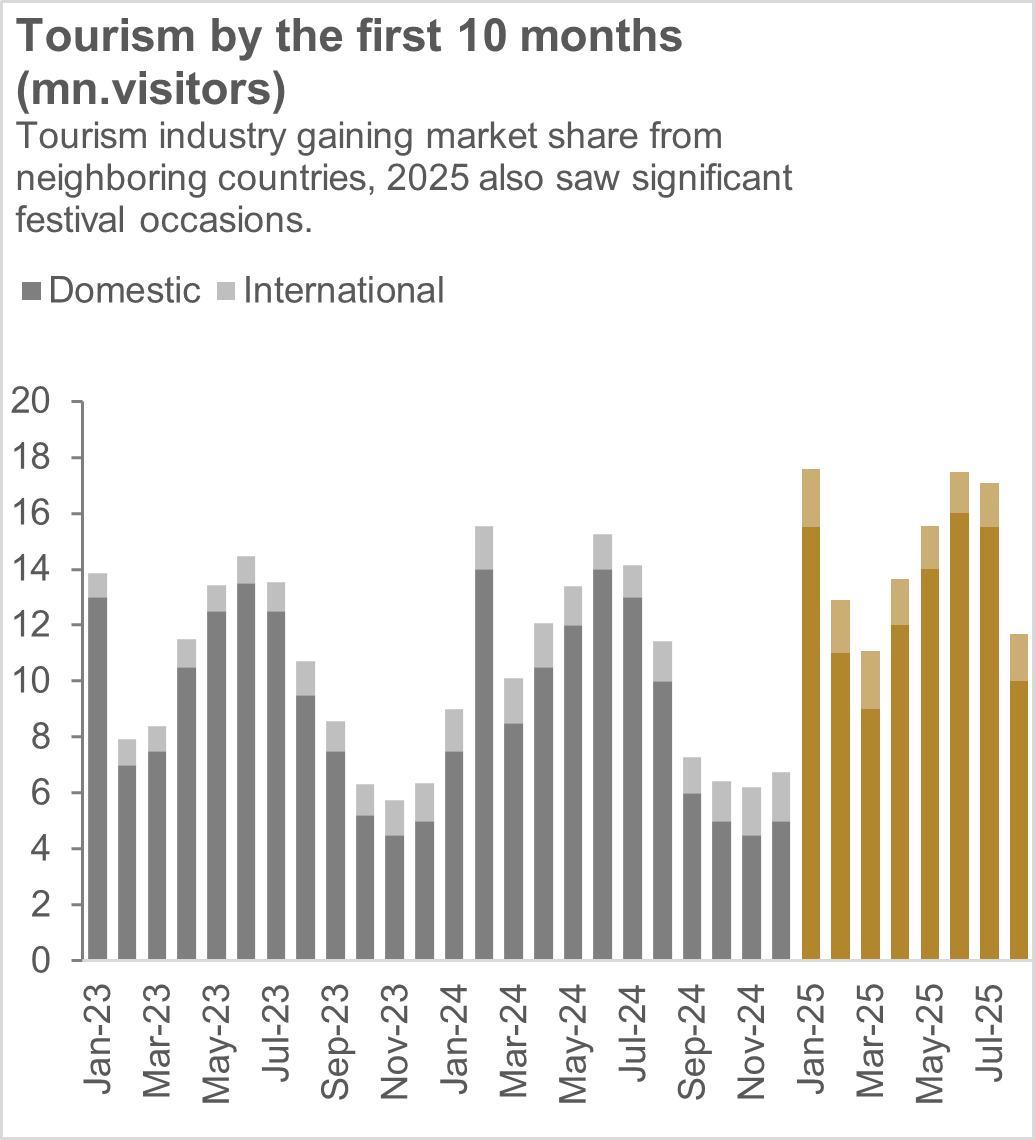

Overall retail activity has yet to return to the double‑digit growth rates seen before COVID. Services drove this year’s gains, while goods sales remained sluggish. Domestic consumption was dented by recent floods and tax policy uncertainty that disrupted small businesses. Tourism was the standout: Vietnam welcomed 17.1 million international visitors in the period, up 21.5% y/y, supported by new visa policies, geopolitical turbulence among rivals, and a calendar packed with local festivals.

Regulatory environment:

To hit its ambitious 2026–2030 target of ~10% GDP growth, Vietnam will need domestic consumption to accelerate. Unlike Western economies steeped in consumerism, East Asian markets such as Vietnam tend to be cautious spenders. Households only loosen their wallets when they feel secure about the future. Without surplus disposable income, savings, or stable assets, consumers quickly retreat into defense mode—cutting back spending or limiting purchases to essentials.

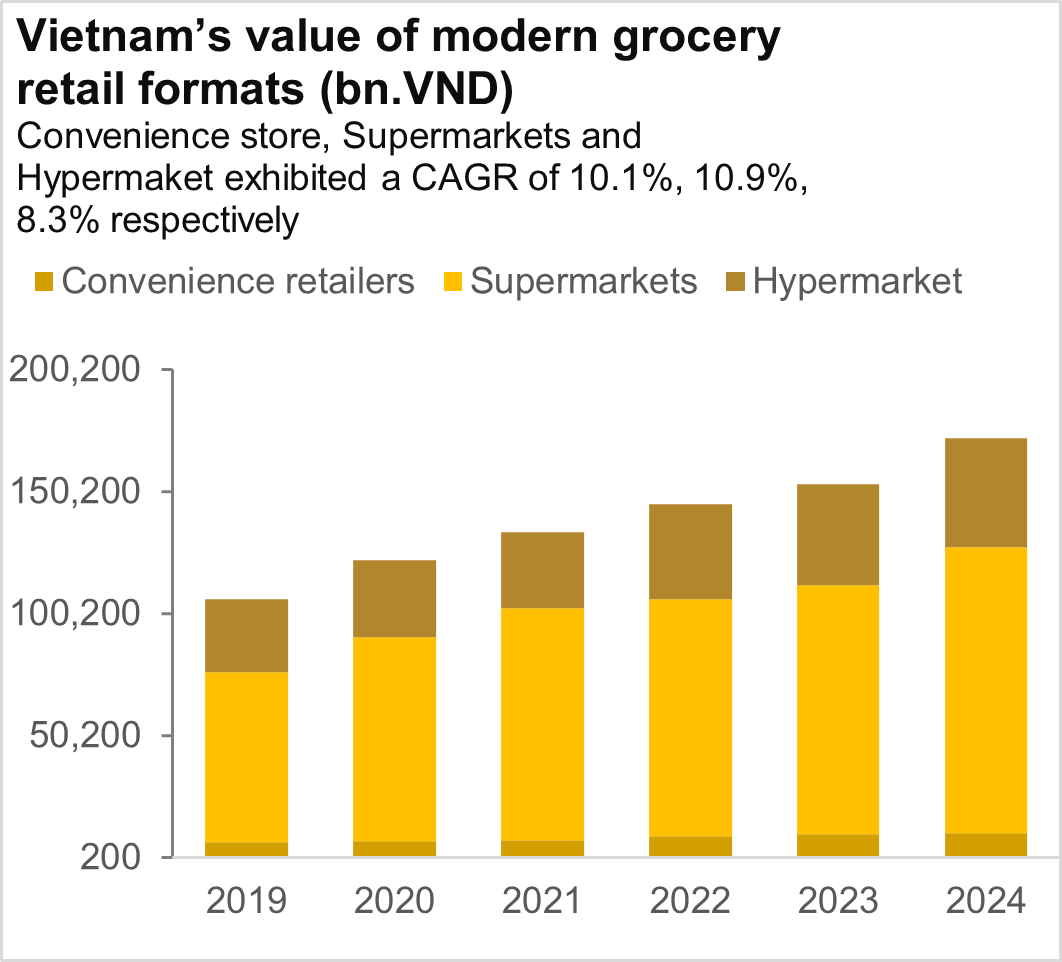

Vietnam is rolling out major legal reforms in 2025–2026 that directly impact wages, income and taxes, as part of broader institutional restructuring. Key measures include higher family tax deductions and pay rises for public‑sector employees. At the same time, policymakers are pushing to expand the footprint of modern retail formats, signaling a shift toward a more consumer‑driven economy.

|

Document |

Content |

Comment |

| VAT Reduction Extension Policy | • The 2% VAT reduction policy has been extended until the end of 2026. It now includes additional sectors such as transportation, logistics, goods, and IT services | • Insignificant, mostly valuable in terms of sentiment. |

| Amended Personal Income Tax Law (Expected 2026) | • Raise Family Deductions: Proposals include increasing the personal deduction from VND 11 million to VND 15 million/month, and dependent deductions from VND 4.4 million to VND 6 million/month, to better reflect inflation and living costs.

• Introduce Tax Bracket Reform: Experts suggest reducing the number of tax brackets and adjusting income thresholds to ease the burden on middle-income earners and improve progressivity. |

• Though not yet in effect, the upcoming amendment is expected to raise family allowances, potentially boosting disposable income and consumer spending in retail. |

| Decree No. 70/2025/NĐ-CP (Effective June 1, 2025 | • Updates invoice regulations. Requires retailers with revenue ≥ VND 1 billion to use e-invoices generated from POS systems. Also mandates invoice timing and format for e-commerce, supermarkets, and service retailers | • This will affect mom-and-pop stores the most, since they’re used to not setting up proper invoice system.

• This will reduce the advantage of GT channel regarding price. |

Over the past two years, China has rolled out a raft of measures to boost domestic consumption—ranging from income support and higher pensions to childcare subsidies, education spending, service‑sector upgrades and consumer incentives such as trade‑in programs and second‑hand market development. While these initiatives have delivered short‑term gains in measured consumption, they have yet to fundamentally shift the country’s spending landscape.

As we discussed above, Vietnam’s retail recovery will only gain noticeable momentum when households feel secure about the future, job prospects are stable, and savings or investments are substantial. A brighter economic outlook, rising disposable incomes, and a healthy, sustainable asset market are seen as critical to reinforcing the wealth effect and unlocking stronger consumer spending.

Emerging trend:

Despite a broad rebound in purchasing power, Vietnam’s retail landscape is showing notable shifts with potential investment implications. NielsenIQ data show FMCG value rose 3.1% y/y in Q3 2025, but volumes fell 1.9%—the steepest drop in a year. Price increases remain the sole driver keeping the sector in positive territory, while real consumer demand continues to weaken.

However, compared with the broader market, purchasing power has not declined uniformly. The shifts reflect regional differences and channel‑specific dynamics, underscoring how consumption patterns vary across Vietnam’s retail landscape.

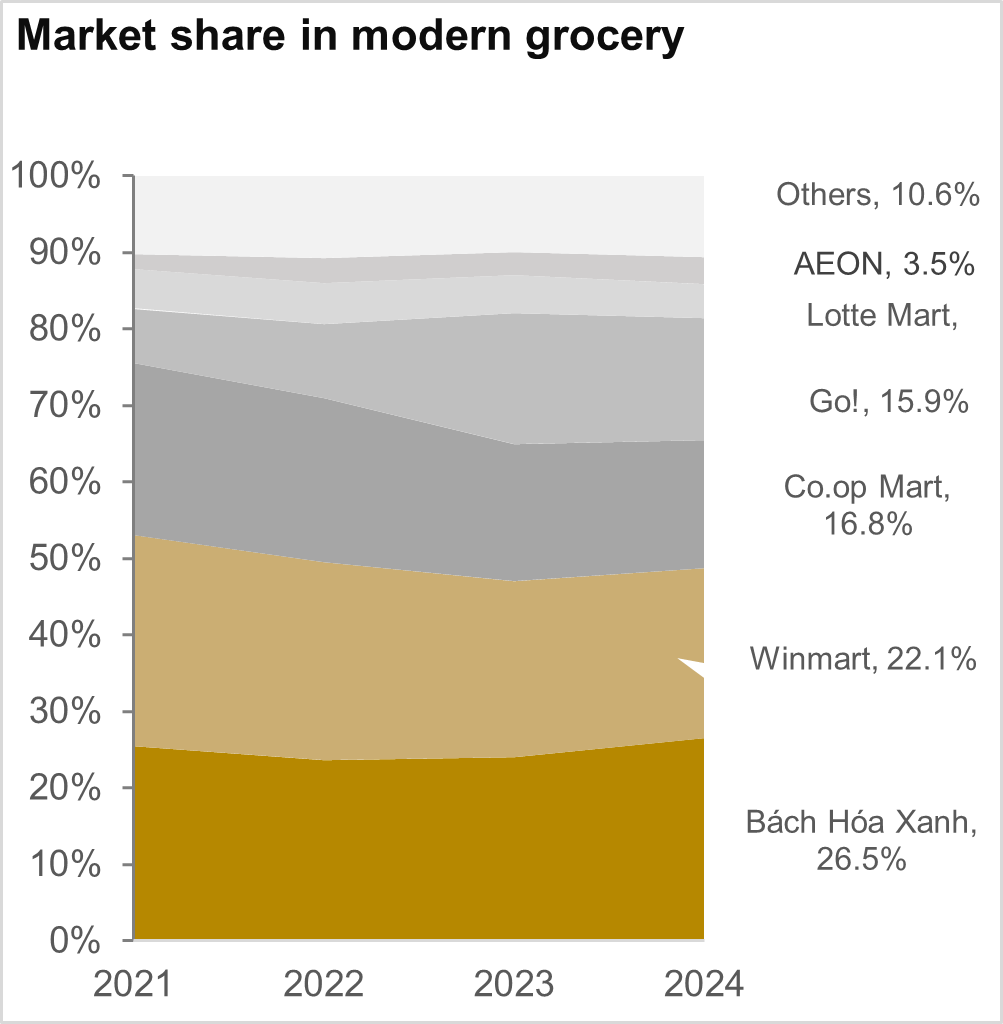

Sources: Euromonitor, PHFM

The Central market has slowed sharply, likely hit by storms and adverse weather. In the South, after several quarters of strong growth, momentum is easing as competition from modern trade channels intensifies. By contrast, modern trade (MT) and milk & baby (M&B) segments remain bright spots, benefiting from broad coverage and the ability to meet “shop‑near, use‑now” demand.

Even as Vietnam’s retail market remains subdued, select players are finding growth by tapping into new consumer trends. Tighter tax rules are raising compliance costs for small traders, narrowing the gap with modern retailers that already operate under full accounting standards. At the same time, consumers are demanding greater transparency, food safety and convenience.

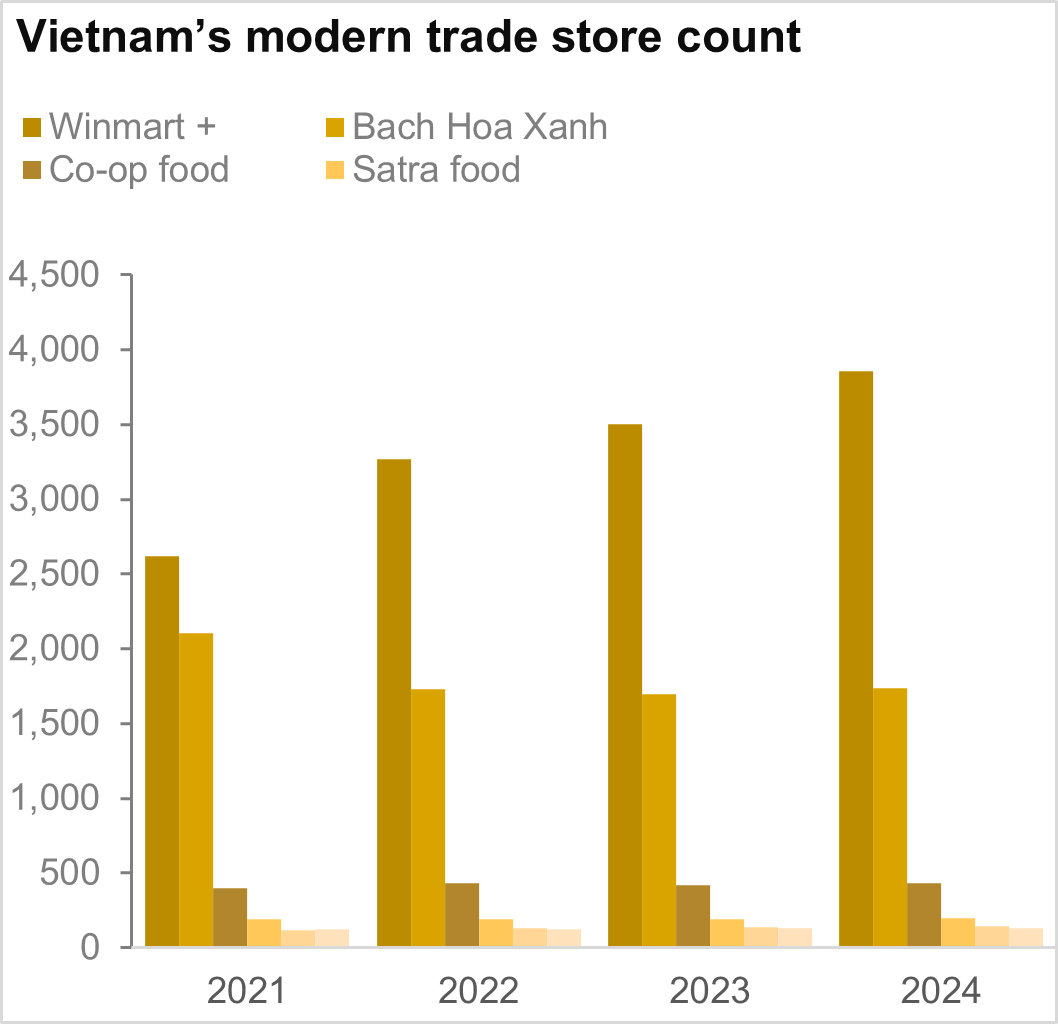

MWG’s Bách Hóa Xanh chain posted a 13% y/y revenue gain in the first ten months of 2025, driven by fresh food and FMCG, while adding 600 new stores to reach 2,370 outlets at the end of October -2025. Meanwhile, Masan’s WinMart+ mini‑supermarkets are making inroads in rural areas, with same‑store sales growth above 15% for two consecutive years. Many new rural stores even outperform urban locations, with payback periods shortened to under 2.5 years.

Conclusions:

Vietnam’s retail market is expected to rebound next year, supported by policies aimed at boosting disposable incomes. Despite lingering uncertainty over consumer sentiment, agile and innovative companies able to capitalize on new consumption trends are in good position to secure impressive growth—even if total spending remains modest.

Nguyen Minh Tri – Invesment Department, PHFM